After a turbulent few weeks during which some of the world’s biggest asset managers removed coveted ESG tags from huge chunks of their business, industry bosses have had enough.

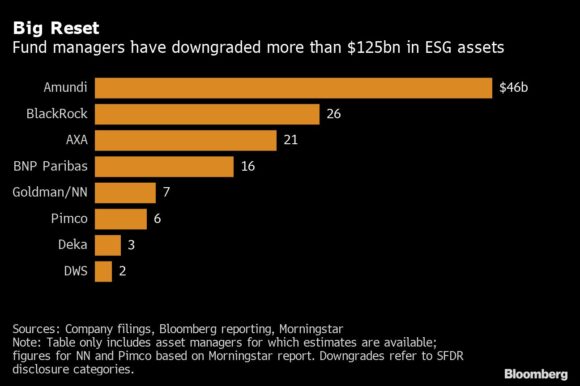

Managers running the funds affected are now talking openly of the “chaos” they say has hit the investment management industry. The chief cause, they say, is a regulatory framework whose confusing rollout just blasted a $125 billion hole through the very top of the ESG market.

Matt Christensen, Allianz Global Investor’s head of sustainable and impact investing, said figuring out how to interpret EU ESG regulations is “taking over a lot of the life of my team and they’re very frustrated.” AXA Investment Manager’s head of sustainability coordination and governance, Clémence Humeau, warns of the fallout for clients as the wider ESG fund market becomes harder to navigate.

BlackRock Inc., Amundi SA, AXA and Allianz are just some of the firms drawn into the recent frenzy of reclassifications. Funds they’d registered under the European Union’s highest environmental, social and governance designation — Article 9 — have now been bumped down to a lesser category — Article 8. Even those tracking Paris-aligned climate benchmarks designed by the EU were no longer deemed green enough to keep the classification.

Many of the downgraded funds had sustainability thresholds of 80%, some even claimed to hold 90% sustainable investments. But since the EU’s Sustainable Finance Disclosure Regulation was enforced last year, the EU Commission has clarified its guidance around Article 9, so that only funds containing 100% sustainable assets, save for hedging and liquidity, can use the designation.

Jean-Jacques Barbéris, head of institutional and corporate client division and ESG at Amundi, said “highly unstable and highly incomparable” regulations mean the firm was “not comfortable with taking commitments” on Article 9. The fund industry is “under heavy scrutiny, under more demands from regulators, and adding an element of uncertainty” via regulations “adds a challenge to the sustainable investment journey,” he said.

The upshot is that the industry now finds itself in the grip of a kind of “mass frustration,” according to Luke Sussams, an ESG strategist at Jefferies International Ltd. The “complexity and scale” of the demands contained in SFDR have created a “huge opportunity cost” for the fund industry, he said, citing conversations with financial professionals affected by the regulation.

Germany’s financial regulator, BaFin, has signaled it welcomes the wave of reclassifications. The Article 9 downgrades are “a positive sign that the industry has recognized the greenwashing risk and takes it more seriously,” said Mark Branson, the head of BaFin. “There was a widespread trend to describe things as greener than they were and to see it as a part of marketing without linking it to the plausibility of investment processes.”

But other regulators say Europe’s ESG investing rules need some adjustments. Verena Ross, who chairs the European Securities and Markets Authority, has publicly urged EU officials to address the “real challenge” posed by the bloc’s evolving ESG rules. Among concerns voiced by ESMA is the lack of clarity around basic ESG concepts such as a “sustainable investment.” ESMA and other EU regulators have asked the EU Commission to provide answers.

Mairead McGuinness, the EU’s financial markets and services commissioner, said earlier this month that some asset managers appear to have taken too “liberal” an approach when assigning ESG designations to financial products. But she also promised a consultation on SFDR early next year.

“We may need to take a much broader look at this regulation,” she told lawmakers on Dec. 6. And if efforts to address shortcomings in SFDR fail, then the EU may need to embark on a fundamental rewrite of the regulation, McGuinness said.

In the meantime, asset managers say national regulators in the EU are interpreting SFDR inconsistently.

There’s an element of the “EU versus nation states,” Allianz’s Christensen said. “The mix is contributing to the chaos” because “you have so many different regulators still jumping in with interpretations.”

That wave of fund downgrades from Article 9 also raises questions around how to treat the much larger — and growing — fund class of Article 8, AXA’s Humeau said.

“As funds were reclassified from Article 9 to Article 8, there are now very different funds categorized as Article 8 in the market, with very different objectives and different levels of materiality of the ESG approach,” Humeau said. That will make it harder for clients to know what they’re getting in an Article 8 product, she added.

The extent to which Article 8 funds, which represent about $4 trillion in total assets, can all claim to be ESG is up for debate. EU requirements for the fund class to date have been vague, requiring only that it “promote” sustainability. A third-quarter analysis by Morningstar found that more than a third of Article 8 funds have zero exposure to sustainable investments, and only 6% target sustainable allocations that are greater than 50%.

Last month, ESMA proposed setting minimum thresholds for funds marketing themselves as “ESG” or “sustainable.” A fund calling itself ESG should be required to be at least 80% ESG, while a fund calling itself sustainable should have no less than 40% sustainable assets, ESMA said. Morningstar estimates that just 18% of Article 8 funds currently live up to that sustainability threshold.

For now, the safest bet seems to be to “go very conservative” on SFDR fund classifications, Christensen said. But when the dust settles on Europe’s ESG investing rules, and “we better understand the regulatory terrain,” some of the recent downgrades may well be reversed, he said.

–With assistance from Frances Schwartzkopff.

Photograph: Pine trees stand in a forest near the site of the Tesla Inc. Gigafactory in Gruenheide, Germany, on Sunday, Feb. 23, 2020. Photo credit: Krisztian Bocsi/Bloomberg.

Topics Legislation

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs