Executives will face bonus cuts if the companies they run fail to hit climate transition targets, under a new European Union proposal that greatly expands the range of levers regulators can draw on to meet terms of the Paris Agreement.

C-suite managers at companies with more than 1,000 employees will be held personally responsible if trajectories for emissions cuts don’t align with the objective of limiting global warming to 1.5C, according to the current text of the Corporate Sustainability Due Diligence Directive.

If adopted, the wide-ranging bill also will force companies to identify and address human rights and environmental abuses in their value chains. CSDDD, which has already met with vocal opposition from the finance industry, was approved Tuesday by the EU Parliament’s legal committee and will now go to the full assembly. From there, it heads to the European Council, where its passage will likely encounter hurdles.

Industry opposition to key parts of the bill is so intense that lawyers monitoring its progress say the EU faces a bumpy process.

“It is likely that there will be further, significant changes to the CSDDD proposal between now and its final adoption,” said Guillaume Croisant, managing associate of the ESG team at Linklaters LLP. “Heated debates are likely on a number of topics” including executive pay.

CSDDD has the potential to be one of the EU’s most far-reaching pieces of environmental, social and governance regulations. While ESG rules enforced to date impose disclosure requirements on companies, the due diligence directive would force them to act on the information they’re disclosing.

A key focus of the bill is to make sure that private companies have “credible plans” for the transition to a low-carbon economy, said Jurei Yada, program leader for EU Sustainable Finance at climate think tank E3G.

Most companies currently don’t link their ESG policies to remuneration. An analysis of 30 of the world’s biggest clothing and shoe companies by the nonprofit Planet Tracker found that more than half failed to create a connection, and those that did are mostly private firms where ownership is concentrated rather than fragmented.

CSDDD’s current text stipulates that companies found in breach of the directive will face regulatory penalties and stakeholder lawsuits. EU lawmakers have called for fines of at least 5% of a corporation’s net global revenue. The measure would affect both larger European firms and companies outside the region that have sales of more than €150 million, with at least €40 million in the EU.

Lara Wolters, the EU Parliament member responsible for ushering CSDDD through the chamber, has said she’s bracing for a “tough” battle with the finance industry. She also said there’s too much at stake for lawmakers to cave.

News Roundup

ESG Ratings | The world’s largest ESG exchange-traded funds have had their scores lowered at the ratings unit of MSCI Inc., after it changed its methodology in response to feedback from clients.

Giants of Article 8 | Money market funds targeting European clients have quietly been reclassifying their legal status to market themselves as promoters of ESG, with close to $1 trillion of highly liquid client assets now registered as such.

Slowdown | There’s been a steep decline in the number of new sustainable funds in Europe, as asset managers in the region react to a continual deluge of regulatory updates intended to clean up the market.

Downgrades | Vanguard Group Inc. said a wave of MSCI Inc. ESG ratings downgrades has resulted in 26 of its AAA funds losing the top grade.

Insurance | Insurers should consider expanding their use of catastrophe bonds as a way to support the market for climate insurance, European bank and pension regulators said.

Passive | Northern Trust Corp.’s biodiversity-focused fund has emerged as the world’s biggest of its kind with $1.2 billion of assets under management. What’s more, its status as an index-tracking product means passive strategies now make up well over a third of a market that, until very recently, was almost entirely actively managed.

Benchmarks | Passive investment funds that target CO2 emissions reductions or EU climate benchmarks can qualify for the region’s highest ESG classification, the European Commission said in a long-awaited clarification of its rules.

Reversal | A mass wave of downgrades that sideswiped investors as they watched Europe’s top ESG designation get stripped from almost $200 billion may now be reversed.

BNP | The investment arm of BNP Paribas SA is looking into how many of the ESG fund downgrades it recently pushed through may now be reversed, as it digests new guidance from the EU around passive strategies.

Riksbank | Swedish asset managers marketing themselves as climate friendly generally don’t live up to the claim, according to an assessment by the country’s central bank.

Crypto | Gary Gensler brushed off criticism from Republican lawmakers about the Securities and Exchange Commission’s aggressive stance on crypto markets and questioned whether the industry even wants to comply with its rules.

US Support | Voters across both major political parties in the US support their investment managers considering long-term risks in their investment decisions, a new poll shows.

Auditing | The body that sets global auditing rules said it would accelerate a public consultation over ESG assurance so that the new rules are in place by the time mandatory sustainabililty reporting kicks in from 2024.

ISSB | The International Sustainability Standards Board said its imminent reporting standards are intended to “nudge” companies into reporting more sustainability risks in their financial statements.

Bloomberg Research

Banker Bonuses | SEC Chairman Gary Gensler’s April 19 comments that regulators should consider dusting off a Dodd-Frank proposal curbing banker bonuses to safeguard the financial system against further bank failures will likely fall on deaf ears. Though regulators may eventually agree on a package, the regulation would take years to implement. (Bloomberg Intelligence)

SFDR | The European Commission’s latest Sustainable Finance Disclosure Regulation revision is welcome after Article 8 defined funds surged 25% ($1.2 trillion collected over two quarters). A reversal of the classification back to Article 9 is likely as sustainable-investment criteria becomes more flexible. Bloomberg Intelligence’s data helps investors track upgrades, downgrades and asset managers’ SFDR offerings for 23,000 funds. (Bloomberg Intelligence)

Tracking SFDR Reclassifications

Consultation | Much-needed clarity from regulators on sustainable fund disclosure in the EU may be a step closer. (BloombergNEF)

Climate Rules | Lawmakers on both sides of the Atlantic are facing legal threats over climate rules, leaving investors and companies unsure how to prepare for upcoming regulations. (BloombergNEF)

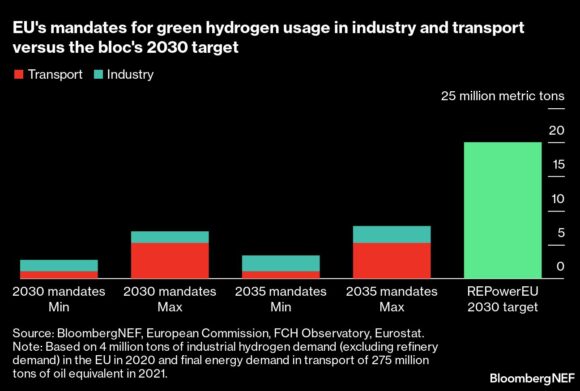

Hydrogen | The world’s first binding quotas for green hydrogen unveiled by the EU fall short of the bloc’s target for 2030, highlighting the efforts still needed to address climate change that scientists warned will likely lead to more dangerously high summer temperatures and drought across the continent. (BloombergNEF)

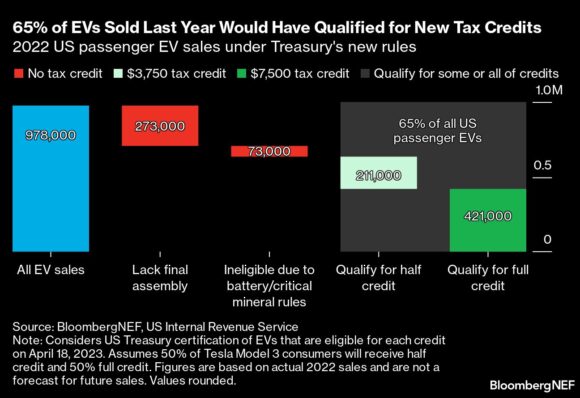

EV Subsidies | Over the past seven months, consumers and automakers in the US have labored to understand the impact of the Inflation Reduction Act on consumer tax credits for electric vehicles. With the update released by the Treasury Department on April 17, buyers finally have clarity on which cars qualify for as much as $7,500 in benefits. (BloombergNEF)

Off the Shelf

Corrections | For years, financial professionals made exaggerated ESG claims that fed a market boom with little in the way of oversight. That era of exuberance around environmental, social and governance investing is now coming to an end with increasingly consequential waves of regulations. In the US, where ESG has also become embroiled in partisan politics, the fallout is evident in the shrinking pool of assets carrying an ESG label: down by more than half over the past two years. In Europe, new regulations led the world’s biggest asset managers to strip coveted ESG tags from about $190 billion in aggregate client funds in the latter part of 2022.

Central Banks | Some of the world’s largest central banks are joining the fight against climate change. Though melting glaciers may be a huge leap from monetary policy, policymakers say they must respond to threats that have the potential to disrupt the global economy. Some critics say climate policy is better left to politicians, particularly in countries where central banks are hemmed in by explicit government mandates.

Taxonomies | Floods, droughts and food shortages are just some of the effects of climate change, as exploitation and corruption drive social injustice around the world. Governments tackling these issues are realizing that to solve them, they need to first define and measure them. Some are turning to so-called taxonomies that establish which economic practices and products are harmful to the planet and which aren’t. The idea is the price of goods and services must reflect the human and environmental cost of both production and disposal, which in turn would spur much-needed change. But designing a code is fiendishly difficult.

Double Materiality | Should a business or an investment fund care only about making money, or should it also worry about the environment, social justice and good governance? Can the two goals overlap? Do they already? These questions get to the heart of something called “double materiality.” While the concept has been built into new European regulations, it has yet to make significant inroads in the US — even as Wall Street behemoths like JPMorgan Chase & Co. embrace the idea. At issue is what information should be mandatory to report, and who decides?

Circular Economy | Take, make, use, dispose. For decades, this has been the standard approach to production and consumption. Companies take raw materials and transform them into products, which are purchased by consumers, who ultimately toss them out, creating waste that ends up in landfills and oceans. Worried about climate change and environmental degradation, people are challenging the sustainability of this linear model and urging a so-called circular economy of take, make, use, reuse and reuse again and again.

ABC | You’ve probably heard of ESG, and may know it as a form of investing and finance that involves considering material financial risks from environmental factors, social issues and questions of corporate governance. If you’re like most people, you’re probably not clear on the difference between ESG and socially responsible investing, impact investing and similar, sometimes overlapping approaches — in part because ESG has come to mean different things to different people. That vagueness has helped fuel rapid growth in recent years. But accompanying those gains has been increased scrutiny from regulators cracking down on banks and investment firms making exaggerated claims.

Photograph: Emissions rise from cooling towers at a lignite fueled power plant in Germany. Photo credit: Bloomberg Creative Photos/Bloomberg

Topics Legislation

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent

Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup