Global commercial insurance rates fell 4%, on average, in the second quarter of 2025 following a 3% decline in Q1 2025, according to the latest Global Insurance Market Index released by Marsh, the insurance brokerage business of Marsh McLennan.

The exception to the rule of the trend toward softening rates was the casualty market, which once again saw average rates increase by 4% globally during the second quarter (level with Q1 2025 and Q4 2024).

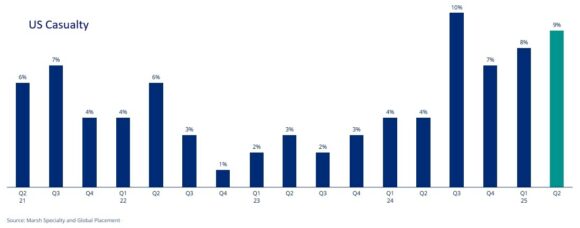

This was led by a 9% increase in U.S. casualty rates, which Marsh attributed to the frequency and severity of casualty claims, many of which are characterized by large, so-called “nuclear” jury awards. During Q1 2025, U.S. casualty rates increased by 8% and rose by 7% in Q4 2024. (Editor’s note: Nuclear verdicts are defined as jury awards that exceed $10 million).

“Mounting competition among insurers with ambitious growth targets is providing reduced pricing and broader coverage options. Against this backdrop, rising U.S. casualty rates are a concern for clients,” commented John Donnelly, president, Global Placement, Marsh, in a statement.

Read more: Excessive Litigation Causes Surge in Liability Insurance Costs: Marsh McLennan CEO

Q2 is the fourth consecutive quarter that saw a drop in composite insurance rates following seven years of quarterly increases and is a continuation of the moderating rate trend first recorded in Q1 2021, said Marsh, explaining that increasing insurer competition is the main catalyst behind rising market capacity, more favorable rates, and broader coverage options.

“In the second quarter, clients generally benefited both from reductions in pricing and improved coverage options. Major insurers had ambitious growth targets and generally experienced favorable conditions, including reinsurance pricing, which contributed to high levels of competition,” Marsh said in the report.

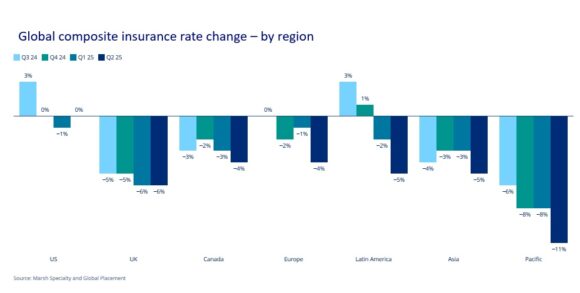

All global regions experienced year-over-year composite rate decreases in Q2 – of between 4% and 11% – except for the U.S., where the rate was flat.

The Pacific and the UK regions experienced the largest composite rate decreases, at 11% and 6%, respectively. Rates declined in Asia; Latin America and the Caribbean (LAC); and India, Middle East, and Africa (IMEA) by 5%; and in Canada and Europe by 4%.

Turning to global property rate trends, Marsh reported they declined by 7% globally following a 6% decline in Q1, with rate movement varying by region. The U.S. and Pacific regions experienced the largest decreases, at 9% and 13%, respectively, while all other regions declined between 4% and 7%.

Financial and professional lines rates continued to moderate and decreased by 4% globally in the second quarter compared to a 6% decrease in Q1 2025. Rates declined in every region, except the U.S., where rates remained flat.

Cyber insurance rates decreased by 7%, with declines seen in every region, including 17% in LAC and 15% in Europe. In the U.S., cyberinsurance rates decreased 3%, which marked the ninth consecutive quarter of reductions.

U.S. Casualty Market Trends

Diving into U.S. casualty market rate trends, insurance rates increased 9% during the second quarter, said Marsh, noting that the increase was 12% if workers’ compensation is excluded.

Marsh went into more detail about U.S. casualty trends:

- Auto liability rates in the U.S. continued to be affected by large jury verdicts and escalating damage repair costs.

- General liability (GL) rates were flat, though sectors like real estate, hospitality, and public entities faced increases due to loss activity.

- Some insurers offered alternative structures for auto liability and GL, such as higher retentions and corridor deductibles, particularly for larger clients.

- Increased coverage restrictions in GL included per- and polyfluoroalkyl substances (PFAS), biometrics, and cyber, with additional exclusions for real estate and hospitality related to sexual abuse and human trafficking.

- In the umbrella/excess liability market, risk-adjusted rates rose 18% in the quarter, up from 16% in the first quarter; traditional rates increased 14% in each of the past two quarters. Some insurers offered a maximum of $10 million in capacity per risk due to adverse U.S. litigation developments.

Umbrella/Excess Liability

Marsh then provided more specifics about U.S. umbrella/excess liability trends, noting that lead umbrella programs with favorable loss experience saw rate increases of 12% to 15%, while those with adverse loss development faced increases over 30%. Limits were often reduced, with minimal new capacity, adding to the impact of the closure of four London markets in 2024. Some high-excess insurers have raised minimum prices to $10,000 per million, which affected umbrella pricing.

In addition, insurers generally shifted from single tower capacity to favoring supported umbrella options, due to severe claims frequency, Marsh said, noting that insurer concerns over third-party litigation funding grew, with lead insurers emphasizing the need for renewal pricing to account for estimated loss cost trends of 12% to 15%.

In the area of auto liability, Marsh said increased frequency and severity of claims have resulted in insurers raising attachment points for large fleets, particularly in higher-risk states. Marsh also noted that certain umbrella/excess insurers sought to limit coverage for specific risks, including PFAS and human trafficking.

*Note: All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, Marsh has rounded all percentages regarding rate movements to the nearest whole number.

Related:

- Global Q1 Commercial Insurance Rates Drop 3%, but US Casualty Bucks the Trend

- Global Commercial Insurance Rates Drop in Q4 for 2nd Consecutive Quarter: Marsh

Topics Trends Commercial Lines Business Insurance Pricing Trends Casualty

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance