Missouri’s top insurance regulator says a new report on exposures within the reach of the New Madrid seismic zone reinforces the need for residents in affected areas to purchase earthquake insurance.

Missouri Insurance Director John Huff says, however, there is a distinct lack of affordable earthquake coverage in his state, especially in the Southeast region.

A report released by global reinsurer Swiss Re suggests that should a series of earthquakes similar to those that occurred in the New Madrid seismic zone in 1811/1812 hit the central United States today the potential economic threat to the region would be crippling.

In its report, “Four Earthquakes in 54 Days,” Swiss Re estimates potential insured losses at around $150 billion in an area that is much more highly populated than it was a little over 200 years ago.

The total damage, including uninsured property and assets, would rise to more than $300 billion Swiss Re estimates in its report, which considers various factors, including seismic, demographic and economic, to model the scope of the risk.

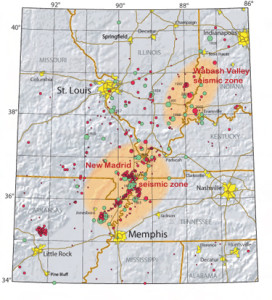

The 150 mile New Madrid fault zone has the potential to affect the region in eight key states — Arkansas, Illinois, Indiana, Kentucky, Louisiana, Mississippi, Missouri and Tennessee — the combined population of which in 1810 was about 830,000. The population of those states has grown by a factor of 55 since then. The area shaken by the 1811/1812 quakes now includes the cities of St. Louis, Memphis, Nashville, Indianapolis and Little Rock, the report states.

Swiss Re posits that most insurers, reinsurers, rating agencies and policymakers are prepared for one large New Madrid earthquake, but it’s not at all certain that they’re prepared for more than one. The seismic event that occurred in the region two centuries ago actually consisted of three separate large earthquake events: one on Dec. 16, 1811, which was followed by a large aftershock; one on Jan. 23, 1812; and one on Feb. 7 1812. Each event measured greater than 7.0 in magnitude, according to the United States Geological Survey.

The report concludes that seismic activity along the New Madrid fault line would tend to occur in “large event sequences.” Such activity would likely be of larger magnitude, closer in time and of greater economic value than that which occurred in Christchurch, New Zealand, with a magnitude 7.1 earthquake in September 2010.

The report, coupled with small temblors that rattled Southeast Missouri in July, serve as reminders that Missouri residents are vulnerable to earthquakes, Insurance Director Huff says in an announcement released by the Missouri Department of Insurance.

“However, many Missourians are having trouble getting earthquake coverage. Recent insurance data demonstrates that southeast Missouri is experiencing an insurance coverage crisis,” he says.

The insurance department notes that the U.S. Geological Survey estimates the probability of a magnitude 7.5 or greater earthquake in the New Madrid zone over the next 50 years is 7 to 10 percent. The probability of an earthquake exceeding magnitude 6 over the same period is 25 to 40 percent.

A joint assessment by the Mid-American Earthquake Center of the University of Illinois and the Federal Emergency Management Agency predicts a New Madrid event could constitute the highest total economic loss of any natural disaster in U.S. history. Swiss Re’s report makes the same assessment.

Data collected by the department from insurers who offer earthquake coverage in Missouri, show that on average premiums in the six counties that comprise the New Madrid area increased by more than 500 percent between 2000 and 2014. In one county the coverage cost rose by nearly 700 percent.

In 2000, more than 60 percent of homes in the New Madrid area had earthquake coverage. By 2014, the rate of coverage had plummeted to 20 percent, according to the insurance department, which expects to release a comprehensive earthquake report later this year.

The value of homes in Missouri without coverage is estimated to be $86.2 billion.

Swiss Re states that more than one-third of its insured loss estimate is attributed to the multiple effects of large earthquakes occurring one after the other, something that wouldn’t be seen in a single, isolated earthquake. According to the report, multiple quakes will cause confusion as well as disagreement in handling insurance claims.

“This is based, in part, on recent experience of claims complexity and disputes following the 2010/2011 Christchurch earthquakes,” the report’s author writes.

Not only will property damage coverage come into play but so will business interruption, demand surge and loss adjustment expenses.

Topics USA Catastrophe Missouri

Was this article valuable?

Here are more articles you may enjoy.

‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT