The disruption in the municipal bond market is punishing some of the most loyal buyers of the debt.

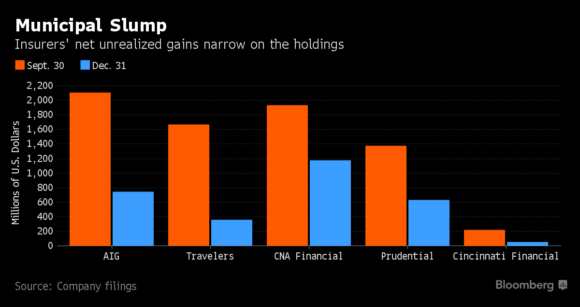

The insurance industry has seen more than $5 billion of gains erased on state and local bonds after Donald Trump’s victory in the presidential race, with American International Group Inc. and Travelers Cos. among the hardest-hit companies. While the yield on state and local debt is typically exempt from federal taxes, that advantage would be diminished if Trump follows through on plans to lower the levy on all corporate profits. Beyond that, investors are concerned that an overhaul of federal laws could end the favorable treatment on munis.

There are “just crazy amounts of ‘What ifs?’ at this time,” said Peter Block, managing director for credit strategy at Ramirez & Co., a New York-based underwriter. Beyond that, he said, the stock rally led to a shift in allocation as some traditional muni investors “saw that equities were just on a tear, and they wanted a part of that.”

Travelers, the only property/casualty insurer in the Dow Jones Industrial Average, had unrealized gains on its $32 billion municipal portfolio narrow to $360 million on Dec. 31 from $1.7 billion just three month earlier, according to regulatory filings. The gain at AIG was just $747 million at the end of 2017, about a third of the figure from Sept. 30. CNA Financial Corp., Prudential Financial Inc., Cincinnati Financial Corp. and Alleghany Corp. also endured declines in their portfolios.

Many types of bonds lost value after the election, as investors bet on economic growth under Trump. In most cases, insurers welcomed the shift because yields climb when the securities lose value. That could help boost investment income on the trillions of dollars in corporate debt, Treasuries and mortgage-backed securities that the industry holds to back obligations to policyholders.

‘Less Attractive’

On munis, however, where insurers accepted lower yields in exchange for tax benefits, the changing economics could leave more of a sting. If the corporate tax rate is lowered to 25 percent from 35 percent, the benefit of holding municipal debt versus AA-rated corporate debt would diminish substantially, said Matt Caggiano, who helps oversee more than $9 billion in insurer municipal holdings at Deutsche Bank AG.

“Now you have a Republican president and a Republican House and Senate,” he said. “They all would like to decrease the corporate tax rate. That could really make munis less attractive to insurance companies.”

Municipal debt has trailed a risk-matched basket of U.S. Treasuries by about 16 basis points since Election Day in November, according to the Bank of America Merrill Lynch index data. Still, big insurers pride themselves on being able to hold securities through market fluctuations.

“We do not expect property-and-casualty insurers sell large portions of their municipal portfolio outright, but rather partially redirect proceeds away from tax-exempts as their municipal holdings mature,” Barclays Plc analyst Mikhail Foux said in a January note to investors.

The declines in unrealized gains don’t count against earnings, but do reduce book value, a measure of financial strength monitored by investors and analysts. P&C insurers account for about 10 percent of the $3.8 trillion municipal market.

‘Non-Trivial’

Investors are still waiting for clarity from Washington, as the Trump administration and Congressional Republicans have sent mixed signals. If lawmakers reduce rates on corporations and individuals, they could seek to limit tax breaks to help replace the lost revenue.

Trump is unlikely to support the complete elimination of the muni exemption, given that the debt supports infrastructure projects, according to Municipal Markets Analytics. Still, the chance has increased for a “negative adjustment,” according to the research firm.

“Obviously, a lot is going to be determined by the shape of any tax legislation,” Travelers Chief Investment Officer William Heyman said in the New York-based company’s fourth-quarter earnings call when discussing the outlook for as far off as 2019. “At the very extreme, if you needed a revenue-neutral bill, and the municipal exemption itself were affected, that would be non-trivial.”

Shares of Travelers and AIG both declined this year through Monday, even as the S&P 500 Financials Index is up about 5.3 percent since Dec. 31. To be sure, the insurers have been hit by other surprises as well, including higher-than-expected claims costs.

Relative Value

At Chubb Ltd., another insurer with significant muni holdings, said this month that it was too early to say whether the company would reduce its exposure. The company hadn’t released its 10-K filing for 2016 as of Monday night.

“We’re running scenarios at different tax rates to determine the impact of the portfolio,” Chief Financial Officer Phil Bancroft said on a Feb. 1 conference call. “So we’re evaluating it. And we’ll look at it in light of the tax developments that emerge over the next months.”

Topics Carriers Legislation

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation