Independent insurance agents and brokers can celebrate a four-year growth trend, reports Reagan Consulting.

in its third-quarter Organic Growth and Profitability (OGP) study, the agency consultant says that the sector’s organic growth rate in the third quarter was 6.1 percent — tied for the highest growth rate in the last 15 quarters. “This strong Q3 performance is another confidence builder for the industry,” says Harrison Brooks, vice president of the firm.

All lines of business contributed to the third quarter and to the strongest nine-month growth performance since September 2013, according to the survey of 200 midsize and large agencies and brokerage firms. The growth was led by commercial lines with 6.8 percent, surpassing group benefits, which grew for the first time since 2014 by 6.3 percent. Personal lines – at 3.8 percent growth – posted its highest Q3 growth rate since Reagan began the OGP survey in 2008.

The survey found that brokers expect strong growth throughout 2018, estimating a full-year growth rate of 6.0 percent versus just 4.5 percent in 2017. “If history is any indication of future performance,” says Brooks, “strong GDP tailwinds are likely to continue to drive strong organic growth for agents and brokers.”

Reagan leadership did express one note of caution around agency profitability.

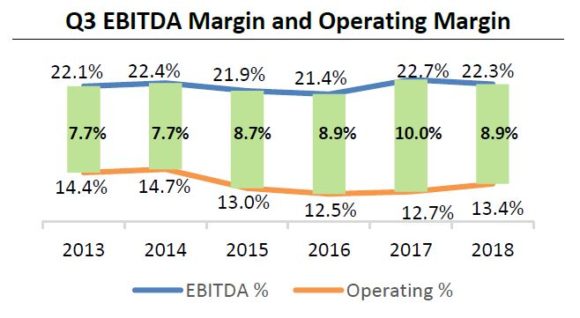

“It will be important to monitor EBITDA [earnings before interest, taxes, depreciation and amortization] margins, especially in larger agencies,” says Brooks. EBITDA margins declined slightly in Q3 2018 from last year, and it appears that contingent income, which dropped from 8.6 percent of revenue in 2017 to 8.0 percent of revenue in 2018, was the primary driver.

The reduced spread between EBITDA margins and operating margins supports that conclusion, the reagan consultants said. Operating margins exclude contingent income and can be managed by the agency through operating efficiencies and expense controls. Q3 reporting brokers and agents did experience an encouraging uptick in Q3 operating margins, sparking hope that the recent dip in EBITDA margins “can be tempered by agencies continuing to improve their operating margins, which is the best indicator of structural profitability,” says Brooks.

Source: Reagan Consulting

Topics Agencies Independent Agencies

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer