Private U.S. property/casualty insurers reported a $4.7 billion net underwriting gain in nine-months 2018, a sharp turnaround from a $21.0 billion net underwriting loss a year earlier.

The results were helped by a rare decline in overall losses and loss adjustment expenses (LLAE) and significant premium growth, according to data firm ISO and the American Property Casualty Insurance Association (the new trade group formed by the merger of the American Insurance Association and the Property Casualty Insurers of America).

Overall LLAE decreased 0.5 percent to $310.2 billion in nine-months 2018, driven largely by a $13.1 billion decline in net LLAE from catastrophes.

Net written premiums grew 11.4 percent to $468.8 billion in nine-months 2018, affected in part by organic premium growth and changes that multiple insurers made to their reinsurance arrangements.

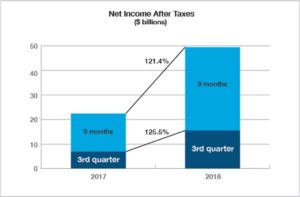

Net investment income grew to $40.9 billion in nine-months 2018 from $35.4 billion a year earlier, with the increase affected by large dividends from insurers’ subsidiaries that do not operate in property/casualty insurance. Overall, insurers’ net income after taxes more than doubled to $49.5 billion in nine-months 2018 from $22.4 billion in nine-months 2017.

Net investment income grew to $40.9 billion in nine-months 2018 from $35.4 billion a year earlier, with the increase affected by large dividends from insurers’ subsidiaries that do not operate in property/casualty insurance. Overall, insurers’ net income after taxes more than doubled to $49.5 billion in nine-months 2018 from $22.4 billion in nine-months 2017.

Third-Quarter Results

Insurers’ net income after taxes rose to $15.5 billion in third-quarter 2018 from $6.9 billion in third-quarter 2017, and their combined ratio improved to 99.7 percent in third-quarter 2018 from 110.7 percent a year earlier.

Their annualized rate of return on average surplus more than doubled to 8 percent in third-quarter 2018 from 3.8 percent a year earlier.

Net written premiums rose 8 percent in third-quarter 2018, compared with 4.2 percent in third-quarter 2017.

Neil Spector, president, ISO, noted that the full-year industry results for 2018 will be affected by the losses from the California wildfires.

He offered counsel for insurers moving forward. “In the coming years, insurers’ underwriting results will critically depend on their ability to acquire and deploy the analytical and technological tools to help automate processes, improve decision making, and reduce costs,” Spector said.

Robert Gordon, APCI’s senior vice president for Policy, Research and International, also had an observation about results moving forward in light of recent stock market activity:

“Annualized investment return continues to underperform the industry average over the last 10 years, and the stock market’s precipitous decline in December may be a harbinger of increasing volatility. Insurers are well positioned to provide stability and expanded protection opportunities to consumers in the new year,” he said.

Source: ISO, APCI

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs