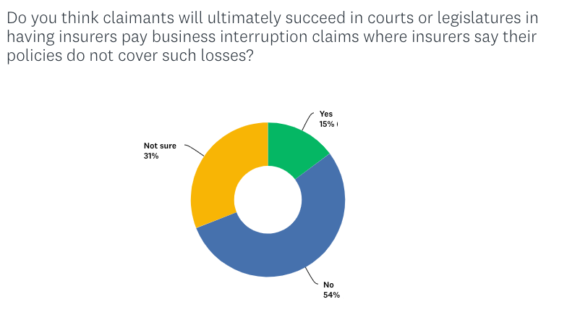

A slight majority (54%) of property /casualty insurance industry professionals think insurers will succeed in defeating legal and political attempts to force them to pay business interruption claims from the coronavirus pandemic.

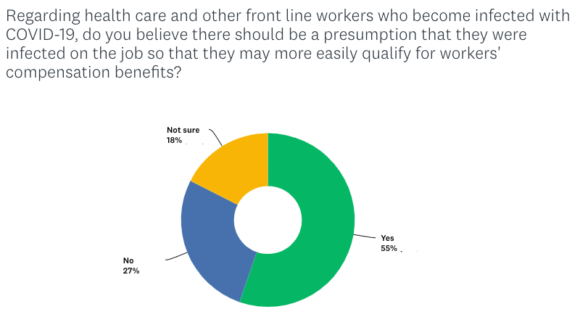

A slight majority (55%) also believe that that the industry should accept the presumption that health care and other frontline workers with COVID-19 contracted the disease while on the job and thus make them eligible for workers’ compensation coverages.

Business interruption and workers’ compensation have emerged as two insurance controversies amid the coronavirus pandemic.

According to results of the Wells Media 2020 Property/Casualty Insurance Industry Coronavirus Survey, while 54% believe the court and legislative efforts seeking business interruption payments will fail, and only 15% believe they will succeed, almost one-third ( 31%) are not sure what will happen.

Hundreds of commercial policyholders are suing insurers seeking payments for business lost due to the shutdowns during the coronavirus crisis. They are pressing various arguments including that their policies do not contain an exemption for viruses, that the shutdown is covered because it was ordered by a civil authority order, or that the virus amounted to property damage.

The insurance industry has been pushing back, arguing that no coverage is owed under most commercial property insurance policies for business income losses caused by COVID-19 closure orders. Insurers argue that business interruption policies are only triggered when actual physical property damage prevents a business from operating.

Earlier this month the first decision in a state court came down decidedly in favor of the industry. Judge Joyce Draganchuk of Michigan’s 30th Circuit Court ruled verbally on July 1 that some tangible alteration to a property is required to trigger coverage. What’s more, a virus exclusion in the property insurance policy would have barred coverage even if the claimants had alleged the virus did cause physical damage, the judge said.

In workers’ compensation, the controversy centers around proving if the virus was contracted on the job. Unlike in a back strain where it is typically straightforward that the injury occurred while on the job, it’s more difficult to determine the origins of diseases like COVID-19.

In most states, workers have to prove they got the virus on the job to qualify for workers’ compensation. However, some states have shifted the burden of proof for coverage of job-related COVID-19 so that workers including first responders and nurses don’t have to prove how they got the virus on the job.

The 2020 Property/Casualty Insurance Industry Coronavirus Survey found that a majority (55%) in the P/C insurance industry support granting the workers’ compensation presumption in favor of the workers. Meanwhile, 27% do not support it and 18% are not sure.

Wells Media Group conducted the Property/Casualty Insurance Industry Coronavirus Survey online from May 26 through June 12, 2020. For that period, the survey was available to readers on three of Wells Media’s sites: InsuranceJournal.com, CarrierManagement.com and ClaimsJournal.com, all of which serve the property/casualty insurance industry. A total of 1,704 respondents participated. They work for agencies and brokerages, insurers and reinsurers, vendors to the industry, and other industry-related organizations in all areas and levels of responsibility.

Topics Trends Workers' Compensation Property Property Casualty Market Casualty

Was this article valuable?

Here are more articles you may enjoy.

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  Study: AI May Be Tempering Insurer Hiring

Study: AI May Be Tempering Insurer Hiring  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends