Estimated total insured losses from Hurricane Isaias will be between $3.0 and $4.5 billion in the U.S. This includes estimated losses to the National Flood Insurance Program (NFIP) of between $400 and $700 million, according to RMS, the catastrophe risk modeling firm.

In addition, RMS estimates Hurricane Isaias insured losses for the Caribbean of less than $500 million.

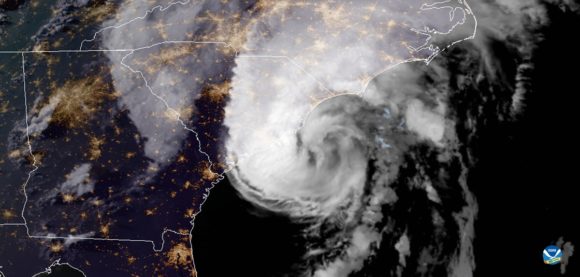

“Although Isaias weakened to a tropical storm after landfall, it maintained its intensity as it moved up the U.S. east coast and underwent extratropical transition, due to its interaction with a strong jet stream and favorable atmospheric conditions. As a result, many areas of high exposure, especially in the Mid-Atlantic and Northeast, were subject to stronger winds and wind gusts than would otherwise be expected, especially in coastal areas of these regions. It’s another example of how impactful low intensity storms can be”, said Jeff Waters, senior product manager, RMS North Atlantic Hurricane Models.

For the U.S., this estimate includes wind, storm surge, and inland flood losses across parts of the Southeast, Mid-Atlantic, and Northeast regions.

The U.S. estimate reflects property damage and business interruption to residential, commercial, industrial, and automobile lines of business. RMS said it expects the majority of insured losses to impact residential lines.

“The large number of affected exposures, especially in the Mid-Atlantic and Northeast U.S., are likely to produce large claims volumes. Pressure to settle these claims quickly may lead to claims inflation. We also considered the impacts of the COVID-19 pandemic. We expect fewer loss inspections following this event, potentially causing prolonged repairs and recovery times, both of which tend to inflate claims costs” said Pete Dailey, vice president, Product Management, RMS.

The estimate also includes estimated losses to the National Flood Insurance Program (NFIP), which RMS expects to be between US$400m and US$700m. RMS derived the NFIP losses using an RMS view of NFIP exposure based on the 2019 NFIP policy-in-force data published by FEMA in 2019.

RMS expects the majority of total U.S. insured losses to be driven by wind. Storm surge is expected to contribute less than 10% of the total losses.

For the Caribbean, this estimate includes wind-only losses, which RMS expects to be less than $500 million. The Caribbean loss estimate includes property damage and business interruption to residential, commercial, and industrial lines of business.

On Aug. 10 risk modelers at Karen Clark & Co. released a similar estimate of $4 billion of insured losses in the U.S. and a lower number of $200 million for the Caribbean. However, KCC did not include costs from the U.S. government’s flood insurance program that are in the RMS number. The KCC estimates cover privately insured wind and storm surge damage to residential, commercial, industrial properties and automobiles.

According to insurance broker Aon’s catastrophe risk analysis division Impact Forecasting, Isaias initially formed as a tropical storm on July 29, made Bahamian landfall on July 31 and grew into an 85-mile-per-hour storm as it made landfall in Ocean Isle Beach, N.C. on Aug. 3.

The storm caused damage in more than 12 East Coast states. Damage included power outages, and downed trees that caused structural damage and crushed automobiles. More than three million customers along the Atlantic coast lost power. There was also wind damage to roof coverings and siding, and window openings of commercial and residential buildings during the hurricane. Some older buildings sustained severe structural damage.

In the Caribbean, high winds caused damage in Puerto Rico, the Dominican Republic and Bahamas, including downed trees and power lines. More than 350,000 people in Puerto Rico lost power and the storm damaged a number of communication towers, KCC said.

The damage done in the northeastern U.S. including Pennsylvania, New Jersey and New York looks be the main driver of insurance and reinsurance industry losses, according to Aon.

Topics USA Catastrophe Natural Disasters Profit Loss Flood Hurricane

Was this article valuable?

Here are more articles you may enjoy.

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley