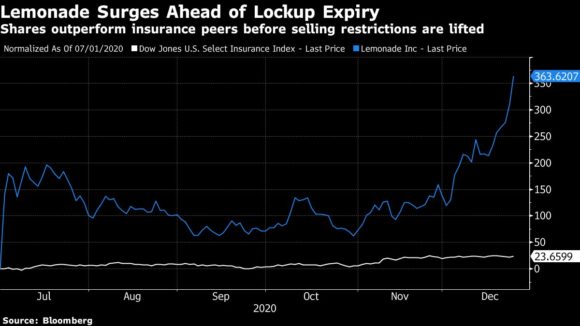

The best-performing listing of 2020 is poised to enter the new year with extra volatility after insider selling restrictions expire this week.

Insurance provider Lemonade Inc. is trading more than 350% above its July 1 initial public offering price, the best of any 2020 debut above $300 million, according to data compiled by Bloomberg. But roughly 44 million additional shares — mostly held by insiders — will be eligible for sale on Tuesday, according to the IPO prospectus.

The company’s shares have soared on the promise of its digital platform in carving out a niche for renters and homeowners, according to Bloomberg Intelligence research. In the past month, the stock has nearly doubled on gaining optimism the group will also be able to expand into new markets like pet and auto insurance.

Despite the acceleration over the past few weeks, Piper Sandler analyst Arvind Ramnani wrote in a note dated Dec. 15. that the firm remains positive “as the long-term opportunity for the company warrants an expanded multiple.”

Traders are bracing for volatility as affiliates — including all of the company’s directors and executive officers — hold more than 38 million shares subject to the lockup. That compares to 15.8 million shares available to trade as of Nov. 12, according to data compiled by Bloomberg. Of that, 24% are sold short, according to financial analytics firm S3 Partners.

This will be the second lockup expiration for the remaining two thirds of shares subject to the lockup agreement after the first expiry in November.

Top holders include SoftBank Group Corp. and Sequoia Capital Operations LLC.

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Preparing for an AI Native Future

Preparing for an AI Native Future  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance