The Federal Reserve Bank of New York warned that credit scores — the all-powerful number that can determine if a consumer is able to qualify for a loan, rent a home or even buy car insurance — might have gotten less reliable during the coronavirus pandemic.

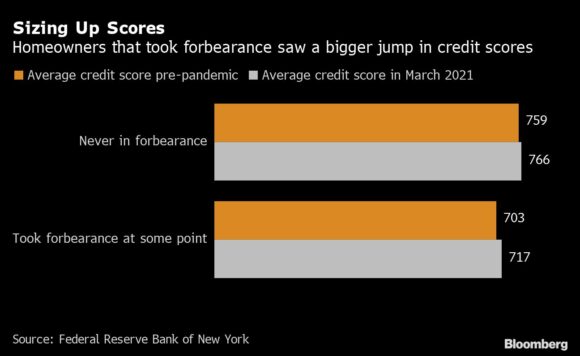

Scores for homeowners who took advantage of payment relief on their mortgages actually rose an average of 14 points over the course of the pandemic, according to a new analysis by the New York Fed. That was a bigger jump than the seven-point increase seen among borrowers that didn’t take forbearance on their loans.

“This is because, although they were not making payments, their credit reports are treated as if they’re making continued payments for credit-scoring purposes and account histories,” researchers for the New York Fed said Wednesday in a blog post. “The concept of the credit score, a device to distinguish good borrowers from bad borrowers, may lose some of its power in signaling creditworthiness to lenders, at least for some time.”

Banks and financial companies use credit scores to determine a consumer’s willingness and ability to pay them back. But the firms that provide the figures have long faced criticism from consumers and advocates who say it’s not clear what data they use to calculate the scores or what can be done to boost them.

In the depths of the coronavirus pandemic, as unemployment surged and government officials urged consumers to shelter in place, the country’s largest mortgage lenders debuted a raft of forbearance options to borrowers that allowed them to delay payments for as long as 18 months.

The New York Fed found that roughly 13% of mortgage borrowers were in forbearance for at least one month during the past year and more than a third of those homeowners were still seeking relief as of March.

‘Muddled’ Tool

“One thing to keep in mind is, credit scores may be less informative,” Joelle Scally, a financial and economic analyst for the Federal Reserve Bank of New York, said in press briefing. “They’re a really important tool for lenders to identify creditworthy borrowers, but with the protection of the forbearance programs some of that may be muddled.”

It’s not just credit scores that are losing some of their power: The New York Fed said about 8% of borrowers were already behind on their mortgages when they entered forbearance. After taking relief, the vast majority were reported as current on their loans.

“As a consequence, credit-bureau measures of mortgage delinquency must be viewed cautiously,” according to a separate blog. “Current foreclosure data and delinquency statistics drawn from credit-bureau data do not accurately give a clear indication of housing-market stresses.”

Top Photo: The Marriner S. Eccles Federal Reserve building in Washington, D.C., U.S., on Monday, May 3, 2021. President Biden’s $4 trillion vision of remaking the federal government’s role in the U.S. economy is now in the hands of Congress, where both parties see a higher chance of at least some compromise than for the administrations pandemic-relief bill.

Was this article valuable?

Here are more articles you may enjoy.

Marsh, Aon in Talks With US on Insuring Tankers in Hormuz

Marsh, Aon in Talks With US on Insuring Tankers in Hormuz  Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say  Study: AI May Be Tempering Insurer Hiring

Study: AI May Be Tempering Insurer Hiring  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition