The heightened perception of risk stemming from cyber attacks, the climate, pandemics and even inflation are just a few of the volatile factors fueling a demand-side need for more specialized coverage approaches, which underscores the premium growth prospects for the overall managing general agent (MGA) segment.

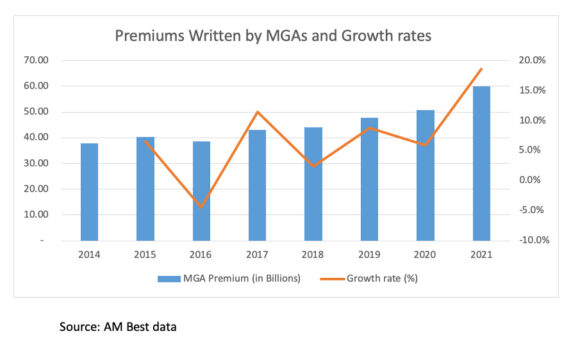

AM Best estimates that the total premium written through the MGA market in the United States reached $60 billion in 2021 compared with $51 billion in 2020. This followed the growth story for the economy in 2021, as lockdowns lifted and monetary policies eased, which contributed to real gross domestic product growth of 5.7 percent. As businesses reopened, commerce resumed and the insurance industry experienced a premium growth of 9.5 percent, attributable to a hardening of market conditions and pricing.

AM Best estimates that the premium that has moved through the MGA market has doubled over the past decade. Acquisitions and consolidations of insurance distributors have led to a decline in the number of brokers, while the number of MGAs rose. Specialized brokers shifted to MGA operations, providing insurers with a more cost-effective conduit to new markets. Some MGAs used established relationships with affinity groups and their ability to bundle risks to provide insurers access to niche business opportunities.

Among these niche opportunity areas is cyber insurance, which is challenged by increasingly sophisticated ransomware criminals. Another is the increased frequency and severity of weather-related events in recent periods, along with the impact and challenges arising from secondary perils. Inflation also has caused an increase in asset values—corporations, consumers and their agents are increasingly facing an insurance market with very cautious risk appetites.

MGAs play a vital role in matching these risks with insurers. There have been a number of entrants to markets such as directors & officers and cyber as these lines have attracted capital and talent.

AM Best includes MGAs in the category of delegated underwriting authority enterprises (DUAEs), which groups together managing general underwriters, coverholders, program administrators, program underwriters, underwriting agencies, direct authorizations and appointed representatives.

Reinsurer Appetites and the Boom in Fronting Companies

Over recent years, the appetite of global reinsurers to participate in DUAE business has increased notably, with a corresponding expansion observed in the capacity deployed by reinsurers in this segment. Reinsurers have long sought for avenues to get closer to original insured risks, and DUAEs are one route to achieve this. Providing capacity for DUAE-placed risks can enable reinsurers to access more primary-like business, which can provide valuable diversification against their traditional reinsurance exposures.

For example, a reinsurer providing capacity to a speciality MGA may be able to access a particular type of risk profile or portfolio of business that simply never makes it to the reinsurance market through traditional risk transfer.

Notwithstanding the allure of access to more primary orientated risks, the development and management of direct DUAE relationships can be a complex, costly and time-consuming endeavor for reinsurers. In particular, the process of selecting DUAEs that will receive capacity, establishing relationships that provide the desired levels of diversification, underwriting profitability and business scale, as well as ongoing monitoring, can be a minefield for reinsurers.

These push and pull factors for reinsurers to engage in the DUAE space are seen as key drivers for the significant expansion in DUAE fronting companies over recent years, which in many cases have been able to position themselves successfully as an important conduit for reinsurers to access DUAE business.

Fronting arrangements are contracts between a licensed, admitted (or on occasion surplus lines) carrier and a company that has the ability to generate insurance business but may not possess the authority or the desire to write the insurance policy.

The fronting insurance company can produce an insurance policy. The assuming company and the primary insurer will have an indemnifying agreement so the risk-bearing company is still responsible for the contracts. At other times, the insurer may act as a pass-through or fronting company for the business, which is then reinsured to a specialty reinsurer created by the producer or an unaffiliated reinsurer, making the reinsurer the party that assumes the economic risk for the business written. The number of U.S. fronting companies and the associated premium volumes processed through these companies have expanded rapidly in recent years.

Expansion in the fronting area continues to provide greater access for reinsurers to participate in the DUAE space. Reinsurers can gain access to a diversified book of business from multiple DUAEs and an opportunity to get closer to the original insured through fronting companies. Pure fronting companies, such as Markel Corp.’s State National, reinsure at 100 percent with third-party reinsurers. By contrast, hybrid fronting companies will often retain 10-20 percent of the risk and also participate in sliding scale commission structures.

This acceptance of risk by the fronting company supports alignment of interests and also aids with embeddedness in the process, partnerships, underwriting capabilities, claims handling and management of reinsurance. The concept of “skin in the game” by fronting companies is likely to remain an important consideration for reinsurers, and over time, we could see increased pressure for fronting companies at the lower end of the retention spectrum to grow their participation to keep interests sufficiently aligned with capacity providers.

Market Condition and Capacity Observations

Most lines of business, albeit to varying degrees, have been subject to pricing increases and generally hardening market conditions over the past 12 months. Yet, for most DUAEs, capacity has remained available and sufficient. Notable exceptions to this include new DUAE entrants and products, which may have been subject to tighter capacity, and some lines of business in which appetites have been reduced over recent periods, such as peak peril property-catastrophe exposure. However, for the DUAE market overall, capacity has generally remained free-flowing and viable for DUAEs.

Part of this ongoing supply of capacity is seen to emanate from the aforementioned influx of reinsurance capacity, aided by the fronting model opening the door to easier access for global reinsurers. In addition, following Lloyd’s pullback of capacity in 2020 as part of its broader program to reduce its exposure to underperforming business, this market increased capacity for DUAEs in 2021.

Capacity provision by the insurance-linked securities (ILS) market is also expected to remain a growing area for DUAEs over time. ILS capital is seeking to back DUAEs that are considered to have strong track records but for whom the traditional reinsurance market is proving tougher at this time. As DUAEs increasingly look to efficient reinsurance capital, this trend is likely to continue through this year and into the next. Business that is focused on casualty lines of insurance and reinsurance could prove increasingly attractive to ILS investors over time given the cash-positive nature of the structure.

This article first was published in Insurance Journal’s sister publication, Carrier Management.

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’