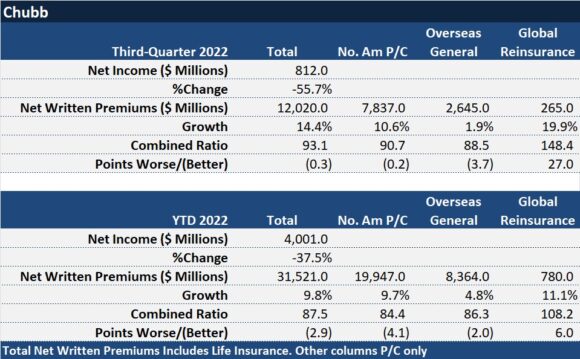

In spite of incurring nearly $1 billion in pre-tax net losses from Hurricane Ian, Chubb reported a combined ratio of 93.1 for the third quarter of 2022, representing $710 million in underwriting income.

Property/casualty underwriting income was up 15% compared to third-quarter 2021, when the combined ratio was almost the same—93.4.

According to an earnings statement published late yesterday afternoon, $1.16 billion of P/C catastrophe losses added 11.3 points to the third-quarter 2022 combined ratio, while a similar level of cat losses ($1.15 billion pretax) added 12.2 points to the third-quarter combined ratio last year.

Hurricane Ian contributed $975 million to this year’s total.

Chubb’s net written premiums jumped more than 10%, with North American commercial lines showing the most growth among Chubb’s reporting segments (up 11.4%).

Still, net income was down for the quarter, falling to $812 million compared to $1.8 billion in third-quarter 2022. Chubb attributed the decline to the adverse impact of realized investment losses, amounting to just over $0.5 billion (principally due to mark-to-market impact on derivatives and private equities as well as from sales in fixed income securities).

Net income also fell for the nine month period to just over $4 billion, compared to $6.4 billion for the first nine months of 2021.

Topics Trends Profit Loss Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows