Alphabet Inc.’s Google heads back to court Monday to face US Justice Department allegations that it manipulates the $677 billion display advertising market in violation of antitrust laws, just one month after losing a landmark ruling that it illegally dominates online search.

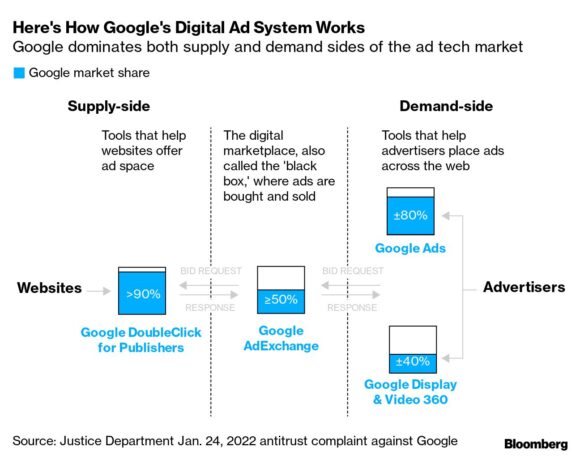

The DOJ and a coalition of eight states are accusing Google of acquiring over years the tools used to buy, sell and serve ads across the internet, locking up the technology behind website ads and harming publishers and advertisers.

The trial, which will take place in Alexandria, Virginia, marks the first case brought by the Biden administration against Big Tech to have its day in court. The Justice Department’s earlier lawsuit accusing Google of illegally monopolizing internet search is the biggest antitrust case in tech since a ruling against Microsoft Corp. more than two decades ago. It was filed in October 2020 under former President Donald Trump.

Google has denied the Justice Department’s claims, asserting that its tools work seamlessly with products made by competitors, and that the government’s case is based on an outdated understanding of digital ad markets.

Google holds the top spot in the global digital ad market, which has grown to $676.9 billion, according to 2024 projections by research firm EMarketer. Of Alphabet’s nearly $260 billion in revenue in 2023, about $31.3 billion came from the display advertising at issue in the case, according to the company’s most recent annual earnings report.

Justice Department antitrust lawyers say that Google, using its position as a middleman that controls the market from end to end, drives up the price of ads while paying less to the websites that show them. Because of its dominance across the technology, Google has the ability to force publishers and advertisers to use its suite of products, generating monopoly profits: Google keeps about $36 out of every $100 in advertising spent through its tools, according to the DOJ lawsuit, which was filed last year.

“Website creators earn less, and advertisers pay more, than they would in a market where unfettered competitive pressure could discipline prices and lead to more innovative ad tech tools that would ultimately result in higher quality and lower cost transactions for market participants,” the Justice Department said in the lawsuit.

Websites show more than 13 billion display ads every day, bringing in roughly $12 billion in revenue annually, according to the Justice Department.

Google plans to argue that as the internet has evolved, so has the advertising technology that supports it. Google says it now faces competition from major players across social media, apps and streaming TV services, including Meta Platforms Inc., ByteDance Ltd.’s TikTok, Amazon.com Inc. and Netflix Inc.

The tech giant also argues that end-to-end integration in its web advertising tools makes the technology more efficient, secure and reliable. Marketers and publishers choose its products because they are superior, not because they don’t have other options, Google says.

In laying out its case, the DOJ plans to show how Google amassed power in digital advertising starting more than a decade ago, buying up early ad networks like DoubleClick. That 2008 deal, the agency alleged in its complaint, “was a first step in Google’s march to monopoly.”

Before its DoubleClick purchase, Google used its burgeoning ad business to place ads next to results on its own search engine. But, according to the DOJ’s lawsuit, it struggled to launch a technology known as an ad server, which would allow it to place ads on other websites. The company also hadn’t yet built up relationships with top advertisers.

The DoubleClick deal helped in both areas. The startup made the leading ad server, and had multiple connections to top publishers and blue-chip advertisers. The Justice Department claims that Google now controls 91% of the market for publishers to offer space to sell ads, and can unfairly raise ad prices on a whim. To argue its case, the agency plans to call Neal Mohan, now the CEO of Google-owned video site YouTube and previously a vice president at DoubleClick, to testify.

Google notes that the federal government cleared the DoubleClick deal, as well as other acquisitions like its 2011 purchase of the ad optimization platform AdMeld, when they happened.

Google’s actions have harmed publishers, the DOJ argues, some of which had to move away from advertising to subscription business models, while others had to shut down. Testimony from current and former executives from News Corp., The Daily Mail and Gannett Co. may be featured at the trial.

Google said it plans to call on small publishers and businesses as witnesses. A breakup of its advertising technology business “would slow innovation, raise advertising fees and make it harder for thousands of small businesses and publishers to grow,” the company said in a statement when the Justice Department’s suit was first filed.

Federal prosecutors may also tap top Google leaders who have held key roles in its advertising businesses to testify. Its witness list includes Google AI executive Sissie Hsiao, who was previously a director of the company’s display, video and app advertising businesses, and Jerry Dischler, now a Google Cloud executive, who once oversaw Google’s advertising products and was also called to testify in the DOJ’s search antitrust trial.

Photo: Photographer: Jason Alden/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Kansas Man Sentenced for Insurance Fraud, Forgery

Kansas Man Sentenced for Insurance Fraud, Forgery  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk