The excess and surplus lines market continued to grow in 2024, with premium reaching more than $81 billion, according to annual reports from 15 state stamping offices released by the Wholesale & Specialty Insurance Association (WSIA).

2024 premiums reflected a 12.1% increase over 2023, when premiums grew 14.6% over the prior year to about $72.7 billion. The last two years follow the record-breaking numbers of 2022 when premiums grew more than 24% to $63 billion. Stamping office states accounted for 63% of U.S. surplus lines premium in 2024.

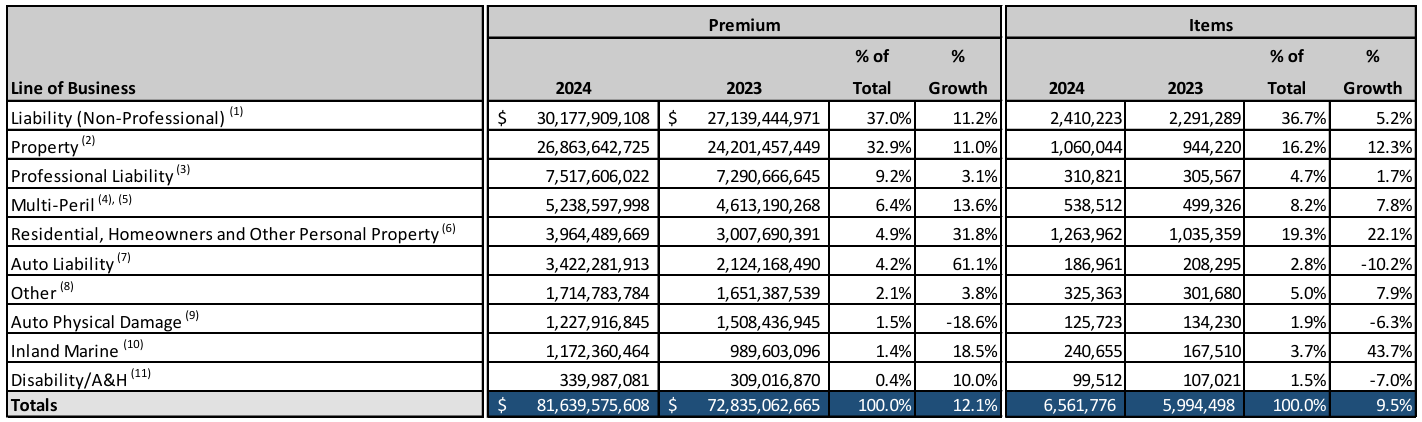

Transactions were up 9.5% to nearly 7 million in 2024. Commercial liability and commercial property remain dominant lines of business in the excess & surplus lines market. Premiums in these lines each increased about 11% to about $30.2 billion and $26.9 billion, respectively, in 2023. The two lines of business represent about 70% of total surplus lines premium from the reporting offices.

Auto liability and personal property had the highest upticks in E&S premium growth – 61.1% and 31.8%, respectively. The report also breaks down data by state, revealing where risk is flowing to the E&S market. For instance, personal property transactions increased the most in Texas (63.3%) and California (60.9%).

Ben McKay, CEO and executive director of the Surplus Lines Association of California, said the state saw a 124% increase in transaction filings within the residential lines of business, “underscoring the continued dislocation in admitted markets.” Still, residential insurance policies account for less than 7% of the overall surplus lines market in the Golden State.

Although some states have reported increases in personal lines, these coverages represented a small portion – just 4.9% – of the overall E&S market.

“Liability lines, including general liability, excess, cyber, and commercial auto, remain a significant driver of our market,” McKay said. “In particular, commercial auto premiums have surged 162% year-over-year.”

In Florida, there was a slow-down in surplus lines growth as the year progressed, according to Mark Shealy, executive director of Florida Surplus Lines Service Office.

“Notably, commercial property saw a 3% increase in premium volume for November compared to 2023, though growth within the quarter showed signs of slowing,” Shealy added. “However, policy counts continued to rise, suggesting a stabilizing market.”

Topics Trends Excess Surplus Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Needs Its Own Risk Class: Lockton Re

AI Needs Its Own Risk Class: Lockton Re  Preparing for an AI Native Future

Preparing for an AI Native Future