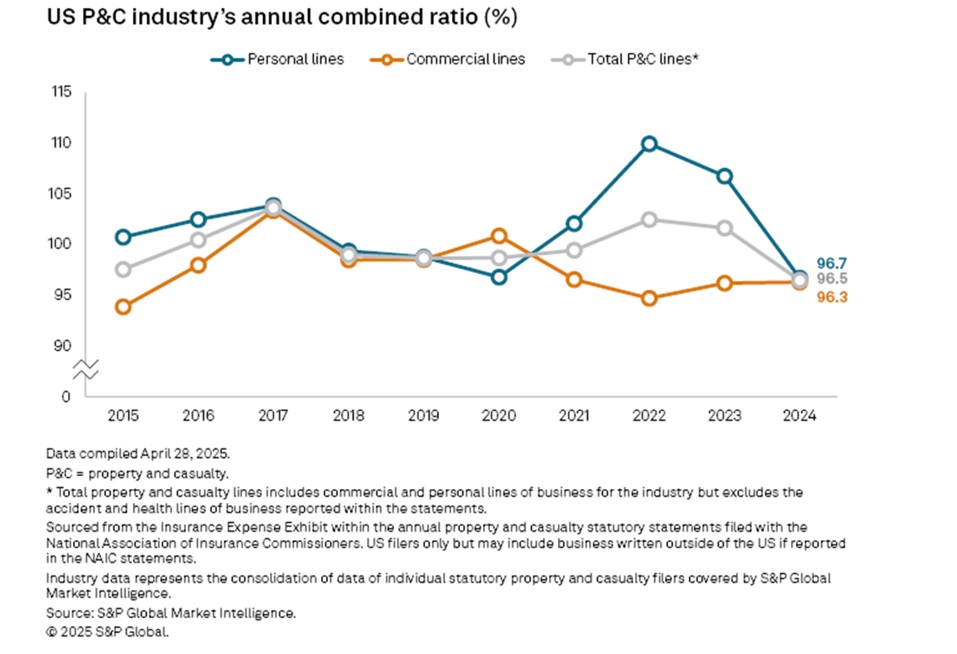

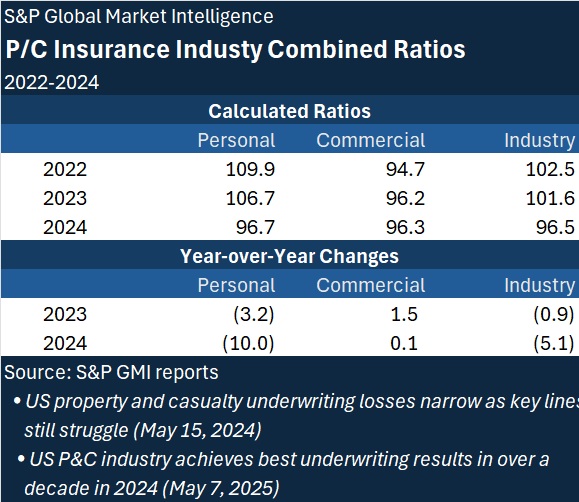

With combined ratios for personal and commercial lines landing only 0.4 points apart last year, the property/casualty insurance industry’s aggregate 2024 combined ratio was 96.5—marking the lowest figure since 2013, a new report shows.

Fine-tuning a slightly higher industry aggregate figure released earlier this year by using data from statutory blanks filed through late April, analysts at S&P Global Market Intelligence reported more than 5 points of improvement in the overall P/C combined ratio figure, and a 10.0 point drop in the personal lines combined ratio.

By S&P’s GMI’s latest calculations, the 2024 personal lines combined ratio was 96.7. The 2024 commercial lines combined ratio was 96.3, just slightly higher than the 96.2 report for 2023.

The S&P GMI report, “U.S. P&C industry achieves best underwriting results in over a decade in 2024,” includes line graphs displaying 10 years of combined ratios for two individual personal lines, private auto and homeowners, and an interactive graph allowing readers to view historical combined ratios for 10 different commercial lines, including the liability and physical damage parts of commercial auto, various liability and property lines and workers compensation.

Among the key insights revealed by the data:

- The homeowners line showed the largest combined ratio improvement last year, dropping 11.2 points to 99.7.

- This marked the first annual underwriting profit in homeowners since 2019.

Noting that the homeowners profit came in spite of significant catastrophe losses from convective storms and major hurricanes, the report explains that higher premium rates and recoveries from non-U.S. domiciled reinsurers benefited U.S. homeowners insurers. Another factor—a material portion of the cat losses was caused by floods, which is not covered by traditional homeowners policies.

- Private passenger auto experienced the next biggest improvement—9.6 points last year. The 2024 private passenger auto combined ratio of 95.3, was down nearly 17 points from its peak of the decade—112.2 in 2022.

- On the commercial auto side, the 2024 combined ratio of 107.2 was only 2.1 points lower than the 109.3 level recorded in 2023. In spite of a nearly 8-point drop in the commercial auto physical damage combined ratio, a stubbornly high liability ratio of 113.0 explained the lack of improvement.

- Commercial property combined ratios—for fire, allied lines and commercial multi- peril (non-liability)—all improved last year, with fire posted the best 2024 combined ratio—77.2.

- The second 2024 best by-line result among those set forth in the S&P GMI report was the workers comp combined ratio of 88.8. While up from 88.1 in 2023, and from the decade low of 86.4 in 2018, the result remains well below the decade high of 95.6 recorded in 2015.

- Among the liability lines shown in the report—other liability, product liability, commercial multi-peril liability and medical malpractice—only med mal improved.

- The other liability line experienced the sharpest deterioration of the commercial liability lines, rising 10 points to 110.1 in 2024, compared to 100.1 in 2023.

The report notes that roughly one-quarter of the U.S. industry’s commercial lines direct premiums written are reported under the other liability line of business, which includes general liability, commercial excess and umbrella, errors and omissions, and cyber insurance—and that the 110.1 aggregated other liability line combined ratio was the highest ratio recorded since 2016 (when it was 110.9).

Topics Trends Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers