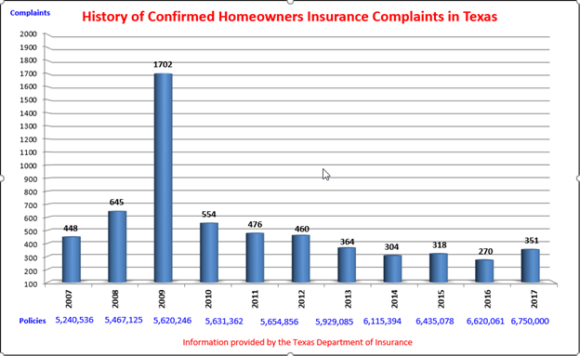

Despite another year of bad weather, data from the Texas Department of Insurance (TDI) shows that justified consumer complaints continued to be low, the Insurance Council of Texas (ICT) reports.

Out of 6.7 million policies, and an estimated 700,000 homeowner claims, the agency recorded 351 justified complaints.

“Insurance companies dealt with hundreds of thousands of homeowner claims in Texas last year and a fraction of 1 percent resulted in a justified complaint,” said ICT spokesperson Mark Hanna said in the group’s announcement. “Insurance companies did their best throughout the year to respond to the various weather catastrophes and in the vast majority of cases, provided a prompt and fair response to every claim.”

Hanna said last year’s hailstorm in Odessa was a good example of how insurance companies took care of their homeowners who were hit. Insurance catastrophe teams were quickly mobilized and adjusters were able to pinpoint where the most severe damage occurred.

ICT has estimated insured losses from that hailstorm at $400 million. No complaints were filed by homeowners in Odessa and Ector County as a result of the storm, Hanna said.

Another significant comparison is the number of complaints following Hurricane Harvey compared to Hurricane Ike. The number of complaints to TDI coming from Hurricane Harvey are only a quarter of the number of complaints that Hurricane Ike had generated at this time.

Since a high of 1,702 complaints in 2009, justified homeowner complaints have continued to drop in the succeeding years. In 2016, justified homeowner complaints declined to only 270 complaints in a year in which there was more than $4 billion in homeowner losses from the state’s record hailstorms.

According to TDI, the top three reasons for the small number of justified homeowner complaints last year were delays, customer service and unsatisfactory settlements.

Source: Insurance Council of Texas

Topics Catastrophe Texas Hurricane Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting