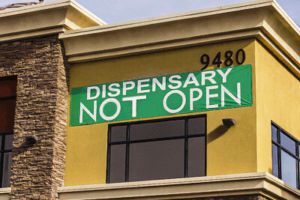

Alabama lawmakers legalized medical marijuana two years ago this month. But it came with a high hurdle: Dispensaries, growers, processors and other license applicants must have at least $2 million of liability and casualty insurance.

Now, the Alabama Department of Insurance says it can’t find an insurance market for that and is asking insurers to fill the prescription.

“At this date, the Alabama Department of Insurance has had difficulty determining whether such ‘liability and casualty insurance’ in the medical cannabis area is available in the Alabama market,” reads a bulletin posted last week. “The Department encourages property and casualty insurers to submit rates and forms…”

The cannabis law, known as the Darren Wesley “Ato” Hall Compassion Act, after the son of a state representative who died of AIDS more than a decade ago, took effect in May 2021. The window for marijuana business applications closed Dec. 31, 2022. Some 90 enterprises, including some of larger names in the cannabis business, have applied for licenses, according to the Alabama Medical Cannabis Commission. But the lack of available insurance appears to be a missing ingredient in approving the licenses.

The department noted that the filing process for insurers may not be so onerous: All insurance filings will be “file and use,” except for workers’ compensation coverage, which must be approved by the department before policies are offered. The filing fee is $100 per form or rate, with a maximum of $5,000 per submission.

Cannabis-related rates would remain in effect for three years or until DOI actuaries are better able to forecast rates based on statewide experience. More information is available from erick.wright@insurance.alabama.gov.

Some 38 states now allow the medical use of cannabis products, according to the National Conference of State Legislatures, and insurance requirements vary greatly. Florida regulations require a performance bond of as much as $5 million. Georgia may require a surety bond in some cases, according to Insureon, an insurance brokerage.

But some states, including nearby Mississippi and Tennessee, have no business insurance requirements, Insureon and ALDOI noted.

But some states, including nearby Mississippi and Tennessee, have no business insurance requirements, Insureon and ALDOI noted.

The bureaucratic hurdles in some states have led to delays and frustration for dispensing firms and users. In Georgia, the state’s first medical marijuana dispensaries opened in late April, solving a years-long bureaucratic puzzle where it was legal to treat medical conditions with cannabis products – but not legal to buy them.

Trulieve Cannabis Corp. opened dispensaries last week in Macon and Marietta, with people lining up at both locations.

Jim Wages, the first customer in Marietta, told The Atlanta Journal-Constitution that his 19-year-old daughter Sydney uses cannabis oil to treat her epilepsy, the Associated Press reported. Now he said he can buy it legally instead of importing it across state lines in violation of federal law.

“We just hit the lottery. We finally got to a point where we could actually walk in instead of having to meet in a parking lot and pick up our oil,” Wages said. “It’s such a relief.”

It’s been legal for people in Georgia to use low-THC cannabis oil to treat a variety of diseases since 2015, but a rollout of legal sales has been delayed for years by regulatory challenges. More than 27,000 Georgians have registered to use the oil. Stores can only sell to people who have gotten a registry card approved by a physician.

Several companies that were denied grow or dispensary licenses have sued. Four additional production licenses are tied up in litigation.

The Associated Press contributed to this report.

Was this article valuable?

Here are more articles you may enjoy.

Home Insurance Customers Staying Put Despite More Shopping Around: J.D. Power

Home Insurance Customers Staying Put Despite More Shopping Around: J.D. Power  Former UPS Driver Wins $238 Million Verdict in Suit Over Firing

Former UPS Driver Wins $238 Million Verdict in Suit Over Firing  Beware of Hidden Email Addresses: TN School Transferred $3M to Fake Account

Beware of Hidden Email Addresses: TN School Transferred $3M to Fake Account  US Nuclear Verdicts Break Records and Drive Social Inflation to 7% in 2023: Report

US Nuclear Verdicts Break Records and Drive Social Inflation to 7% in 2023: Report