Consumer complaints about property-casualty insurers in Florida have more than doubled in the last five years and are on track to reach a new high in 2025, according to data provided by Florida regulators. Insurance industry insiders said the numbers can’t be trusted because they include mediation and calls for assistance that aren’t actual complaints.

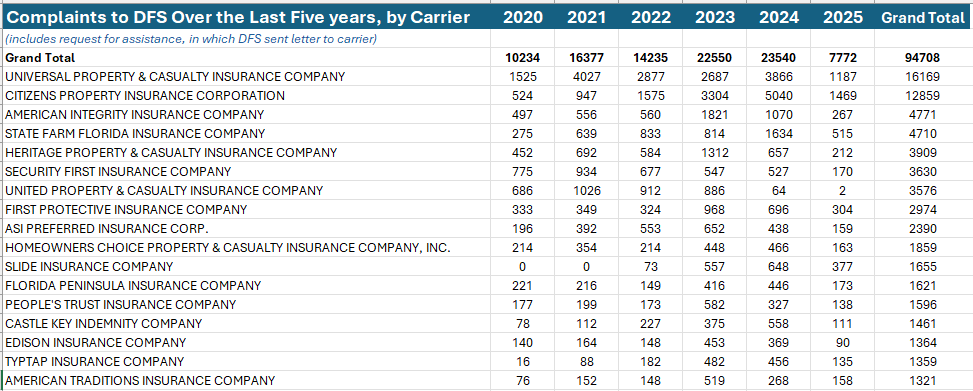

The state Department of Financial Services released the data to Insurance Journal, showing that overall complaints from residential policyholders, regarding 326 insurance carriers, have climbed from 10,219 in 2020 to more than 23,400 in 2024. If the trend for 2025 continues, complaints could top 31,000 this year. That’s a grand total of almost 95,000 complaints in recent years.

DFS received the most calls about Universal Property & Casualty Insurance Co., one of the largest insurers in Florida. During the five-year period, DFS recorded about 16,170 complaints about Universal. That’s significantly more complaints than regulators fielded on Citizens Property Insurance Corp., which remains the largest property carrier in the state, with some 200,000 more Florida policies than Universal holds.

American Integrity Insurance and State Farm Florida Insurance ranked a distant third and fourth in the DFS tally, both with about 4,700 complaints. Heritage Property & Casualty Insurance and Security First Insurance came in at fifth and sixth, with about 3,900 and 3,600 complaints, respectively, in the five-year time frame.

The data includes complaints about most types of residential policies: homeowners, condominium unit owners, dwelling fire, mobile homes, renters’ insurance, windstorm and flood coverage.

The vast majority of complaints were from HO policyholders: about 88,000 in all for the period. For all categories of residential policies, most complaints were about claims issues, followed distantly by a relatively small number of complaints about premiums, agents and adjusters. DFS did not provide the actual complaints or details on the nature of each allegation.

Despite questions about the data, people involved in the industry say that angst and complaints among insureds are likely rising for a number of reasons: A steady increase in premiums for most Florida homeowners in recent years has generated ill will toward insurers. Other reasons include a surge in national and state news reports alleging unpaid and underpaid claims, along with profit-shifting by some insurers. Some have argued that 2023 limits on claims litigation have led to more complaints outside of the courtroom. And three significant hurricanes in the last four years brought storm surge and flood damage to thousands of properties across the state.

“Especially for 2024, both Helene and Milton were flooding events AND wind events,” said Professor Charles Nyce, chair of the Department of Risk Management and Insurance at Florida State University. “Many homeowners do not understand that wind-driven water is still a flood event and is not covered by your homeowners insurance policy. This leads to difficult claims processing and many more complaints.”

The issue of consumer complaints was rekindled in February by Florida Insurance Commissioner Michael Yaworsky. He posted a bulletin, warning insurers, including write-your-own flood insurance companies, about a spike in complaints. Yaworsky noted that storm claims that are improperly denied due to concurrent causation would not be tolerated by his department. That memo prompted Insurance Journal to request the overall complaint data from DFS, which handles complaints and some dispute resolution for consumers.

The DFS data show that complaints about flood insurance claims have risen each year, but still total just over 500 for the last five years. Through April 8 of this year, though, flood-related complaints have spiked and could top 470 if the trend continues, the data show.

Most of the complaints recorded by DFS appear to be related to non-flood residential policies. For Universal Property & Casualty, for example, the number of complaints has been up and down in recent years but have climbed from 1,525 in 2020 to 3,866 in 2024.

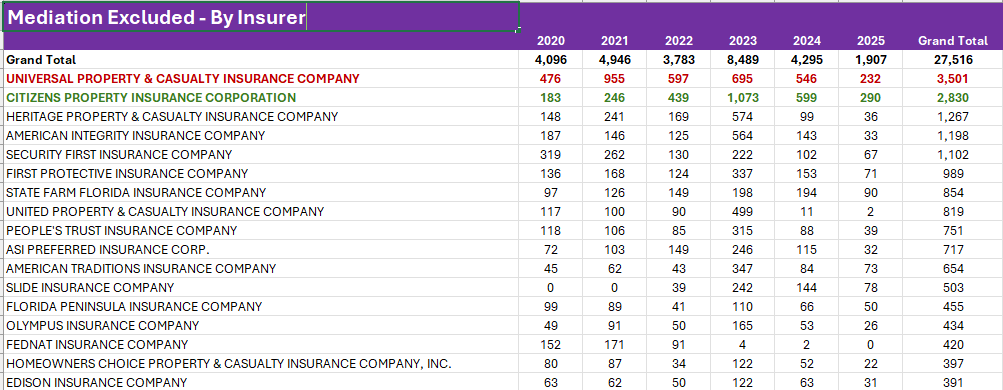

Travis Miller, the chief attorney for Universal, said the DFS database does not give an accurate picture. For starters, DFS includes consumer issues that were settled through DFS’ own mediation process, or were little more than assistance requests from policyholders, something that most states do not consider to be true complaints.

At first glance, one might assume that mediation numbers are fair game, since the process likely started with complaints from policyholders.

“But so does litigation, and DFS does not count litigation in the complaint numbers,” Miller said.

Without mediation included, the number of complaints is far smaller and rose only slightly, from about 4,000 in 2020 to 4,250 in 2024, for all carriers, the DFS data show. If the trend continues for this year, however, the number could reach almost 7,600. The number of complaints that end up in mediation or litigation is not tracked by DFS, but it’s likely that many complaints are double-counted, once as a request for assistance and again as mediation.

“We are not aware of any other state among the 20 in which the company operates that dramatically increases the data it holds out as ‘complaint’ data by including these types of statutorily-favored processes,” Miller said in an email. “This has the effect of creating unwarranted perceptions of the Florida market, which we unfortunately must explain from time to time to other states or organizations.”

A DFS spokesman did not fully explain why mediation data is included in complaint totals.

“Mediation is a program in which consumers contact the DFS Division of Consumer Services for assistance to resolve their insurance claim,” said William Patrick, deputy communications director for DFS. Litigation is a civil matter filed in the courts, for which the Department and the Division of Consumer Services do not partake, he noted.

Many consumers’ calls for assistance are resolved by the department without further proceedings, the DFS communications director explained.

DFS tracks another data set – letters sent to insurers when a consumer complaint reveals an apparent violation of law by the carrier. Those numbers rose steadily from 2020 to2023 but have dropped since then.

Some Southern states report far fewer complaints than Florida does. In Georgia, a state with half the population of Florida, the insurance commissioner has said his office receives about 10,000 to 11,000 complaints each year about insurers. Texas, a state with a third-more people than Florida, saw some 5,500 consumer complaints regarding residential insurance companies in 2024. Those Texas complaints are on the rise, though, starting at just 2,013 in 2020 and climbing almost each year since then, according to the Texas Department of Insurance.

The Universal attorney noted that Universal’s own data show that “true complaints” have dropped from 2021 to 2024. Miller did not provide actual numbers on those complaints. He also argued that the DFS complaint data include minor requests for help, such as when policyholders ask for a contact at their insurance company, Miller said.

And comparing Universal to Florida’s Citizens Insurance may not be a fair measuring stick, Nyce said.

“Citizens has a large market share in the tri-county area (near Miami),” he noted. “That is not where hurricanes have hit the last few years; the storms have been more Gulf Coast-side and Panhandle, where Citizens is not necessarily the largest insurer. The larger the market share in the storm impacted areas, the more claims, and the more opportunity for unhappy consumers.”

Miller argued that it’s unlikely that so many large insurers, some of which are known for their claims-handling and customer service, would see such a big jump in actual complaints from policyholders. Like Universal, other carriers have been under scrutiny from regulators and lawmakers, and have stepped up their efforts to pay claims and to pay on time, he and others in the industry contend.

Universal and others have focused on another measure of customer dissatisfaction – claims lawsuits. Data from regulators show that insurance litigation in Florida has dropped dramatically since lawmakers in late 2022 ended one-way attorney fees and put new hurdles on bad-faith claims, both of which have disincentivized litigation.

In some ways, a rise in complaints is to be expected, given the wrenching changes in the Florida market over the last decade, industry experts said.

“Insurers can be less accommodating in the claims process because of the legislative changes, and that can lead to more complaints,” Nyce said. “But, in addition, more claims from more storm activity and more complicated claims with wind versus water, compounded by higher premiums, will also lead to more unhappiness with the insurance product.”

Consumers are not going to be happy with insurance until they feel that premiums are in line with the value of the product they are buying, he added.

Was this article valuable?

Here are more articles you may enjoy.

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT