Citizens Property Insurance Corp., the state-created insurer of last resort, is no longer the largest carrier in Florida. The ranking is seen as a significant milestone in the push for a more stable, market-based insurance system in the state.

Citizens’ leadership announced late last week that October takeouts and assumptions by other insurers had trimmed Citizens’ policy count to about 560,000 – a level not seen since spring of 2021, just before a litigation crisis worsened and multiple carrier insolvencies began to balloon Citizens’ exposure.

The drop means Fort Lauderdale-headquartered Universal Property & Casualty Insurance and State Farm Florida Insurance are now the largest property insurers in Florida. Universal reported some 561,546 policies in Florida at the end of September. State Farm held some 646,429 policies at the end of August, according to the latest information from Florida regulators.

The latest Citizens count is 40% smaller than the corporation’s peak of 1.3 million policies in force in September 2023, three months before Florida lawmakers enacted changes that curtailed one-way attorney fees and disincentivized claims litigation. A smaller insurer of last resort means more policyholders are turning to private carriers as private insurer premiums are declining – another sign that the legislative reforms and a Citizens depopulation program have had an impact. The once-distressed Florida market is now stabilizing, insurers and Citizens’ officials have said.

A Citizens spokesman called the new numbers “significant,” and are partly the result of 199,000 assumptions of takeout offers in October.

The assumption rate by policyholders appears to have climbed in recent months. For the first half of this year, the Florida Office of Insurance Regulation approved takeout offers on some 1.2 million Citizens policies. But only about 200,000 of those offers were accepted by policyholders and were removed from Citizens, OIR has reported.

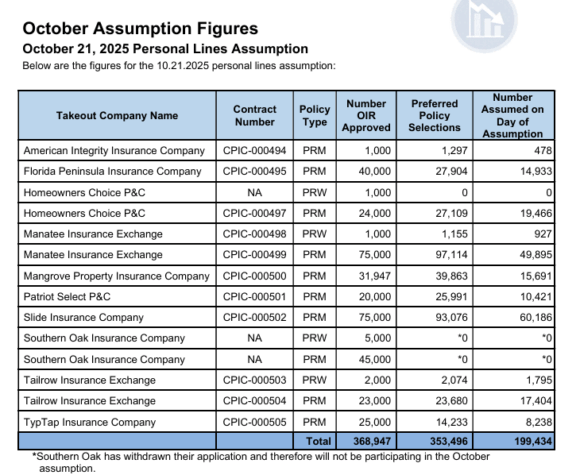

This fall, nine carriers were approved for 368,947 takeouts, and more than half of those were accepted in October, Citizens’ data show.

The largest share of October takeouts went to Slide Insurance and to Manatee Insurance Exchange.

The news came just days after Security First Insurance announced a statewide average rate decrease for homeowners, one of the largest rate cuts in the last three years and another sign of a warming market. Auto insurers also have credited legislative reforms with stabilizing the market. State Farm last week said it is cutting average personal auto premiums in Florida by about 10%, the latest in a string of rate decreases by State Farm this year.

Was this article valuable?

Here are more articles you may enjoy.

Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’