The U.S. Federal Reserve will hold an open meeting this coming Friday on proposals, in the works for more than...

SIFI News

After coming together to help Republicans retake Congress, the financial industry is splitting over the best strategy to accomplish its...

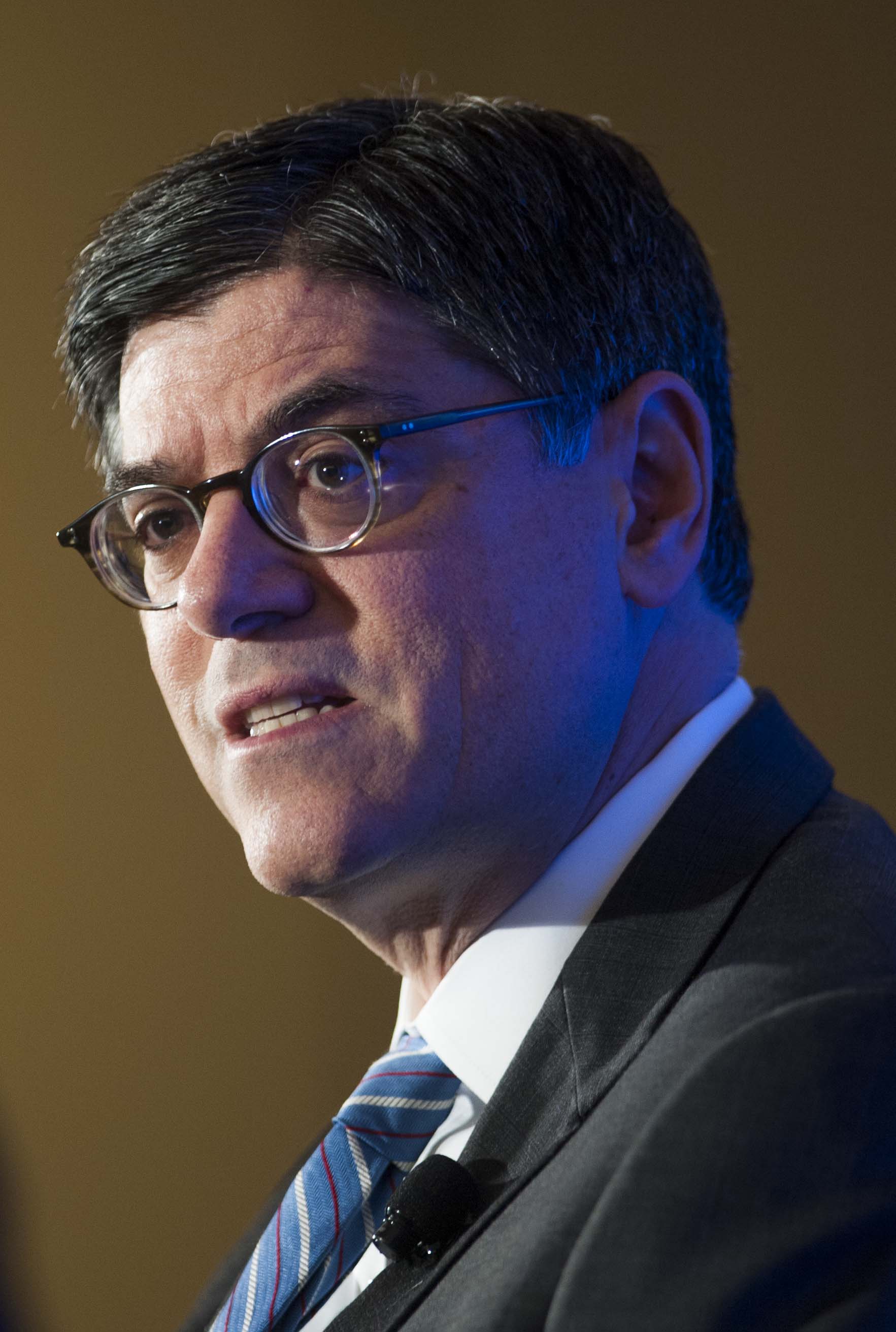

Delaware Insurance Commissioner Karen Weldin Stewart has recently sent a letter to U.S. Treasury Secretary Jacob Lew and other federal...

The U.S. Federal Reserve on Tuesday announced plans to study the potential effects of forcing big insurance companies to meet...

The U.S. Chamber of Commerce is calling for rules that would make it more difficult for a group of regulators...

President Barack Obama’s nominee to serve as deputy U.S. Treasury Secretary told lawmakers on Wednesday she believes that large systemically...

Federal Reserve Vice Chairman Janet Yellen said the central bank will “carefully consider” how to apply new regulatory standards to...

Prudential Financial Inc., the second-largest U.S. life insurer, abandoned its challenge to a U.S. designation from a Treasury Department panel...

The Financial Stability Oversight Council (FSOC) designated AIG as a Systemically Important Financial Institution (SIFI) after determining that “material financial...

New requirements that will be imposed on insurers that the Group of 20’s Financial Stability Board has designated to be...