For Boat Owners and the Agents Who Write Them, Location and Experience Matter

As boating season gets into full swing in North America, chances are good that many recreational boat and yacht owners are sitting in their offices and cubicles obsessing not about how to close the next big sale or write a revolutionary computer program, but about when they’re going to be able to get out on their favorite waterway. Whether they’re thinking about insurance for their pleasure craft is another matter.

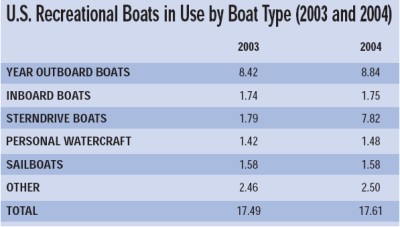

There were more than 17.6 million recreational boats in use in the United States in 2004, and an estimated 69 million people involved in boating activities, according to the National Marine Manufacturers Association. Since insuring personal pleasure boats is not mandated by the states, it’s difficult to know how many of those vessels carry even basic liability insurance.

However, since lenders and most marinas require boat owners to insure their boats (under 26 feet in length) and yachts (over 26 feet), many of the boats in use are likely to be insured, especially the more expensive watercraft.

As in real estate, location matters when it comes to insuring boats and yachts. Where the vessel is operated and stored when not in use and the location of the owner are primary factors in rating pleasure marine policies. However, it basically boils down to: Boat owners and agents in Florida, good luck; in the Midwest, Southern California and even the Northeast, it’s smooth sailing as far as insurance is concerned.

Florida, Gulf Coast: tough sailing

Florida was already a tough market for insuring pleasure craft before four hurricanes slammed into the state last year. Now, some companies have pulled out altogether and those that remain have enacted stricter underwriting standards.

The market in Florida has been “getting smaller and smaller over the years,” said Terri Saxon, an account executive with Hull & Co.’s marine division in Florida. “And those companies that are still around are a lot more particular. Their guidelines have changed on what they’re going to write. They’re staying away from certain risks, certain counties–in particular, Dade, Broward, Monroe and Palm Beach counties. …

“In addition to that, they’ll only do certain values, maybe $250,000 and above,” Saxon continued. “Some of them are staying away from lower values in certain counties. So there have been quite a lot of changes. It’s getting harder and harder to get the boats placed.”

The restrictive underwriting extends up the Atlantic coast to Virginia and along the Gulf of Mexico to Brownsville, Texas — in other words, coastal areas in hurricane zones.

Dennis Onstott, a producer with EP Marine in Houston, estimated that prices have risen some 60 percent in Florida in the last year and between 30 to 40 percent, at a minimum, in Texas.

“Coastal drives it all,” Onstott said. “The guy who’s got a boat that’s trailer-able and doesn’t keep it on the coast is going to have a much easier time than somebody who leaves it on the coast.

“A few of my companies are even getting to the point where they are asking if the boats are on floating piers instead of fixed piers in the marina. … [They prefer] floating piers that move up and down with the tide. With a fixed pier there’s only a certain amount of play with the tidal surge.”

Still, Florida is a huge yacht market, according to Smith. As evidence he cited last year’s Ft. Lauderdale boat show, which showcased thousands of large yachts, 80-feet and up, collectively worth more than $3.5 billion sitting side by side in the water for many miles along the coast.

Great Lakes, West Coast, Northeast: calm seas

Beyond the southeastern U.S. and the Gulf Coast, other parts of the country are enjoying a stable market for boats and yachts this year, with relatively small rate increases, or in some cases decreases and less restrictive underwriting.

The Great Lakes region has historically been a profitable one for insurers and competition is fairly robust there. Until recently Michigan has been the state with the most boats, nearly one million vessels are registered. However, California overtook Michigan last year in the number of personal pleasure watercraft registrations, according to Mike Smith, president and co-founder of Global Marine Insurance Agency in Traverse City, Mich.

California, especially Southern California, is an attractive area for this line of insurance. Derek Lerma, with American Marine Insurance Services in Ojai, Calif., maintained that southern California poses virtually no weather-related catastrophe risk as far as recreational boating goes, and theft is not a major concern with the big yachts that his company targets.

The New England marine market for personal pleasure craft has become slightly more competitive this year, according to Paul Fitzpatrick, of The Fitzpatrick Agency in Bridgeport, Conn. “We haven’t seen rate increases from Maine to Virginia,” he said, adding that in some cases underwriting has become somewhat less restrictive.

“ACE actually broadened their coverage for certain states in the Northeast,” Fitzpatrick said. “They had a 3 percent wind deductible that was all along the eastern seaboard and they took it off for Maine, Massachusetts, Rhode Island and Connecticut.”

To illustrate the pricing difference between Florida and other regions, Hull & Co.’s Saxon said she had a brand-new, 2005 34-foot yacht on her books valued at $236,000, with $500,000 in liability navigating Florida and the Bahamas that carries a premium of $3,700. Acknowledging there are many variables involved, Fitzpatrick speculated that a similar vessel in the Northeast could have a premium that is less than half that amount– in the $1,300 to $1,600 range.

Experience matters

One of the main criteria insurers weigh when it comes to insuring a boat or yacht is the owner’s boating background.

“Experience is very important–what vessels have they owned prior to [the current one], how many years of boat ownership have they had,” Saxon said. “[Insurers] don’t want more than a 10-foot jump in size from previous boat.” Most companies will feel it’s too big of a jump if someone buys a yacht that is 20-feet bigger than the one they owned previously, she added.

Smith, of Global Marine, agreed that as far as “old-fashioned” underwriting goes, previous boat ownership and experience, and a boat of a similar size and type as the previous one, are important factors that insurance companies look for in a risk.

“We have some people that late in life decide they’re going to get into boating,” he said. “They sell their business for a lot of money and go out and buy a 50-foot something. And they’ve never owned a boat … that’s a difficult challenge.”

Progression in complexity

Tim Nolan of Virginia-based BoatUS, a national boat owners association that manages a personal marine program for CNA, noted that the value of a boat comes into play in underwriting but after location, the underwriter is looking at the match between the boat and the boater’s experience. “In other words, if you’re a new boater and you’re buying the biggest boat in the world, you’re probably going to have a rough time getting insurance. But if you’ve got experience, it’s generally easier to get insurance on the biggest boat in the world. Underwriters like to see a progression as far as the type and complexity of a boat in the person’s experience,” Nolan explained.

Tim Bankston, underwriting supervisor with Kansas-based Old United Insurance Company, agreed that a boater’s experience is key. “We find that operators with less than three years’ of experience have higher loss ratios than operators with more than three years’ of experience,” he said.

Inexperienced boaters are encouraged to take boating classes from organizations such as the U. S. Power Squadrons and the U.S. Coast Guard. Companies often offer discounts for those who take classes or hold various certifications.

Year, make, model and more

As for additional underwriting criteria, Fitzpatrick in Connecticut said there is a lot that underwriters want to know including “the year, the make, the model, the length of the boat, the type of engines that it might have, whether they’re gas or diesel. If the boat’s more than seven years old, I ask if they have a current survey. The insurance companies want to know what kind of condition the boat is in. If it’s that age or older most of [the carriers] want a survey done in the last year or two to show the condition and the value. I’ll ask about the equipment they have on board–radio, depth finder, GPS, the radar. I’ll also ask if they have an automatic fire extinguishing system in the engine department.”

Hull & Co.’s Saxon said insurers generally have trouble with older boats, especially older wooden boats, as well as “boats in bad condition, bad surveys, they don’t survey well. Sometimes high performance boats, boats that go too fast or maybe the people who bought them aren’t experienced.” Saxon said while there are some boat insurance programs for some high performance watercraft, they are very stringent.

Even credit scoring has entered into the marine rating mix, according to Smith. “It’s more than credit scoring–we call it black box technology. Companies have designed their proprietary software that looks at a number of factors, credit being a major one, but also including years of boating experience, years of boating knowledge, marital status … and they run all this information through their black box and they use it to rate.” The Michigan marine agent said carriers have told him that use of such technology could mean a 10 or 15 percent reduction in loss ratio.

Agreed value versus actual cash value

In the world of marine insurance for personal use boats and yachts, the two basic coverages that most companies provide are hull (property) coverage and liability (protection and indemnity, or P&I), according to Saxon.

Hull coverage can be purchased as an agreed value policy or an actual cash value policy, depending on the type and size of the vessel and the needs of the owner.

In an agreed value policy the value is stated on the policy, explained Tim Nolan, of Boat U.S. “You have a number–say it’s $50,000, the agreed value is $50,000 and if you lose the boat today or 300 days, if you lose the whole thing, that’s what [the carrier is] going to pay you.”

With an actual cash value policy, payment for a full or partial loss will be based the actual cash value of the boat, equipment or other property at the time of loss.

Which kind of policy is best for a particular risk depends what kind of boat it is, Nolan continued. “The way partial losses are handled between the two policies varies a lot–the agreed value policy is pretty much a replacement policy, except for a few specified items in the policy … whereas on an actual cash policy everything’s going to be depreciated.

“In real life terms what that means is, if somebody came in and stole all your electronics, on your agreed value policy [the insurer] would pay you whatever it costs to replace those items with similar items,” he said. On an actual cash value, because of depreciation, the insured will collect less money.

Depends on needs

Since actual cash value policies pay out less, they tend to cost less. “It depends on what your needs are as to what I’d recommend you get,” Nolan said. “For most people I’d recommend the yacht value form of coverage because you know what you’re getting far more up front than you do with the actual cash value policies.”

The P&I, or liability, section of the yacht policy is a Lloyd’s of London form of liability that has evolved for generations, Smith of Global Marine said. “It is specifically designed to address all of the maritime laws in this country, of which there are many, and it defends very well in a maritime admiralty jurisdiction. It has coverages that are specifically designed for that.”

“Most people don’t think they’re going to have an accident,” said Smith. “The frequency of losses in our business probably averages in the 3 to 5 percent range,” he added, “so not very many people have an accident every year. But when you sink a half a million-dollar boat, you don’t forget it.”

Smith maintained that most people with high-dollar vessels have loans on their boats and understand that they cannot self insure liability. “Many wealthy people can afford to self insure a $200,000 or $500,000 physical damage loss, because it’s a known quantity, but with liability you don’t know,” he said.

Boat loving brokers

Those who specialize in marine insurance are often boat lovers themselves.

“Marine insurance is a highly specialized business,” American Marine’s Lerma said. “You have to know about boats.”

“We call it the water gene. They grew up around the water, love it … if they’ve got that we can teach them the insurance business,” Global Marine’s Smith says of his agency’s producers.

Marine insurers also prefer agents with marine experience when considering agency appointments. “It might be that the agency itself will be focused on marine,” said Michael J. Cok, executive director for independent agency operations at Foremost/Zurich Marine. “It might be a department or within their personal lines group or an appendage to their personal lines group. … [We make] an individual assessment that the agency has had some experience or some experienced staff in that field,” he added.

“I would say there are many examples of agencies that got focused on this line because of the passion of a producer or an agency principal themselves. Boats are fabulous things and the people that own them are passionate about them. And when agencies can tie in their business to something they love to do and spend time with that’s just a great fit. Many, many of our marine specialty agents are very active boaters with tremendous boating experience.”

Was this article valuable?

Here are more articles you may enjoy.

Florida Home Inspector Used Stock Photos 200 Times, Defrauding Citizens, DFS Says

Florida Home Inspector Used Stock Photos 200 Times, Defrauding Citizens, DFS Says  Home Insurance Customers Staying Put Despite More Shopping Around: J.D. Power

Home Insurance Customers Staying Put Despite More Shopping Around: J.D. Power  Francine Estimated to Cause $9B in Damage With $1.5B in Insured Losses

Francine Estimated to Cause $9B in Damage With $1.5B in Insured Losses  23andMe Settles Data Breach Lawsuit for $30 Million

23andMe Settles Data Breach Lawsuit for $30 Million