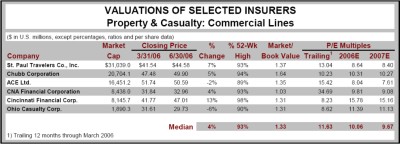

Stock Prices: Insurers’ stock prices remained relatively stable during the second quarter of 2006. In a time of the year when stock prices tend to fluctuate depending on the weather forecast, companies were able to offset the fear of another active hurricane season with strong first quarter earnings reports made public in the second quarter. Despite flat to average premium growth for commercial insurers, most companies improved their combined ratios by writing more quality business in non-coastal areas. Commercial lines pricing has become more competitive in non-coastal areas, as insurance companies seek to increase premium writing to offset their reduction, and in many cases termination, of writing policies in hurricane prone coastal areas.

The trends mentioned above were prevalent in St. Paul Travelers’ (NYSE:STA) first quarter 2006 earnings report as they reported a 2 percent decline in gross written premiums and a 1 percent increase in net written premiums (excluding run-off operations) but reported a GAAP combined ratio of 88.9 percent, a 1.6 point improvement from the prior year quarter.

Cincinnati Financial Corporation (Nasdaq:CINF) faired better in the premium growth category with a 4 percent increase in first quarter property and casualty net written premiums. Their stock traded up 13 percent for the second quarter of 2006.

Ohio Casualty experienced the largest decline in stock price for the quarter, down 6 percent after reporting a total property and casualty net written premium decrease of 1.2 percent for the first quarter of 2006 and a combined ratio of 94.9 percent compared to 95.6 percent for the first quarter of 2005.

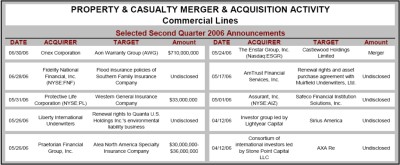

M&A Activity: Acquisition activity remained uneventful through the second quarter of 2006 as companies maintained their conservative stance on the acquisition front and relied instead on improved combined ratios as a source of profit. However, renewal rights deals continue as little risk is involved and companies have the choice of renewing only quality profitable business. During the second quarter, Fidelity National Financial Inc. (NYSE:FNF), Liberty International Underwriters, Praetorian Financial Group Inc., and AmTrust Financial Services Inc. all announced renewal rights transactions.

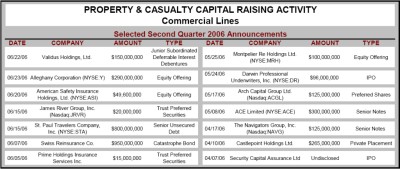

Capital Raising: There was very little capital raising activity during the second quarter of 2006. However, that may all change during the third quarter as it did last year when companies scrambled to raise money to avoid rating agency downgrades after massive catastrophe losses. Two more specialty insurers began trading publicly following successful IPO’s during the second quarter. Darwin Professional Underwriters Inc. (NYSE:DR) announced the closing of its previously announced IPO of six million shares of common stock at $16 per share yielding gross proceeds of $96 million and net proceeds of approximately $86.3 million. All the proceeds of the IPO were used to reduce Alleghany’s equity interest in Darwin. After the IPO, Alleghany continues to own approximately 55 percent of Darwin’s issued and outstanding shares of common stock. Eastern Insurance Holdings Inc. (Nasdaq:EIHI) announced the successful completion of its stock offering in which EIHI sold 7,475,000 shares of its common stock at a price of $10 per share, raising gross proceeds of $74.75 million.

LMC Capital LLC is a national investment banking firm focused exclusively on the insurance industry. Services include highly qualified, industry-specific advisory relating to mergers and acquisitions, capital raises and valuations. The firm may be contacted at (704) 943-2600, by e-mail at Info@LMCCapital.com or visit the firm’s Web site at www.LMCCapital.com.

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs