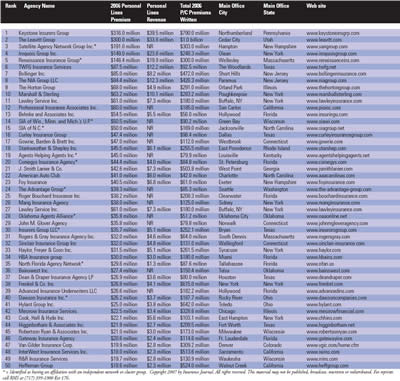

About the Personal Lines Leaders:

The Personal Lines Leaders in this special feature are taken from Insurance Journal’s Top 100 Property Casualty Independent Agencies as reported in April. This list utilizes only the personal lines numbers of agencies that submitted data to the Top 100 agencies report.

About the Personal Lines Profiles:

The accompanying Personal Lines Profiles provide snapshots of some of these Personal Lines Leaders. Insurance Journal thanks these profiled agencies for sharing their keys to success, their strategies for success, and their likes and dislikes about this segment of the property/casualty business.

Keystone Insurers Group

Northumberland, Penn.

Owner(s)/principal(s): 188

2006 personal lines premium: $316.0 million

No. of personal lines insurers: 28

Keystone Insurers Group franchisees primarily serve rural and suburban communities with a presence in suburban areas throughout the Midwestern and Eastern United States in 183 locations. Keystone Insurers Group was founded in 1983.

Keystone provides real-time comparative quotes for personal lines customers and grew the group’s personal lines business in the past five years through marketing and sales focus.

Lea Ann Hawk, operations manager, says what Keystone likes most about the personal lines business is the stable, steady income stream, good retention levels and great technology.

Keystone says the biggest challenge today in the homeowners market is that the comparative rating process is not consistent. When it comes to auto insurance, increasing claims/repair costs, uninsured and underinsured coverage are the most challenging.

Eight percent of Keystone’s personal insurance sales are for personal umbrellas.

Hawk says three keys to success in personal lines are: target marketing, strong markets and good work flows.

Lawley Service Inc.

Buffalo, N.Y.

Owner(s)/principal(s): William J. Lawley Jr., Christopher D. Ross, Michael R. Lawley

2006 personal lines premium: $61 million

No. of personal lines insurers: 15

Lawley Service Inc. resides in downtown Buffalo, N.Y., on its local main street, Delaware Ave. The agency, founded in 1955, provides personal lines insurance for Buffalo’s 900,000 or so resident business owners, executives and the general public through eight office locations.

Lawley has grown its personal lines book through mergers and organic growth during the past five years, reports Fred Holender, director of strategic initiatives. The agency provides real-time comparative quotes for personal lines customers, and reports that what it likes most about the personal lines business is the lines stability and predictability, as well as profitability. Holender says, what Lawley likes least about the personal lines business: “Consumers tend to treat personal lines as a commodity.”

The biggest challenge today in the homeowners market, he adds, is insuring property insurance in coastal areas (Florida, Carolinas, Long Island, N.Y.). For auto, it’s the commodity perception among consumers.

About $2 million of Lawley’s sales are derived from personal umbrella products.

Holender says three keys to the agency’s success in personal lines are: exemplary customer service; large number of carriers that provide alternatives to a variety of consumers; and well-trained, knowledgeable, and caring staff.

Bollinger Inc.

Short Hills, N.J.

Owner(s)/principal(s): John A. Windolf, G. Alex Crispo, Douglas T. Cook, Lori Windolf Crispo, Matthew Gardner, Rhonda Linnett Graber

2006 personal lines premium: $85.0 million

Number of personal lines insurers represented: 20 +

Founded in 1933, Bollinger Inc. serves clients through its six offices in New Jersey, New York, Pennsylvania and Connecticut. The agency touts serving middle market insureds and writes approximately 1.5 policies per client.

Rhonda Linnett Graber, managing director of Personal Insurance at Bollinger, says the firm has had significant growth through acquisition over the last five years, and also averages growth of about 6 percent organically each year.

What Bollinger likes best about the personal lines business is the ability to help clients understand what coverage is available to them, says Linnett. “What we like the least is the misinformation that is put out there by competitors with very large advertising budgets.” Linnett adds that the biggest challenge in homeowners market today is availability. When it comes to the auto market, the challenge is competiting advertising.

The three keys to Bollinger’s success in personal lines are: personalized service teams; competitive insurance markets; and an aggressive salesculture.

The NIA Group LLC

Paramus, N.J.

Owner(s)/principal(s): 22

2006 personal lines premium: $84.4 million

No. of personal lines insurers: 25

Founded in 1925, The NIA Group operates 16 branch offices located throughout New Jersey, New York, Connecticut and Florida.

Mitch Silver, senior vice president, Personal Insurance, says NIA’s personal lines business has grown over the past five years by concentrating on the VIP/larger accounts segment. NIA also provides real-time comparative quotes for personal lines customers.

According to Silver, the most fulfilling aspect of the personal lines business is the satisfaction that comes from providing valuable financial protection for the assets of individuals and families. The least enjoyable aspect, he says, is the price competition from direct writers.

For homeowners insurance, the biggest challenge is the availability and affordability of insurance for properties located in coastal areas, Silver says. “For auto insurance, the continuity of carrier markets is a critical issue,” he adds. “There are auto carriers that are in and out of this marketplace and this has a destabilizing effect.”

When asked to name three keys to NIA’s success in personal lines, Silver said: outstanding personalized service, technology and location.

Behnke & Associates

Hollywood, Fla.

Owner(s)/principal(s): Fred Behnke, Scott Kinzel, Mark Introcaso, Gene McFadden

2006 personal lines premium: $54.5 million

No. of personal lines insurers: 10

Behnke & Associates serves a typical mix of South Florida families, including a number of retirees in the established, mostly middle class community of Brownard County.

The agency’s personal lines business has grown in the last five years primary due to the real estate boom and the ever-changing insurance industry in Florida, says Rex Mason, personal lines manager.

Mason says what he likes most about the personal lines business is assisting clients with homeowners needs and helping first time buyers understand their coverage. What he likes least is the instability of carriers doing business in the state.

The biggest challenge for the homeowners market in Florida is rate changes and company liquidations, Mason reports, but adds that competition is good for the auto market. Just two percent of sales are from personal umbrellas.

Three keys to Behnke’s success in personal lines: capacity to place coverage in admitted markets; rates that are competitive; and real estate sales.

North Florida Agency Network

Tallahassee, Fla.

Owner(s)/principal(s): Rod Vaughn, Virginia Vaughn, Vanessa Jung

2006 personal lines premium: $29.6 million

No. of personal lines insurers: 31

North Florida Agency Network is a network of agencies with administrative offices in Tallahassee. NFAN, founded in 1996, has 24 agency office locations in 32 counties making up the Northern tier of Florida counties.

Rod Vaughn, president, says that NFAN has more than doubled its personal lines volume over the last five years and expects a minimum 30 percent growth each year over the next five years. “We constantly look for the best solutions for our personal lines clients’ needs at the most competitive rates available,” he adds.

What Vaughn says he likes best about the personal lines business: “Advances in automated solutions for workflows and the increased commitment our carriers and management system vendors are making to exciting breakthroughs like the current focus on increasing the use of real-time.” What he likes least “is the fact that our industry is probably the most overregulated of all.”

Vaughn says, the biggest homeowners challenge “is the fact that there is great demand but little supply. Our auto challenge is the fact that we have ample supply but little demand.”

While Vaughn says NFAN’s producers quote personal umbrellas with every auto quote where underlying liability limits are adequate to support the umbrella, finding umbrella carriers that will write over many of the unrated homeowner carriers in Florida presents a challenge.

Three keys to NFAN’s success in personal lines, he says, include: “Our commitment to personal lines as a major profit center; our commitment to full utilization of automated systems; and our belief in the independent agency distribution system.”

Foy Insurance

Exeter, N.H.

Owner(s)/principal(s): Jeff Foy, Mike Foy, Jim Foy

2006 personal lines premium: $40.5 million

No. of personal lines insurers: 35

Foy Insurance, founded in 1893 as Elwell’s Insurance Agency, resides in the small city of Exeter, N.H., population 15,000, but is surrounded by many neighboring small towns. Foy operates 14 offices in surrounding locations and provides real-time comparative quotes for personal lines customers through AMS SETWrite.

Jeff Foy, chief operating officer, says the agency has continued to grow its personal lines business through a variety of means including: a strong sales culture; aggressive cross-selling; above average retention; educated and licensed staff at all levels; incentive programs for growth for all staff (including clerical/support staff); broad mix off advertising/marketing; and operating local offices on “main streets” that are visible, accessible and locally-staffed.

What Foy likes most about the personal lines business is “dealing with people who have put their faith in you.” The least: “the commoditization of it by certain companies (example – Geico).”

Foy says the biggest challenge in homeowners today is that estimating replacement cost is a very inexact science. The greatest challenge in auto is getting clients and prospects to understand that auto insurance is not a commodity

Foy’s three keys to success in personal lines: “1) We treat personal lines like most agencies treat commercial lines. It does not take a back seat to commercial. 2) We have partnered with all of the best markets/carriers. 3) We have local offices staffed with local people instead of one big office or a service center in some other part of the country.”

The Advantage Group

Seattle, Wash.

Owner(s)/principal(s): John Carmody, Ernie Meier, Gary Niehl, Vern Cohrs

2006 personal lines premium: $39.3 million

Number of personal lines insurers: 17

The Advantage Group’s home office is located in Bellingham, Wash., with a population of about 67,000, but it operates 19 office locations throughout Northwest Washington, ranging from Blaine on the Canadian border, to Seattle, to Hoquiam on the Pacific coast with marketing access to the large population base of the Puget Sound area. The agency provides real-time comparative quotes for personal lines customers.

John Carmody, executive director of The Advantage Group, says the agency has enjoyed consistent personal lines growth over the years. “We like personal lines and work at generating new business along with maintaining good retention,” he said. “Several of our office locations focus on non-standard personal lines allowing us to write a cross-section of business.”

Carmody says that what he likes most about personal lines is that it is a profitable line of business and “we are good at it.” He believes that cross-selling, particularly personal umbrella products, is a major marketing opportunity.

He also said there’s not much he doesn’t like about the personal lines business, except “new production can be a bit of a challenge when core carriers are not adequately priced within the marketplace competitive arena.”

The biggest challenge for homeowners in the Pacific Northwest is earthquake coverage, availability, limits and pricing, he says. For auto, it is increasing price competition in a softening market.

Carmody says that the most important key to his agency’s success in personal lines is “we really like personal lines.” He added that the firm also has a good selection of strong, committed personal lines carriers that offers a broad cross-section of markets. Plus, he notes, “we are local in the communities we serve and well organized to produce personal lines. Local personalization serves us very well.”

Roger Bouchard Insurance Inc.

Clearwater, Fla.

Owner(s)/principal(s): Rick Bouchard, Tim Bouchard, Ray Bouchard, Earl Horton, Sam Lupfer

2006 personal lines premium: $38.2 million

No. of personal lines insurers: 35

Roger Bouchard Insurance Inc., founded in 1948, operates four office locations serving the Tampa Bay market, a seven county region on Florida’s West Coast.

In the past five years, Chuck DeMola, vice president of Personal Lines and Small Commercial, says Roger Bouchard has grown its personal lines business through the acquisition of smaller agencies in Florida, the hiring of sales only personnel in each of its offices, account rounding, cross-selling and target marketing.

The agency offers real-time comparative quotes for personal lines customers for six different companies for auto insurance with one time data entry.

DeMola says what the agency likes best about personal lines is “being able to help people protect what is most important to them and the trust and relationships we have been able to develop with our customer base.”

What the firm likes least, he says, is having to “rewrite homeowners insurance for customers being non-renewed by their current carrier at significant rate increases. That in many cases causes a financial hardship for that customer.”

For Floridians, the lack of property/wind capacity with A.M. Best-rated carriers is the biggest challenge in homeowners, says DeMola. For the auto market, the biggest challenge is being able to place auto coverage with the same carrier as the homeowners, eliciting multi-policy discounts, he adds.

About 5 percent of Roger Bouchard’s personal lines business comes from personal umbrella products.

When asked to name three keys to the agency’s personal lines success, DeMola stated: total account sales; account rounding; and cross-selling within the agency’s commercial customer base.

Oklahoma Agents Alliance

Oklahoma City, Okla.

Owner(s)/principal(s): Ken Anderson, Tony Caldwell

2006 personal lines premium: $35.8 million

Founded in 2000, Oklahoma Agents Alliance is a network of independent agencies with offices in 45 locations.

OAA grew its personal lines business substantially over the past five years by marketing to centers of influence and through direct mail campaigns. Five percent of their sales can be attributed to personal umbrella.

Chris Torres, president, says what he likes most about the personal lines business is ease of doing business, but what he likes least is market fluctuations. Three keys to OAA’s success in personal lines include: aggressive sales and marketing by agents with direct writer personal lines backgrounds; broad geographic dispersion of business; and many competitive insurance carrier partners.

Higginbotham & Associates Inc.

Fort Worth, Texas

Owner(s)/principal(s): Rusty Reid, Jim Krause, Morgan Woodruff, Michael Parks, Jim Hubbard, Doug Dickerson, Mary Russell

2006 personal lines premium: $21.9 million

No. personal lines insurers: 12

Founded in 1948, Higginbotham is operates six offices throughout Texas, each of which has access to its full commercial and personal P/C, risk management, employee benefits, life, executive compensation and retirement plan resources.

The agency reports that its personal lines business has grown the past five years through a single source approach. “Our single source approach enables us to proactively identify customers’ exposures and align their personal and commercial policies.”

Thee keys to the agency’s success in personal lines: A single source for insurance, risk management and employee benefits expertise; loyal customers that refer business; and a customer service team with concentrated experience in personal P&C that gives customers one point of contact.

Dawson Insurance Inc.

Rocky River, Ohio

Owner(s)/principal(s): D. Michael Sherman

2006 personal lines premium: $26.2 million

No. of personal lines insurers: 50

Dawson Insurance Inc., founded in 1931, operates offices in both Ohio and Florida. Its main office in Rocky River serves a primarily middle- to upper class community with a total population of 20,700.

The firm does not provide real-time comparative quotes to personal lines customers, but has grown its personal lines business in the last five years mostly through acquisitions.

Therese K. Johnson, senior vice president, says that the biggest challenge now in the homeowners market continues to be market availability for Florida clients. She also noted the competitiveness of the Ohio market for both auto and home as a challenge. Johnson estimates that about one-eighth of the agency’s personal lines sales account for personal umbrella products.

When asked to name three keys to the agency’s success in personal lines, Johnson said: variety of markets; superior customer service; and networking that results in referrals.

Frenkel & Co. Inc.

New York, N.Y.

Owner(s)/principal(s): John Kelly, John Bradley

2006 personal lines premium: $26.8 million

No. of personal lines insurers: 20

Frenkel & Co. Inc., founded in 1878, serves only high net worth individuals through its two office locations in New York and New Jersey.

The agency has grown its personal lines business through a combination of referrals and affiliations with Barron’s, financial institutions and investment houses, says John F. Kelly, CEO and president. Frenkel also offers real-time comparative quotes for personal lines customers through Chubb, AIG and Fireman’s Fund.

Kelly says what he likes most about the personal lines business is cross opportunities and efficiency in automation. But what Kelly likes least is how catastrophe losses affect the market.

The biggest challenges today in homeowners are catastrophe losses, mold and valuations concerns, he adds. The most pressing challenge for the auto market is limitations based on areas.

About 15 percent of Frenkel’s sales are for personal umbrellas, Kelly reports.

When asked to name three keys to the agency’s success in personal lines, Kelly said: effective use of automation; training and retention of key personnel; and solid market relationships.

Mesirow Financial

Insurance Services

Chicago, Ill.

Owner(s)/principal(s): Richard Price, John Harney, Norm Malter

2006 personal lines premium: $22.5 million

No. of personal lines insurers: 10

Mesirow Financial Insurance Services, founded in 1972, serves the local Chicago community and surrounding suburbs as well as all 50 states through its four office locations.

Mary Gould, Mesirow’s managing director, says the agency has tripled its personal lines business with the acquisition of two large agencies. Also, the firm boasts a 5 percent rate of return for in-house referrals.

Gould noted that 20 percent of its sales are for personal umbrellas, and the firm provides real-time comparative quotes for most personal lines business.

The biggest challenge in the homeowners’ market is securing clients with secondary homes in catastrophic states like California and Florida, Gould says. “For auto coverage, the most challenging task is trying to insure clients with less than perfect driving records.”

When it comes to personal lines, Gould says she enjoys most the “diversity of our clients and the products we can offer them.” What she enjoys least is “struggling to place insurance in catastrophic places.”

When asked to name three keys to Mesirow’s success in personal lines, Gould replied: excellent customer service; solid relationships with carriers; and substantial referral business from large lines producers.

Cook, Hall & Hyde Inc.

East Hampton, N.Y.

Owner(s)/principal(s): multiple

2006 personal lines premium: $22.1 million

No. of personal lines insurers: NR

Cook, Hall & Hyde Inc., founded in 1947, is a regional broker with three offices in New York and New Jersey. The agency also operates a private client practice built around the needs of affluent individuals.

While the firm does not provide real-time comparative quotes for personal lines customers, its personal lines business has grown consistently for the past 25 years, says Len Scioscia, president. “We have consistently built our dedicated sales organization to capitalize on our agency’s team selling concept and to maximize our relationships with centers of influence.”

Scioscia reports that more than 30 percent of the agency’s new sales each year come from referrals within the agency, primarily among its salespeople. “Personal insurance is a well integrated part of our ‘team selling’ initiatives,” he says. “This allows us to present ourselves differently to our customers when compared with most other agencies.”

Approximately 50 percent of the agency’s customers purchase personal umbrella products, but on a revenue basis, personal umbrella represents a very small percentage of the total, Scioscia notes.

Scioscia cites three keys to the agency’s success in personal lines: history of investing in new salespeople; state of the art service platform; and relentless execution of a “team selling” strategy.

American Auto Club Ins. Agency

Charlotte, N.C.

2006 personal lines premium: $41.0 million

No. of personal lines insurers: 10

Founded in 1998, American Auto Club Insurance Agency has 24 locations in North and South Carolina. The firm has an affinity marketing program with AAA Carolinas and the AAA member is the target prospect.

Jim McCafferty, president, says the agency has enjoyed double digit growth for each of the past five years, most of it organic. McCafferty says, 51 percent of the new business comes from referrals, and 39 percent comes from advertising/marketing.

He says the biggest challenge facing the personal lines industry is two-fold: 1) commoditization of the products and 2) disintermediation of the agency force. “With the unbelievable sums of money being spent on auto insurance advertisement the local independent agent can’t get (their) share of voice,” he adds.

Three keys to his agency’s success: positive personal interactions; separation and centralization of functions/services; and great partners/performers.

Topics Carriers Auto Agencies Florida New York Leadership Property Casualty Homeowners New Jersey Ohio Oklahoma

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows