Demotech’s review of second quarter 2012 data, as reported by insurers to the National Association of Insurance Commissioners, shows that industry workers’ compensation direct written premiums continued to grow. The question remains, however, whether those increases are enough to improve profitability given adverse loss cost trends and low investment returns.

Workers’ compensation insurers reported a 9.1 percent increase in direct premiums written during the first six months of 2012 versus the same period in 2011. Coupled with the 9.6 percent increase observed last year, premium writings are significantly higher than in 2010, yet have recovered only half of the decline from their peak in 2006.

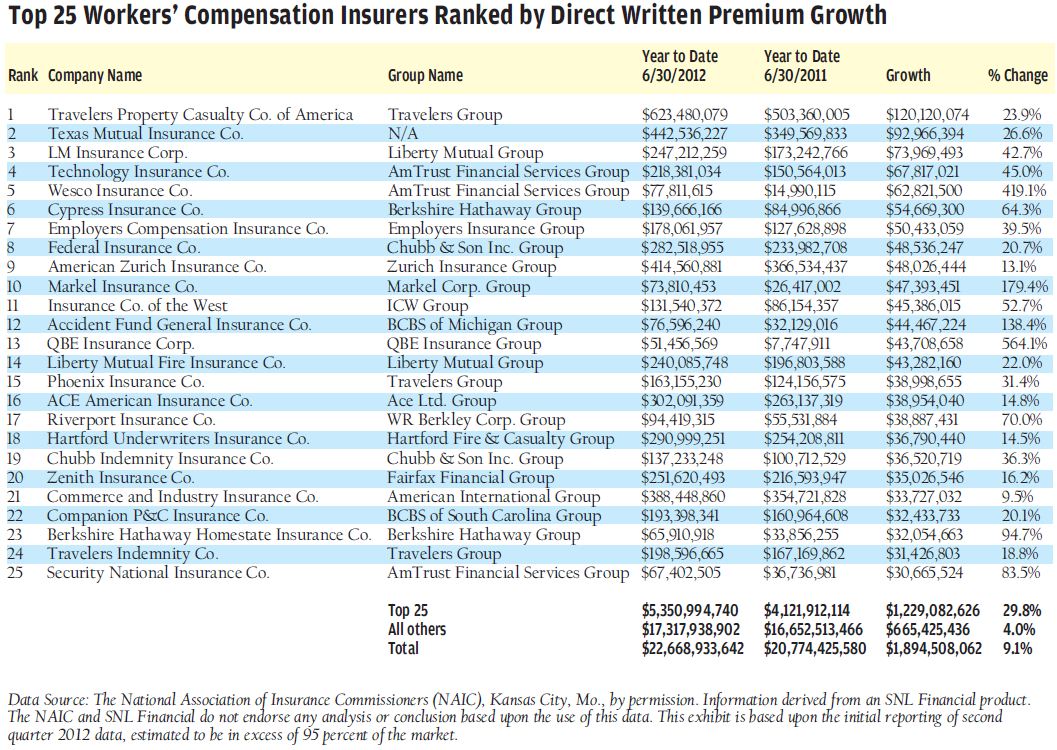

The top 25 workers’ compensation insurers, ranked by the highest direct premium growth, reported a 29.8 percent increase during the first six months of 2012 versus the same period in 2011.

As noted in an article published in the June 8 issue of Insurance Journal, premium growth for Texas Mutual Insurance Co. was driven by the financially strong Texas economy. AmTrust Financial Group’s acquisition of workers’ compensation business that had formerly been written by Majestic Insurance Co. resulted in premium growth for Technology Insurance Co., Wesco Insurance Co. and Security National Insurance Co.

Several of the top 25 companies — Travelers Property Casualty Co. of America, Cypress Insurance Co., Employers Compensation Insurance Co., Markel Insurance Co., Insurance Co. of the West, and Zenith Insurance Co. — wrote the majority of their premium in California, where these companies and their competitors filed for significant rate increases in the past year, in line with bureau loss cost increases. However, the recently passed reform bill creates additional uncertainty about future claim costs and bureau recommendations in California. Most of the other top 25 companies are National or Near National companies that benefited from the rate increases filed in a majority of states in the past year.

The weak economic recovery, less favorable claim frequency trends, increases in medical and pharmaceutical costs, and price reductions to retain renewal business will continue to pressure workers’ compensation financial results. Lower interest rates will result in less investment income to offset these unfavorable loss cost trends.

Topics Trends Carriers Workers' Compensation Talent Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs