The Agent’s Role as Advisor and Risk Manager

Editor’s note: This is the first of a three-part series to explain insurers’ requirements for building updates and to help agents advise clients on mitigating risks inherent in older buildings. Later articles in the series will address plumbing systems, and HVAC and roofing systems.

While some items — wines, fine arts and antique furnishings — improve with age, most buildings do not. In fact, the older a building, the more likely it is to have serious defects, particularly in critical building systems such as electrical, plumbing, HVAC and roofing. Older buildings generate more claims than younger properties, especially if they have not been well-maintained or if their building systems have not been updated.

Among the most important questions a property insurer will ask an agent is the age of the original building, the age of any renovations or additions, and the age and condition of critical building systems: electrical; plumbing; heating, ventilation, and air conditioning (HVAC); and roofing.

Whether providing with insurance for habitational, commercial, or industrial occupancies, an agent who is knowledgeable about older buildings and the risks they present can offer a valuable service. Helping clients manage risk and protect their assets is much easier than trying to assist them with recovery after a devastating loss, a loss that could have been prevented by understanding and addressing the risks covered in this series of articles.

Because older buildings tend to generate more claims, it makes sense that a property insurer will ask a prospective or renewing policyholder for information about building systems in older properties. These questions are found in the building improvements section under Additional Coverages of the Acord 140 Property Section of the insurance application. This information helps the insurer price the coverage fairly, and brings to light serious defects in the building systems so they may be corrected.

In the case of serious defects, such as a leaking roof, or when a major update is needed, such as to an obsolete electrical system, the insurer may ask the prospective policyholder to undertake the renovations as a condition of coverage.

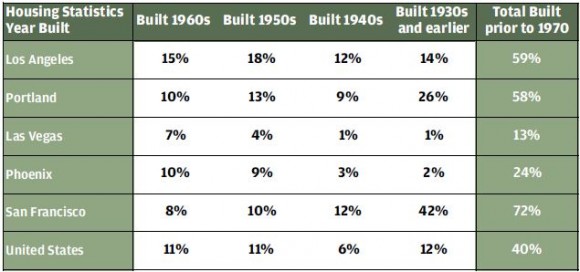

The “age of building” issue is especially important in more “mature” cities, where older buildings are more common. In some Western cities, such as Los Angeles, Portland, and San Francisco, the proportion of owner and tenant occupied housing structures older than 40 years is significantly higher than the national average.

If a property is more than 20 years old, the insurer may ask about the year of construction, including the dates of the original building and any additions, renovations, modernizations and occupancies. If the building is older than a certain age, generally 20 to 40 years, the insurer may require the property owner to undertake certain updates, or upgrades, to critical building systems or show proof that updates were done recently, typically within the past 10 to 20 years. The insurer may ask the client to demonstrate that the critical building systems meet current codes and have been maintained properly and continuously. Without these guarantees, the insurer may decline coverage, or may offer coverage at a higher premium or with higher deductibles.

Understandably, property owners may balk at providing the information, and may resist an insurer’s requirement to undertake potentially costly repairs or renovations.

At this point, the response of the agent is critical.

It may be tempting to soothe the client by “pushing back” at the underwriter who has requested the information. However, an agent can better serve the policyholder, the insurer, and the agency by seizing the opportunity to serve in an advisory, rather than adversarial, capacity.

A resourceful and helpful agent will:

- Understand the risks associated with older buildings;

- Educate policyholders about the hazards associated with older buildings and the reasons underwriters request information about older properties;

- Collaborate with policyholders and underwriters to gather pertinent information and identify areas of concern;

- Communicate the condition, suitability, safety and reliability of the policyholder’s building systems to the underwriter;

- Counsel and assist policyholders in making smart risk management decisions about their properties, including necessary upgrades and appropriate insurance;

- Follow up to ensure that agreed-upon upgrades are completed and maintenance programs are in place.

Most property owners understand that buildings from the 1920s, 1930s and 1940s will need upgrades. Yet, in dealing with properties dating from 1950s through the 1980s, it can be a challenge to convince owners these, too, are “older buildings.” Buildings in the 30- to 60 year-range present unique hazards, particularly due to the prevalence of building components known to be likely to fail, such as obsolete electrical components and polybutylene water piping. In such cases, an agent can play a critical role by providing information and guiding good risk management choices.

Each insurer establishes its own standards for age of building, updates required, and conditions that must be met before a policy will go into effect. An insurer may have different requirements for different types of buildings, or for properties in regions where weather conditions are a factor in aging and deterioration. There is no industry-wide standard or requirement.

While aging and deterioration affect all building systems, defects in the electrical system pose the greatest immediate risk.

Electrical Systems

The primary concern in an older building is the electrical system. Many fires begin in electrical systems, not due to deficiency in the design or quality of electrical components, but because the systems, which generally function quietly and efficiently without apparent need for maintenance, are rarely inspected and often poorly maintained. A building’s electrical system is usually taken for granted because it operates behind the scenes until a failure occurs. In most cases, fires caused by electrical deficiencies could have been prevented by effective electrical maintenance programs.

Electrical engineering and safety standards have advanced considerably in recent decades, making newer technologies the better choice for every building, in terms of safety, effectiveness and cost. Additionally, failure rates of older electrical technologies are high, making it important that older buildings be retrofitted to replace old, unsafe wiring safer technologies (Figure 1). Aluminum wiring, “knob and tube” wiring, and certain brands of circuit breakers, all commonly found in older buildings that have not been updated, are known fire hazards.

If the property is more than 30 years old, expect the insurance underwriter to ask:

- What type of wiring is present in each part of the building?

- When was the wiring installed? What is its condition?

- Does any part of the building have aluminum wiring, BX (“armored”) wiring, or “knob and tube” wiring? (Figure 2)

- Has the wiring been updated in any part of the building? When? What updates were made (full, or partial)? Was this done by a licensed electrical contractor?

- Is the system protected by circuit breakers or by fuses? What overload protection is in place?

- Have there been any problems or failures of the electrical system? If so, describe the problem and how it was addressed.

- How is maintenance of the electrical system handled?

For every building, underwriters must verify that the electrical system meets current building codes for each occupancy present in the building, and has been updated to meet code for each change in occupancy.

Once a building reaches a certain age, typically 30 years, the insurer will request documentation that the wiring has been upgraded, updated or replaced — such as during a renovation — or has been inspected and validated by a licensed electrical contractor.

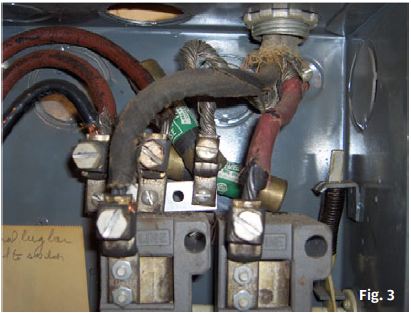

A leading cause of building fires is poor maintenance of the electrical system. Maintenance quality can be assessed during a visual inspection by a trained professional. However, some electricians have the capability to conduct ultrasonic and thermographic evaluations to identify hazards a visual inspection cannot. A professional electrician is trained to identify electrical risk conditions like poor housekeeping, inadequate maintenance, transient voltages, non-compliance with electrical codes and outdated or faulty equipment, or simple problems like a missing knock-out or chafed wires, two conditions that can increase fire risk (Figure 3).

To be considered “updated” or “upgraded,” the electrical system must meet current codes for the present occupancies. If there has been a change in occupancy, a qualified electrical contractor must verify that the system is adequate for the new occupancy. The system must have been fully inspected and updated to meet current codes for the present occupancy within a time period specified by the insurer. Verification of updates and system adequacy can be obtained through a certificate or other acceptable form of documentation from a qualified electrical contractor.

For example, an old knob and tube system may be “upgraded” by the installation of a new panel box and breakers. However, a true assessment of the system must include the condition and reliability of the wiring, switches and receptacles that may remain as original equipment. (Figs. 1 and 2)

From the physical perspective, “updated” or “upgraded” means that the electrical wiring has been changed, improved or replaced to accommodate the electrical requirements of a new occupancy or a change in operations of an existing occupancy. From the inspection perspective, “updated” or “upgraded” means that the system has been evaluated by a qualified electrical contractor who has verified that the building’s electrical system is adequate for the current occupancy.

Any change in occupancy or operations that appears to have increased demand on the electrical system should be evaluated by a qualified electrical engineer to ensure proper configuration, adequate load capacity, proper distribution of load and proper coordination of protection devices.

The idea of “building updates” may be unappealing to some prospective and renewing policyholders if they think that upgrades are solely to satisfy an insurer. Yet, without upgrades and ongoing maintenance, critical building systems will eventually begin to deteriorate. Failure is inevitable. The cost of upgrades are typically less than the costs of an electrical fire.

By helping the policyholder to understand the reasons behind the “age of building” and “update” questions that appear on most insurance applications, and by assisting with gathering and communicating accurate information for the underwriter, the agent fosters a mutually beneficial relationship between the insurer and the policyholder. By serving as an informed advisor and advocate, the agent can help the policyholder to reduce risk, increase safety, and save money over the long term.

Was this article valuable?

Here are more articles you may enjoy.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup