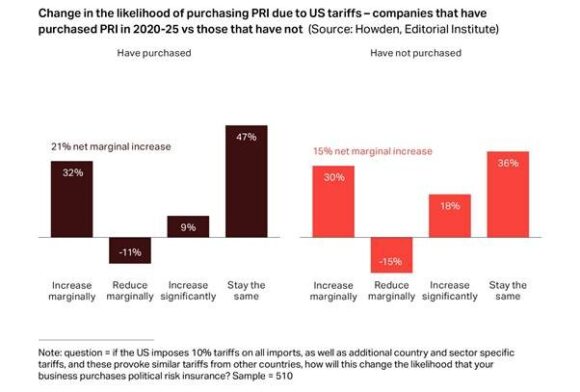

Demand for political risk insurance is likely to rise by 33% due to tariff uncertainty and the instability of the current trading environment, according to Howden’s 2025 survey of multinational corporates with revenue of more than US$1 billion.

Rising geopolitical tensions, financial market flux, trade uncertainty, supply chain recalibration, and competition for critical minerals are driving demand for protection in the form of credit and political risk insurance (CPRI), said Howden’s report, titled “Opportunity in Flux.”

“CPRI continues to act as a growth enabler by protecting investments, facilitating trade and driving economic activity at a time of heightened global instability,” the report said.

Howden said a key takeaway from the report is the growth opportunity that this sector offers for insurers and their clients.

“Even the series of economic and geopolitical shocks in recent years has done little to hold back performance, with net combined ratios in the range of 70-80% rivalling the best underwriting in the market,” the report said.

“This is not down to some random aberration in the loss environment – this period has brought a sequence of economic and geopolitical shocks with COVID-19 (and the accompanying recession), higher inflation, wars in Ukraine and the Middle East and now tariff uncertainty – but more a reflection of strong underwriting standards and alignment of interest with policyholders that is limiting losses flowing into the market.”

Substantial Market Premium Base

“With a premium base of US$49 billion spanning six distinct product segments,” the size of the CPRI and surety market surpasses most other, more high-profile specialty insurance markets, including marine and energy, Howden said.

The six product segments discussed in the report are: U.S. admitted surety & fidelity; international surety; trade credit; non-payment; export credit agencies, and political risk.

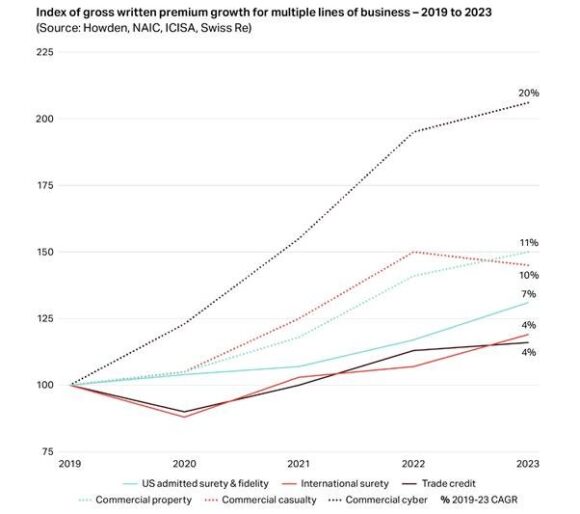

While the market has performed strongly, CPRI premium growth has not developed at the pace of other more volatile and/or longer-tailed business lines, Howden said.

For example, the report explained, the property market grew up to three times faster than trade credit between 2019 and 2023 while cyber achieved close to five times the growth rate during the same period.

Amid the softening of the broader insurance cycle, Howden argues that now is the time to draw in additional new entrants and for existing CPRI carriers to accelerate ventures into new asset classes and territories, increase commitments and drive innovation.

The biggest challenge – and Howden’s stated call to action for the market – is ensuring deployable capacity and underwriting flexibility keep up with clients’ changing needs.

Supply-Demand Imbalance

“The perceived complexity of certain CPRI products and a desire to operate in a narrow window of volatility by re/insurers has led to a supply/demand imbalance in certain areas of the market,” Howden said, noting, that conditions have eased in the insurance market over the past year.

“Pressures remain in the reinsurance market, where the participation of only a handful of recognised lead underwriters and underlying caution is manifesting in rigidity that can be detrimental to growth and ultimately relationships,” the report said. “Some of the larger capacity providers continue to stall, due in large part to negative news flow around the risk landscape but also at times a fundamental lack of understanding of the product.”

However, the report said that CPRI market leaders have shown “these challenges can be overcome with highly attractive, diversifying underwriting income achieved by building up experience and expertise.”

Market Opportunity

“There is room for a greater growth rate in today’s world; CPRI presents a compelling case from both a buyer and capacity provider perspective in supporting businesses to invest and trade through heightened volatility whilst delivering market-leading underwriting results,” according to a press statement accompanying the report.

“The CPRI market’s outstanding long term performance is testament to the deep sector expertise that pervades the value-chain. With demand for CPRI protection rising, now is the time for the market to step up even further,” commented Matthew Strong, deputy CEO, Howden CAP and head of Credit and Political Risk, in the statement.

“This will enhance global economic growth by increasing commitments and innovating, as well as providing businesses, lenders and public sector entities around the globe with the certainty they need to trade and invest with confidence,” he continued.

“Opportunity is the key takeaway to emerge from our report. Yes, risk is up in a highly fractured world, but providing protection to help clients trade and invest through such uncertainty is precisely why CPRI exists,” according to Phil Bonner, managing director, Global Specialty Treaty, Howden Re.

“Our market does this in a way no other can whilst achieving exceptional performance, as demonstrated by underwriting results that rival any other product line of insurance. As demand for protection rises in response to global instability, our call to action for the market is to not only provide adequate supply but to also offer underwriting flexibility and imagination that keep up with clients’ changing needs,” Bonner said.

Topics Trends

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan