“There is no such thing on earth as an uninteresting subject; the only thing that can exist is an uninterested person” – G.K. Chesterton

The insurance market for transportation risks is increasingly conservative in what it accepts, coverage offered and in the premiums charged for coverage. In addition the market for transportation accounts is shrinking with carriers leaving the segment or limiting the number of accounts that they will accept.

Underwriters earn their living by being interested in all facets of the accounts that they are being asked to insure. The ability to attract their interest in a conservative insurance marketplace will make all of the difference in your securing coverage on favorable terms for your client.

When considering the acceptance, terms and price of a commercial transportation account there are a number of subjects that grab an underwriter’s interest beyond the normal submission details. Here are some thoughts on how you can attract interest in your customer.

How interested is your customer in operating in a safe manner?

- Describe actions taken to embed and sustain a safety culture throughout their organization.

- Demonstrate an ongoing commitment from the customer to improving their safety culture.

- Identify areas that can be improved upon and ask for the carriers assistance in helping them with impactful, productive and cost-effective methods to improve.

How does your customer address the financial challenges of operating a profitable business while at the same time investing in their safety culture?

- What comes first – profit or safety? How does management prioritize a safe operating culture against the financial objectives of the business?

- Are profits reinvested in the business to improve the quality of their drivers, their vehicles and their safety measures?

- What is unique about their business that allows them to thrive in a competitive, crowded and challenging operating environment?

- What image does your customer project to their customers, vendors and the public?

The condition of your carriers shop, the condition of their equipment and their drivers’ behavior behind the wheel are important areas that underwriters are interested in.

What many insurance producers and transportation operators are unaware of is that transportation underwriters can gain a snapshot of the aforementioned areas within minutes of receiving your submission for coverage. But the fact is that you can obtain this information before you present your customer to the insurance marketplace.

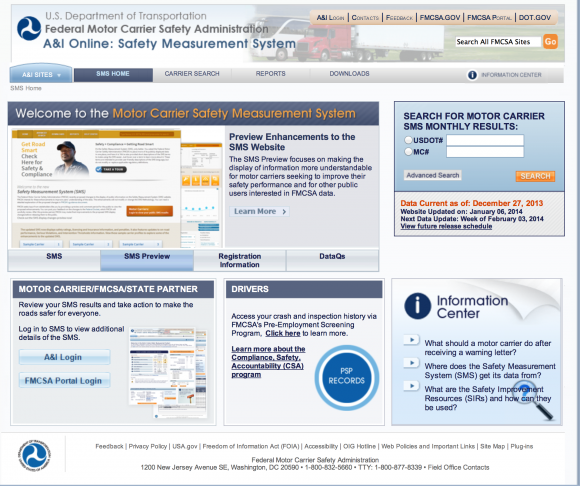

The information is easily obtained through public records compiled and kept current on the Federal Motor Carrier Safety Administration (FMCSA). The information available provides the underwriter with performance measures that reflect the quality of the operator as well as a comparison to other operators in their industry. In many cases the information is often given more weight in an underwriters’ assessment than your customers’ loss history (although that is important as well).

The areas that are measured include: unsafe driving; hours of service compliance; controlled substance and alcohol; driver fitness; and vehicle maintenance.

You can access this information at the FMCSA Compliance, Safety and Accountability website www.csa.fmcsa.dot.gov. Click on the “SMS Results” tab and search by USDOT or MC number or use the Advance Search by carrier name.

The information can highlight customers’ strengths as well as identify the improvement opportunities that need to be addressed in order to present transportation underwriters with the reasons they need to take an interest in your customer.

Topics Underwriting

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley