The rollout of autonomous vehicles in the next few decades could lead to a massive reduction in U.S. motor vehicle premiums in the coming years, Aon Benfield said in a new report.

Expectations are that “industry pure premiums” will drop 20 percent under their 2015 levels by 2035, even if the technology is adopted at just a moderate pace, Aon Benfield said. Assuming the same moderate trajectory, those premiums could plunge by more than 40 percent if full adoption of autonomous vehicles takes place, as expected, by 2050.

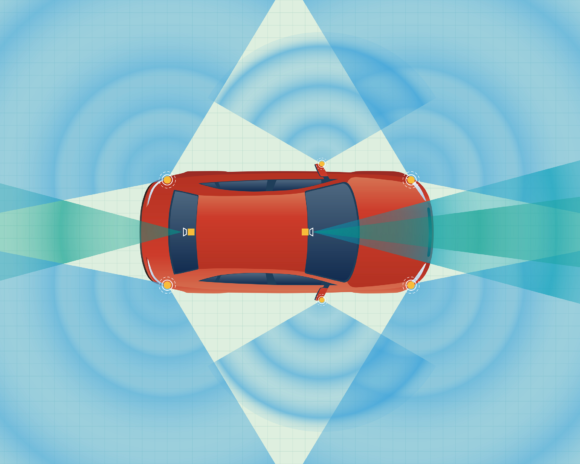

The prediction assumes a number of variables. As Aon Benfield noted, the prediction of premium reduction dovetails with an envisioned 81 percent drop in claims frequency over time, after the first commercially available autonomous vehicle technology hits the road in 2018.

There’s also an assumption of higher claims severity behind those numbers, because of sensor costs and greater cost of handling product liability claims. Aon Benfield explained that autonomous vehicle sensors currently go on vehicle bumpers, a practice that leaves them the first thing to get damaged in an accident.

As well, accident liability is expected to shift from the vehicle driver to “the future operator of the autonomous vehicle fleet.”

Aon Benfield said it bases its predictions for self-driving technology adoption on historical precedent for other modes of transportation.

“Cars took approximately 80 years from the date of the first commercial availability to reach 90 percent adoption; air travel took approximately 60 years; mobile phones 30 years; while smart phones have taken only 10 years,” Aon said.

Based on those numbers, its prediction for adoption of self-driving technology in the next 30 years (and resulting premium shifts) is very much “a middle-of-the-road” approach. The report said this timeframe “is consistent with the historical adoption of safety features in personal vehicles.”

Aon Benfield’s findings are part of its annual Global Insurance Market Opportunities report, which came out in September 2016 as part of this year’s Monte Carlo Rendez-Vous gathering.

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups