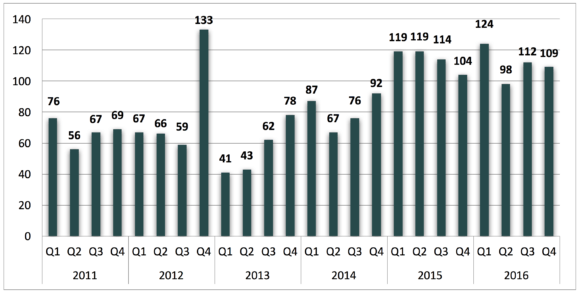

Merger & acquisition activity in the insurance distribution space continued at an industrious pace throughout 2016, with 443 closed transactions. This was down from 456 in 2015, but still higher than previous years on record (most recently 322 in 2014, 224 in 2013 and 325 in 2012).

The deal count for the fourth quarter of 2016 was the highest for Q4 activity since 2012. There were 109 announced transactions closed in Q4, up from 104 in 2015, 92 in 2014 and 78 in 2013. In December alone, 59 announced deals closed compared with 44 the year prior.

Retail agencies accounted for 373 of the 443 agency transactions and the other 70 firms sold were specialty distributors. Roughly 38 percent of the firms that sold were multi-lines agencies, writing property/casualty and employee benefits/consulting coverages. The next 44 percent of the selling firms were P/C only, and the remaining 18 percent were EB only.

The most active segment of buyers in 2016 continued to be private equity-backed firms, completing 55 percent of the transactions. The next most active group was independent brokers and agencies (24 percent), followed by other types of firms (9 percent), publicly traded insurance brokers (7.5 percent), and banks & thrifts (5 percent).

The top five buyers in 2016 accounted for roughly one-third of the volume, and the top 10 buyers accounted for roughly 50 percent of the volume.

The top five acquirers were Acrisure LLC, Hub International Ltd., BroadStreet Partners Inc., AssuredPartners Inc. and Alera Group Inc. All private equity-backed firms.

Acrisure was the most active acquirer in 2016, with 38 announced transactions; 16 were in California. Most of the announced transactions were P/C firms. Acrisure does not publicly announce all of its transactions, so the actual number of Acrisure’s closed deals is likely greater.

Hub was the second most acquisitive firm in the space, with 31 deals. These were spread throughout the U.S, with just under half taking place in the Western U.S. and the other half occurring in the East and Midwest. Roughly half of the agencies acquired by Hub were multi-line agencies, one-fourth were P/C only, and the other quarter were EB only firms.

BroadStreet Partners Inc. had 28 announced transactions in 2016. The firms acquired were primarily P/C agencies.

AssuredPartners Inc. announced 26 deals in 2016, concentrated in the Eastern half of the U.S. Just over 53 percent of their acquisitions were multi-line agencies, 35 percent were P/C only, and the rest were employee benefit only firms.

Alera Group’s 24 individual transactions closed in late December made it one of the largest employee benefit firms in the country with a presence in 15 states and total revenue of roughly $158 million.

The next five buyers, by number of deals closed, announced 74 transactions in 2016. Arthur J. Gallagher & Co., the only publicly traded company to make the top 10 acquirers list, closed 23 deals. Confie Serguros (17 transactions), Hilb Group (15 transactions), USI Holdings (10 transactions) and Risk Strategies Co. (9 transactions) are all private equity backed firms.

Overall, the deal activity for 2016 was down slightly from 2015, but it was still one of the most active years of M&A on record, and another year of proliferation of private equity backed firms in the industry.

Securities offered through MarshBerry Capital, Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co. Inc. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440-354-3230). Except where otherwise indicated, the information provided is based on matters as they exist as of the date of preparation. Past performance is not necessarily indicative of future results and individual results may vary.

*Correction: This story has been corrected from an earlier version to clarify that Arthur J. Gallagher & Co. is the only publicly traded company to make the top 10 acquirers list. Insurance Journal regrets the error.

Topics Mergers & Acquisitions USA Agencies Property Casualty Employee Benefits

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’