A growing number of senior executives around the world are willing to pay bribes to win or keep business, as the hunt for growth supersedes concerns over ethics and regulatory fines, according to a survey published on Wednesday.

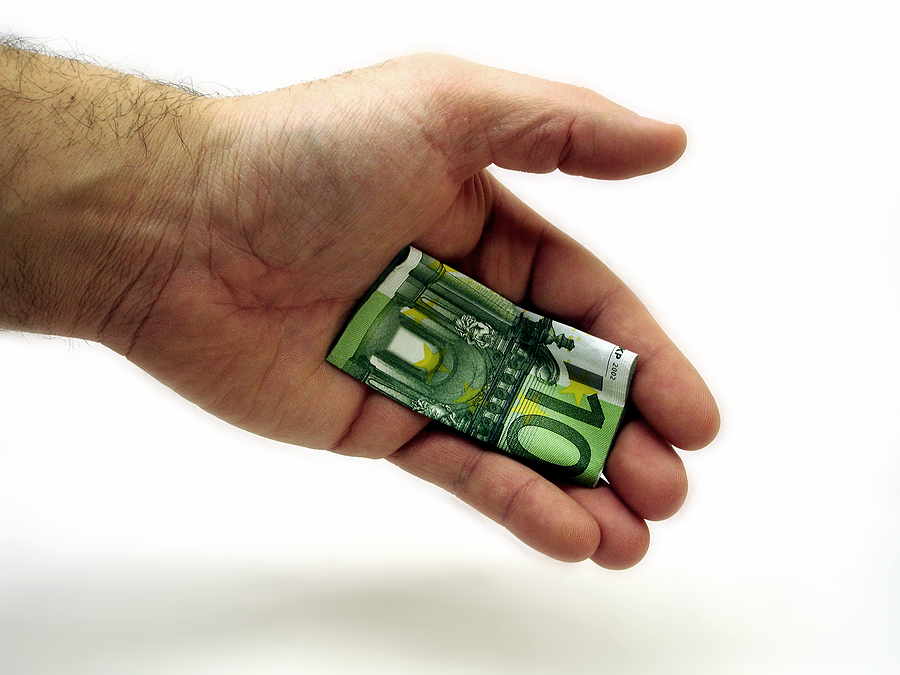

Ernst & Young said in its annual global fraud survey that the number of top executives at leading firms who said they would be willing to pay cash to secure business – particularly as they expand into new markets – had risen to 15 percent from 9 percent this year.

“Growth and ethical business conduct in today’s markets can appear to be competing priorities,” noted David Stulb, Global Leader of Ernst & Young’s fraud investigation and disputes services practice.

“Our findings show that, as businesses continue to pursue opportunities in new markets, many executives are underestimating the risks. Boards need to put pressure on management to conduct more frequent and more robust anti-bribery/anti-corruption risk assessments.”

Colombia, Ukraine and Brazil topped the list of countries perceived to be the most corrupt. But, after quizzing around 1,700 executives across 43 countries, Ernst & Young said over one third of respondents believed corruption was widespread in their country.

Of the 400 chief financial officers quizzed, 15 percent admitted they would be willing to pay cash to secure business and 4 percent said they would be willing to misstate financial performance.

“This group of executives is not large in absolute numbers but, given their responsibility, they represent a huge risk to their businesses and their boards,” Ernst & Young said.

More than half of senior executives thought company boards needed a more detailed understanding of the business and that a failure to penalize misconduct diluted management messages.

Under the U.S. Foreign and Corrupt Practices Act (FCPA) and the UK’s Bribery Act, companies are required to do due diligence on overseas partners and, under UK law, can be responsible for unethical behavior by “associated parties”.

But Ernst & Young said 44 percent of respondents said when companies pursued deals in rapid-growth markets, background checks on third parties were not being performed.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’