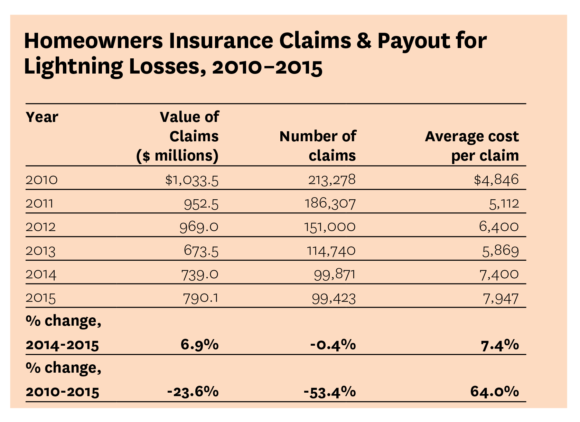

The number of homeowners insurance claims from lightning strikes in the United States fell in 2015. However, the total insurers paid on those claims rose by nearly 7 percent, according to the Insurance Information Institute (I.I.I.).

In fact, $790 million in lightning claims was paid in 2015 to nearly 100,000 policyholders.

An analysis of homeowners insurance data by the I.I.I. and State Farm found:

- Total insured losses from lightning rose 6.9 percent from 2014 to 2015, although losses have declined 23.6 percent since 2010.

- There were 99,423 insurer-paid claims in 2015, down 0.4 percent from 2014.

- The average lightning claim paid 7.4 percent more than a year ago: $7,947 in 2015 vs. $7,400 a year earlier.

- The average cost per claim rose 64 percent from 2010 to 2015. By comparison, the Consumer Price Index, which measures the change in the cost of a fixed basket of products and services, including housing, electricity, food, and transportation) rose by 9 percent in the same period.

“The average cost per claim is volatile from year to year,” said James Lynch, I.I.I. vice president of information Services and chief actuary, “but it has generally continued to rise, in part because of the enormous increase in the number and value of consumer electronics including increasingly popular home automation systems.”

The drop in claims is consistent with data from the National Weather Service, which recorded 334 events with property damage in 2015, down from 401 in 2014. There were 135 days in 2015 in which lightning caused property damage, and 128 such days in 2014.

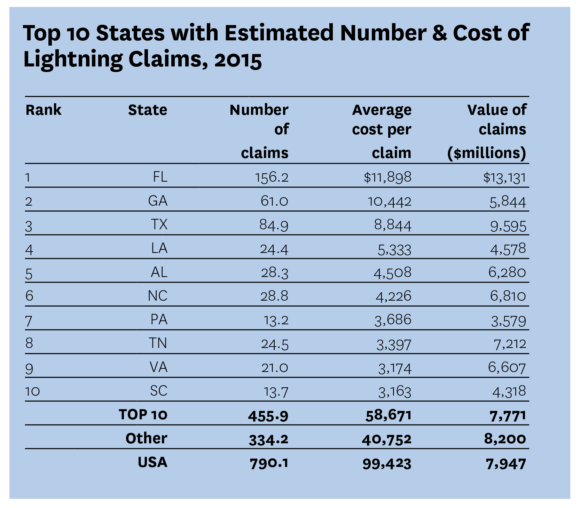

Florida – the state with the most thunderstorms – was the top state for lightning claims in 2015, with 11,898.

Damage caused by lightning, such as fire, is covered by standard homeowners insurance. Some policies provide coverage for power surges that are the result of a lightning strike.

“Not only does lightning result in deadly home fires,” Lynch said, “it can cause severe damage to appliances, electronics, computers and equipment, phone systems, electrical fixtures and the electrical foundation of a home.”

Topics Trends Claims Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio  GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half  Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion  India’s GIFT City Attracts Lloyd’s and Other Global Reinsurers, Sources Say

India’s GIFT City Attracts Lloyd’s and Other Global Reinsurers, Sources Say