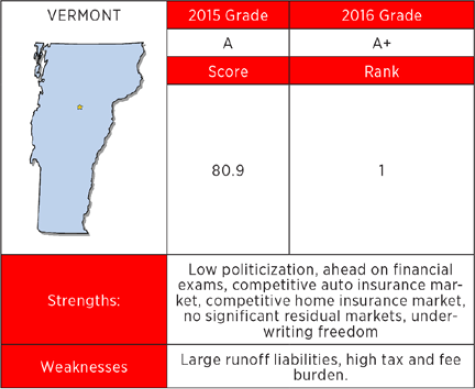

The R Street Institute, an industry think tank headquartered in Washington, D.C., found Vermont has the best insurance regulatory environment in the U.S. for the third straight year in its annual Insurance Regulation Report Card.

The fifth annual report, written by R Street Senior Fellow R.J. Lehmann, issues letter grades for all 50 U.S. states based on seven categories – politicization, fiscal efficiency, solvency regulation, auto insurance market, homeowners insurance market, residual markets and underwriting freedom.

Best in East: Vermont

The report found Vermont had the best insurance regulatory environment, receiving the only A+ score and improving its A grade last year.

One strength the report found in Vermont is its underwriting freedom. This section of scoring was based on rate-filing system descriptions from the 2015 ISO State Filing Handbook, examining the processes states use to review rates in four property-casualty insurance markets: private auto, homeowners, medical liability and general commercial lines.

“We experience firsthand that consumer choice and price competition are two of the most important consumer protections when it comes to affordability and service,” said Kaj Samsom, deputy commissioner in the Vermont Department of Financial Regulation’s Insurance Division.

One weakness the report outlined for Vermont was its high tax and fee burdens, which factored into the report’s measure of fiscal efficiency for each state.

“My guess is it is our fines and penalties that drive this metric,” Samsom said. “We make no apologies for that. If you break the law, you may face significant penalties. The penalties go straight to the General Fund, not our budget, to avoid any perverse incentives.”

Samsom acknowledged that while the report’s A+ grade is appreciated by Vermont DFS staff, each market is unique, making it difficult to accurately rank all 50 states.

“Does it mean Vermont is the best regulator? Absolutely not,” he said. “Attempting to rank the performance of a regulator is fraught with problems. Each state’s markets, consumers and issues are so unique that having a standardized scorecard is bound to be problematic.”

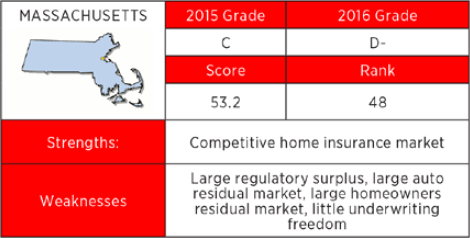

Worst in East: Massachusetts

Chris Goetcheus, director of communications at the Massachusetts Office of Consumer Affairs and Business Regulation, also criticized aspects of the scoring as too one-size-fits-all. Massachusetts received the lowest grade of the Eastern U.S. states with a D-, down from its grade of C last year.

“I think the D- grade is unwarranted,” he said. “There are areas where I think this report is flawed in regard to its evaluation of the Massachusetts Division of Insurance.”

The report pointed to a regulatory surplus of more than eight times the size of the insurance department budget as one weakness. The regulatory surplus for each state was considered in determining its fiscal efficiency. Goetcheus contested that under Massachusetts law, revenue and regulatory spending are divided appropriately.

“The Massachusetts DOI in the 2016 fiscal year generated $88 million in total revenue, and under our law, the majority of those revenues go to the General Fund,” Goetcheus said.

The report also found Massachusetts’ large residual markets to be a weakness. Based on Automobile Insurance Plans Service Office (AIPSO) data, the report found three Eastern U.S. states – Maryland, Massachusetts and Rhode Island – have residual markets that account for more than one percent of auto insurance policies. The report measured the size of residual markets for home insurance using the most recent available data from the Property Insurance Plans Service Office.

“The reason our residual market for property insurance may be higher than other states is Massachusetts’ FAIR plan offers a full homeowners policy portfolio,” Goetcheus said. “Some states don’t offer such a broad portfolio, tempering the market share size.”

One strength the report found in Massachusetts is its ability to regulate insurer solvency. The report looked at how well states examine companies they regulate by using the National Association of Insurance Commissioners’ (NAIC) data on the number of financial exams and combined financial/market conduct exams states reported for domestic companies from 2011 through 2015. It compared those figures to the number of domestic companies listed as operating in the state for those five years.

Ratings Methodology

The report acknowledged that because it is limited to factors it can quantify, there are considerations it doesn’t reflect. R.J. Lehmann told Insurance Journal The R Street Institute believes there is a role for regulation and tries to outline that in its report.

“We are free market advocates. That is not something we would hide,” he said. “We’re not going to say it’s not ideological, but it’s not anti-government.”

Lehmann and other fellows at R Street Institute are authors of the Right Street blog on InsuranceJournal.com.

IJ West Editor Don Jergler contributed to this report.

Topics Trends USA Legislation Homeowners Massachusetts

Was this article valuable?

Here are more articles you may enjoy.

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion