Massachusetts Division of Insurance’s last data call showed that the vast majority of insurance claims stemming from the Boston marathon bombing tragedy have been resolved.

The data also revealed that among the 160 commercial property and business interruption claims made as a result of last year’s bombing, less than 14 percent had separate terrorism coverage and that there probably would have been coverage gaps had the terrorism exclusions applied. Massachusetts Division of Insurance said, however, that it is not aware of any terrorism exclusions impacting coverages related to the bombing.

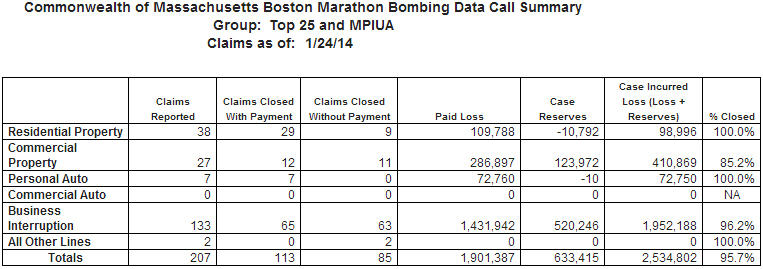

Massachusetts Insurance Commissioner Joseph Murphy said in a recent interview that with claims as of Jan. 24, 2014, there were 207 Boston bombing-related property/casualty claims that were reported by top 25 insurers and the residual market insurer Massachusetts FAIR Plan. Among these claims, 198 claims — or 95.7 percent — have been resolved, with the overall paid loss of about $2 million. The case incurred loss, including paid loss and case reserves, is approximately $2.5 million.

“We’ve done an ongoing data call with the industry to get our arms around the claims activity that has occurred following the event a year ago,” Commissioner Murphy said. “About 96 percent of all the claims that were made were resolved as of January of this year.”

The commissioner said his division is aware of some businesses that were affected by the law enforcement closure of the impacted area and that some of them have not gotten coverages. “They’ve gotten their business interruption but perhaps they had some additional specific, inventory-related claims that they weren’t covered for,” he said.

One of the insurance lessons from the tragedy is that while people try not to think of terrorism on a day-to-day basis, businesses and consumers need to be aware of what risks they face, the commissioner said. “I think the lesson is to make sure to have appropriate coverage in place.”

The total claims amount, which includes medical as well as property/casualty claims, is reported to be about $25 million. This was a little bit of a unique situation, the commissioner said, in that in most catastrophes that the state dealt with in recent memories — such as tornadoes in 2011 — there were a lot of commercial and residential structural damages as well as automobile damages. But in this case, the majority of the claims amount — approximately $22 million — were from health insurance-related claims.

The commissioner noted that the Terrorism Risk Insurance Act certification to certify the bombing as “an act of terrorism” has not been made, and he said he’s fairly confident the certification won’t be made. That’s because one of of the criteria for the certification is the $5 million property/casualty claims threshold, which has not been met.

He also said his department is not aware of any terrorism exclusions impacting coverages, “but hopefully one of the takeaways will be that businesses will realize that the threat of terrorism can occur.”

He explained there is an analogous Massachusetts state law that mirrors some of TRIA. The Massachusetts law allows for a statutory exclusion to be included in the standard commercial Massachusetts fire insurance policy and its related coverages in the event of terrorism certification. The commissioner said some carriers opt to exclude terrorism from their base coverages, then offer terrorism coverage endorsements for an additional premium. The terrorism coverage would be an add-on to the standard commercial policy in that it is an additional coverage from the standard policy that is meant to pay for losses associated with an event that has been certified as an act of terror, the commissioner said.

“The question then becomes how many businesses have only that standard policy, i.e., without the terrorism coverage add-on?” he asked. “As you might imagine, businesses have different types of policies.”

For example, a candy store may have a standard policy and coverage while a hotel or other types of businesses that operate around the clock may have opted for a more complex policy and related coverages. The commissioner said the Division of Insurance collects data at the aggregate level, not by individual policy, and therefore cannot offer informed opinion on the types of policies held by individual businesses.

“If this event was certified, could there have been some coverage gaps? There probably would have been,” he said. “But again, we would need to look more closely at the policies in place for those impacted businesses.”

The commissioner said the data call showed that among the 160 commercial property and business interruption claims that were made as a result of the bombing, just 13-and-a-half percent had separate terrorism coverage. “We would need to do a deeper dive to see if there was any terrorism coverage in any of those underlying policies as well,” he said.

But he added that with only 13-and-a-half percent of the 160 policy claims having separate terrorism coverage, “I would venture to guess that there could have been some coverage issues” if the bombing was certified as a terrorism event. “But it didn’t. It didn’t meet one of the several of the criteria within TRIA.”

“This was certainly the first instance of terrorism on American soil since the 9/11 attack. I think consumers need to be cognizant of that and factor that into their insurance purchasing decisions,” he said. “We want to encourage people to look at and consider terrorism coverage.”

Commenting on the TRIA reauthorization, he said that insurance commissioners and the National Association of Insurance Commissioners (NAIC) have been actively engaged with Congress to push for a long-term reauthorization of the federal backstop program. The current TRIA program is set to would expire on Dec. 31 unless renewed.

Recently, a bipartisan bill was introduced in the Senate to reauthorize the TRIA program for seven years. But some industry groups have also expressed concern that the latest bill contains provisions that could boost insurer costs.

Commissioner Murphy said insurance commissioners have weighed in several times to support a long-term reauthorization of TRIA in some form. He said the reauthorization is “absolutely critical” for providing the terrorism coverage and offering stability and predictability that the insurance industry and consumers need.

“I am hopeful that some fashion of that reauthorization will pass,” the commissioner said. “We will continue to beat the drum on how important the TRIA reauthorization is.”

Related Articles:

Financial Regulators Tell Congress TRIA Still Needed

Marsh Report Finds Continued Demand for Terrorism Risk Insurance; Urges Renewal

Businesses, Insurers Tangle Over Boston Marathon Loss Payouts

Topics Catastrophe Claims Property Property Casualty Massachusetts

Was this article valuable?

Here are more articles you may enjoy.

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Preparing for an AI Native Future

Preparing for an AI Native Future  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance