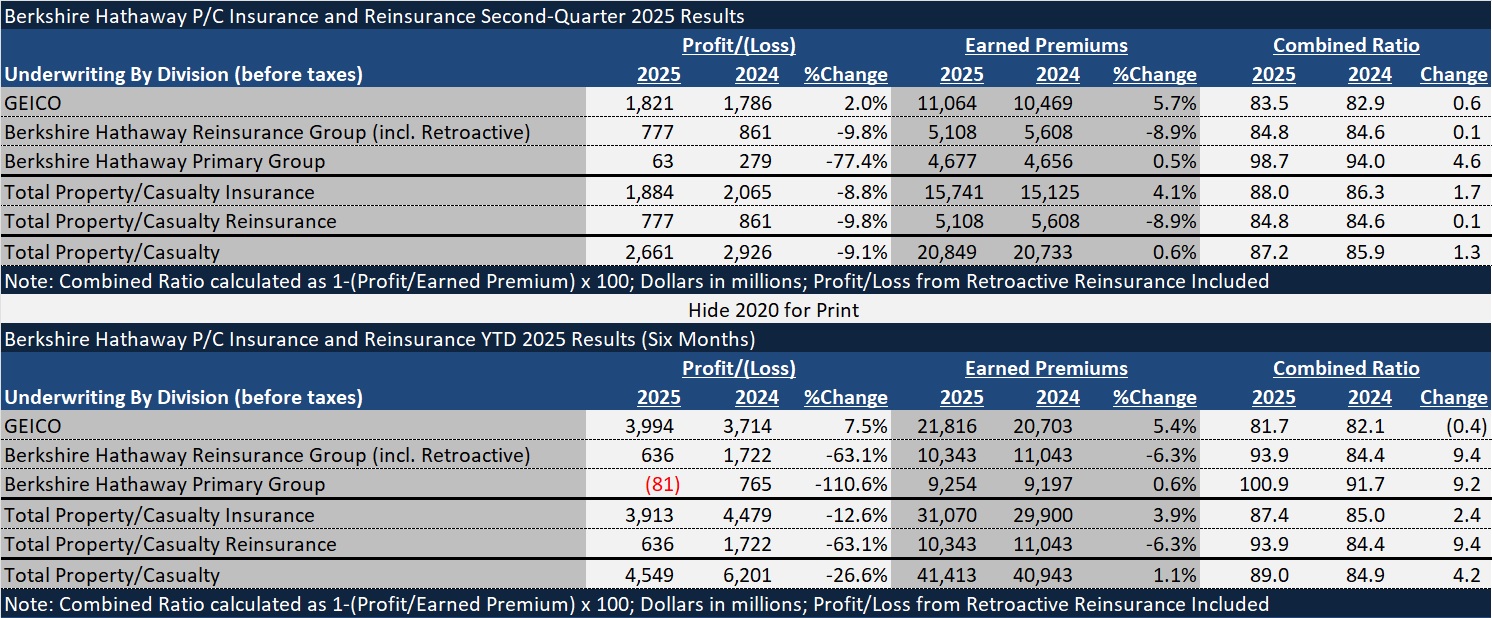

GEICO was the only one of Berkshire Hathaway’s major property/casualty reporting divisions to post higher underwriting profit in the second quarter of 2025.

But a 2% rise in underwriting profit for the personal auto insurance operation was not enough to offset declining underwriting profits in other primary (commercial) insurance and retroactive reinsurance operations. Overall, Berkshire’s underwriting profit slumped 9% for P/C insurance and reinsurance operations.

Berkshire Hathaway’s commercial primary insurance operations saw the biggest percentage drop in underwriting profit, falling 77% to $63 million for second-quarter 2025 compared to $279 million in second-quarter 2024. Translated to a combined ratio, the second-quarter 2025 ratio was 98.7—almost 5 points above a 94.0 recorded for second-quarter 2024.

Both the loss ratio and expense ratio components of the combined ratio deteriorated—with the loss ratio rising 1.9 points and the expense ratio rising 2.8 points. The Management’s Discussion and Analysis section of the second-quarter 2025 report attributes the expense ratio deterioration to increases at GUARD Group and to business mix changes.

In addition to GUARD, Berkshire Hathaway Primary Group includes Berkshire Hathaway Specialty Insurance, RSUI Group and CapSpecialty, Berkshire Hathaway Homestate Companies, MedPro Group, National Indemnity Company, Berkshire Hathaway Direct and U.S. Liability Insurance Companies. Berkshire describes these as independently managed underwriting operations that provide a variety of primarily commercial insurance solutions, including healthcare professional liability, workers compensation, automobile, general liability, property and specialty coverages for small, medium and large clients.

Written premiums for the commercial primary companies together dropped 2.3% and earned premiums were flat at roughly $4.7 billion, while losses and loss adjustment expenses increased $100 million (3.2%) in the second quarter.

Berkshire’s report says the premium decline primarily reflected reductions at GUARD (36% year-to-date) and, to a lesser degree, at BHSI and RSUI. GUARD exited certain unprofitable lines and tightened overall underwriting standards beginning in 2024, the report says.

Year-to-date, earned premiums rose less than 1% to $9.3 billion for all the primary commercial companies combined while losses and LAE soared 12.5%—adding 7.6 points to the primary group’s loss ratio. Roughly $300 million of losses incurred from the January 2025 wildfires in Southern California and a higher level of prior-year loss reserve boosts for liability claims in second-quarter 2025 compared to second-quarter 2024 ($401 million vs. $228 million) contributed to the rising loss ratio. “Casualty claim costs continue to be negatively impacted by unfavorable social inflation trends, including the impacts of jury awards and litigation costs,” the MD&A said, without further discussion.

Berkshire Hathaway’s property/casualty reinsurance operations were also impacted by wildfire losses, with $760 million in losses incurred, pushing the six-month combined ratio to 89.2 compared to 81.6 in second-quarter 2024. (Note: Combined ratio results shown in the accompanying chart also include the impacts of changes in the ultimate claim liability estimates for retroactive reinsurance contracts written in past years.) P/C reinsurance results improved for the second quarter, with General Re and TransRe Group together posting just over $1.0 billion of underwriting profit on $5.1 billion of earned premium, or a combined ratio of 79.2.

GEICO’s combined ratios for this year’s second-quarter and six-month periods remained in the low 80s—83.5 for the second quarter and 81.7 for the first half. While GEICO’s loss and LAE ratio improved 2.3 in the second quarter, the company’s expense ratio rose 2.9 points over second-quarter 2024.

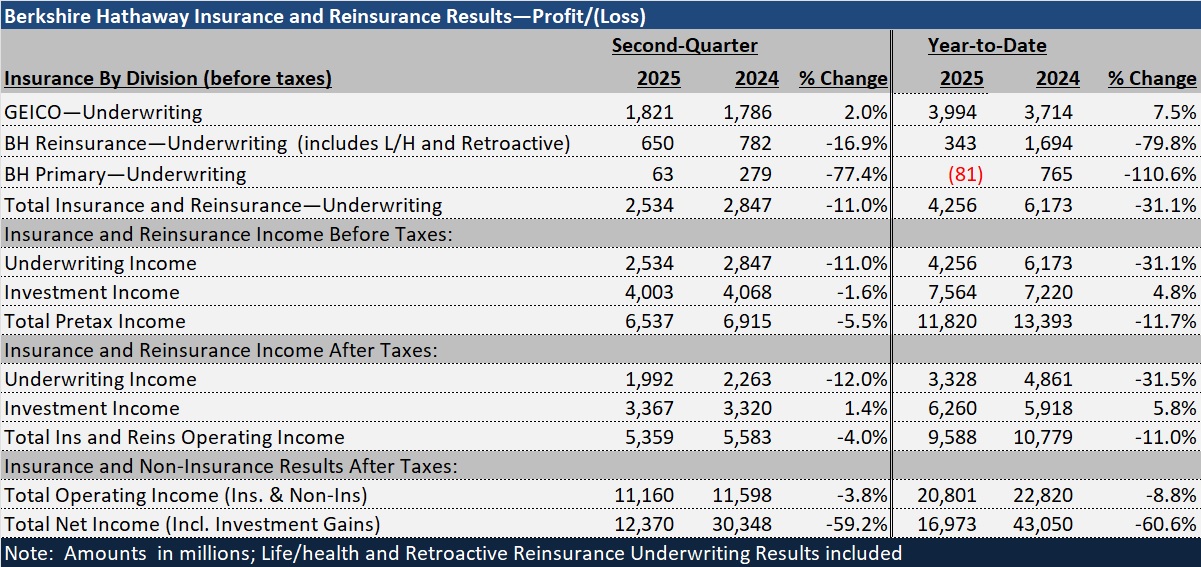

Putting all the underwriting results together, including life reinsurance operations, total pretax underwriting profit for the second quarter was $2.5 billion, 11% lower than the second-quarter 2024 figure of $2.8 billion. Investment income added $4.0 billion before taxes.

After-tax underwriting and investment income totaled $5.4 billion for second-quarter 2025, roughly 4% below second-quarter 2024.

The non-insurance operations of the conglomerate saw a similar percentage decline in operating earnings in aggregate. Total second-quarter operating earnings for insurance and non-insurance operations totaled $11.2 billion, 3.8% below the same quarter in 2024.

On the bottom line, Berkshire recorded a 59% drop in net income. The drop reflects much lower investment gains in second-quarter 2025 ($5.0 billion vs. $18.8 billion in second-quarter 2024) and a $3.8 billion write-down of an investment in Kraft Heinz.

The second-quarter filing included some narrative about changes in macroeconomic conditions and geopolitical events, not specific to the insurance operations but signaling a high level of uncertainty about future Berkshire results.

“The pace of changes in these events, including tensions from developing international trade policies and tariffs, accelerated through the first six months of 2025.

“Considerable uncertainty remains as to the ultimate outcome of these events. We are currently unable to reliably predict the ultimate impact on our businesses, whether through changes in the availability of products, supply chain costs and efficiency, and customer demand for our products and services. It is reasonably possible there could be adverse consequences on most, if not all, of our operating businesses, as well as on our investments in equity securities, which could significantly affect our future results,” the report said.

Topics Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears