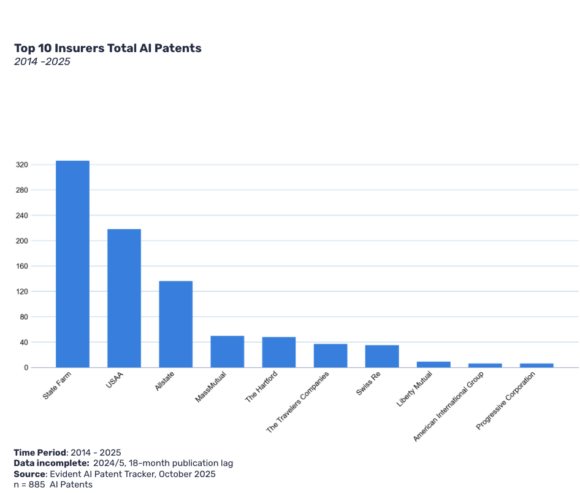

Three property/casualty insurers have dominated the industry’s artificial intelligence patent activity since 2014.

State Farm, USAA and Allstate account for 77% of all AI patents by insurers in that time, according to tracking data from Evident, an AI benchmarking and intelligence platform for financial services.

Evident reported that State Farm has filed 326 AI-related patents since 2014, while USAA has pursued AI-specific patent rights 218 times. Meanwhile, Allstate has submitted 136 applications. Evident also found that 166 AI patents have been filed by 30 major insurers across North America and Europe since January 2023.

“Patents offer a rare window into where insurers are placing their biggest bets on AI,” said Alexandra Mousavizadeh, cofounder and CEO of Evident, in a statement. “This data shows that innovation is overwhelmingly being driven by a handful of U.S. firms, especially in P&C.”

She believes the insurance sector is at a crossroads.

“Either patents remain the domain of a few frontrunners, or they become merely a signal of broader competitive intent,” Mousavizadeh said. “As generative and agentic AI reshape the value chain, insurers will need to decide whether to build IP defensively or lead from the front.”

Mousavizadeh added that while the volume of filings remains modest compared to banking, “we’re seeing a sharp uptick in generative and agentic capabilities,” and the IP landscape is shifting from protecting past systems to enabling future ones.

In follow-up correspondence, a PR representative shared that Evident’s research has found insurers focus on claims and underwriting AI patents, and that customer service and risk modelling and pricing account for the second and third largest patent activity, respectively.

Insurer customer service patents are increasingly focused on generative AI, while risk modelling and pricing continue to be anchored to traditional machine learning.

Overall, P/C insurers hold 89% of all insurer AI patents since 2014. Evident reported that this reflects the companies’ structural advantage when filing AI-related IP.

“Their innovations often involve telematics, IoT-driven risk monitoring and other sensor-based systems, which more easily meet the ‘technical contribution’ threshold required for patent eligibility in both the U.S. and Europe,” the press release said.

Evident found that generative AI patents—mainly focused on customer service and claims—surged from 4% to 31% of filings between 2014 and October 2025. Meanwhile, agentic AI is emerging but rare; only three insurers have filed agentic patents, with USAA leading. Interestingly, insurer patent activity peaked in 2020 and has not fully rebounded, despite growing insurer interest in GenAI, Evident shared.

In its annual AI insurance index, Evident wrote that AI-specific patents can play a key role in fostering innovation, but their value is a topic of fierce debate.

The June report said that while patents do incentivize investment in research and development by providing inventors with protections for novel work, the AI community thrives on open-source models, data sharing, and transparent benchmarks of newly released models, which is the opposite of locking up proprietary methods behind paywalls or the threat of legal jeopardy.

“So while AI-specific patents signal innovation and enable a functioning market for breakthrough ideas—at their extreme, ambiguous and overreaching filing activity risks undermining the collaborative, fast-moving nature of AI research and open innovation models,” Evident said in the report.

In an email, Mousavizadeh said that Evident expects agentic patent activity to increase in 2026, with a growing focus on system-level designs, multi-agent coordination, control and continuous feedback loops as insurers formalize successful agentic use cases into patentable architectures—particularly in high-impact areas like underwriting and claims handling.

Below are descriptions of some of the AI patents that Evident has charted with its tracker.

- USAA: Generative AI to clarify aerial imagery for property damage assessment.

- State Farm: Machine learning-driven claims triage and autonomous vehicle fault analysis.

- Allstate: In-vehicle AI assistant to automate claims and offer behavior-based discounts.

- Swiss Re: Predictive analytics for medical data and anomaly detection.

- MassMutual: Interpretable underwriting and AI-tagged document indexing.

- Liberty Mutual: AI-generated release notes for engineering teams.

- Zurich Insurance Group: A system for matching user-typed addresses to a clean, structured address database.

Topics InsurTech Carriers Data Driven Artificial Intelligence Property Casualty Numbers

Was this article valuable?

Here are more articles you may enjoy.

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears