The New Jersey NAACP and two Latino groups last week filed suit against the state Department of Banking and Insurance, charging that the agency encourages discrimination in auto insurance rates by allowing insurers to use drivers’ education and employment levels in determining premiums.

“Indeed, auto insurance carriers use education and employment as mere proxies for income and race,” reads the complaint filed in Superior Court of New Jersey, Mercer County. “The fact that Black and Latino drivers are more likely than others to score poorly on education and employment scales has nothing to do with driving, and everything to do with systemic inequities that persist throughout our state and country.”

The suit, filed by the NAACP New Jersey State Conference, the Latino Action Network and the Latino Coalition of New Jersey, notes that New Jersey law prohibits the use of race and income in setting insurance rates. But the Department of Banking and Insurance, along with Commissioner Justin Zimmerman, have allowed auto insurers to flout that law by approving rates and forms that use education and employment to help set premiums.

The department declined to comment on the litigation. The complaint notes that agency officials have conceded that minorities and lower-income drivers are less likely to benefit from education and occupation-based rating systems.

“DOBI also contended that the correlation alone does not prove proxy use, overlooking that in discrimination analyses … intent is not always necessary – outcomes matter,” the suit reads.

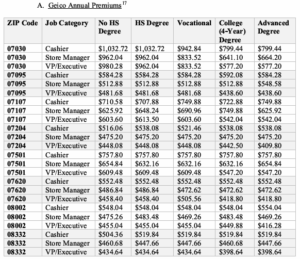

The complaint included charts published by Consumer Reports and ProPublica, purporting to show how GEICO and Progressive auto insurance premiums drop significantly as drivers’ education levels increase, even when driving records were identical.

The suit asks a judge to declare that use of income proxies violates the state constitution; to bar the use of education and employment in rating determinations; and to order the insurance commissioner to order that the rating system be revised so that it does not discriminate against minorities; and to award attorneys’ fees to the plaintiffs.

The Lowenstein Sandler law firm is representing the NAACP and the Latino groups in the legal action. Lead attorney Alexander Shalom was previously a senior lawyer with the American Civil Liberties Union in New Jersey.

Topics Auto New Jersey

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers