A survey of 41 major corporations by broker Willis Towers Watson found that 61% believe political risk levels increased in 2019 while 68% have actually suffered a political risk loss.

Disruption of international trade was considered the most significant risk in the majority of regions, the survey found. Trade sanctions were cited by 58% of respondents as a concern for their operations in Europe, while 70% of respondents in Asia Pacific were worried about trade sanctions. For Russia and The Commonwealth of Independent States (CIS), the figure was 77%.

Sanctions against Russia, Iran and Venezuela, a trade war involving China, and the threat of Brexit in Europe were reported as concerns by respondents.

Concerns about political violence were the highest in Africa (74%) and the Middle East (71%), with respondents reporting that new technologies such as drone strikes could exacerbate such risks.

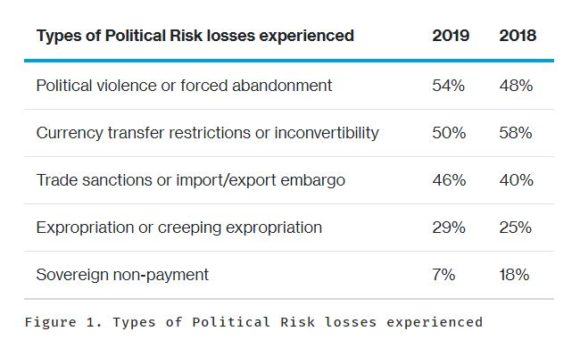

During 2019, there was an increase in the proportion of companies reporting that they had experienced political risk losses. For example, 54% of respondents had experienced a loss due to political violence, compared to 48% in 2018, and 46% reported losses due to trade sanctions or import / export embargoes in 2019, compared to 2018’s figure of 40%. (See graphic below for details of the types of political risk losses experienced by firms during 2019, compared with 2018, according to WTW’s survey results).

At the same time, the Willis Towers Watson survey said, 32% of companies with revenues exceeding $1 billion reported experience of a catastrophic (more than $250 million) political risk loss.

“It is clear from our survey that political risk continues to increase, and that related financial losses are on the rise,” said Paul Davidson, chairman of Financial Solutions at Willis Towers Watson, in a statement accompanying the survey results. “Corporations now face a strategic choice: to either maintain their global business models while accepting, mitigating or transferring the political risks associated with them, or attempting to realign themselves with the emerging shape of a new and apparently more nationalist global landscape.”

The vast majority of respondents (71%) stated that emphasis on political risk management at their company had increased since 2018, and nearly 40% felt that they were facing more pressure from investors regarding political risk management.

The survey found that recent developments such as the China-U.S. rivalry and the sanctions that have arisen as a result have made political risk more tangible.

As in previous years, the study included follow-up interviews with a panel of survey participants. The panel’s top risks of concern included:

- U.S.-China strategic competition

- Middle East regional stability

- Environmental/Social/Governance (ESG) shock. While this risk did not appear among the top ten in 2018, panelists indicated that rising tensions between business and society were increasingly leading to political risk events.

Source: Willis Towers Watson

Topics Trends Profit Loss Europe China

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley