A report on the current state of climate risk disclosures among the largest companies in China and the United States found that Chinese companies lag significantly behind their global peers in the S&P 500 in climate risk disclosures and need to work towards wider adoption to catch up.

The report, which was prepared by Ping An Digital Economic Research Center and OneConnect in collaboration with Imperial College London, used natural language processing (NLP) techniques to assess the current state of climate disclosure.

The report calls for “tighter links between climate risk exposures and financial performance and adoption of more forward-looking information in truthful, transparent, and communicable disclosures, with the help of scalable technology tools to automatically assess disclosure quality.”

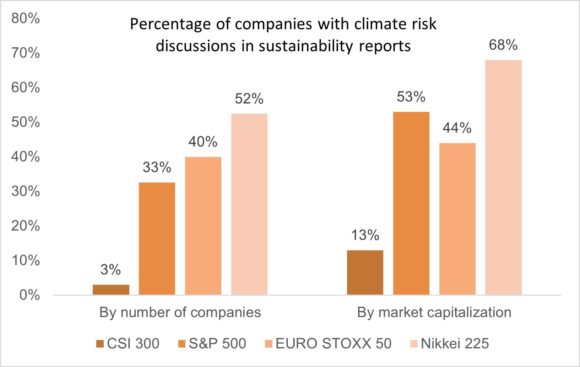

The report found that Japanese companies have the highest incidence of discussions of climate risks in their sustainability reports, followed closely by European and U.S. companies. Chinese companies lag significantly behind their global peers.

Among the four major equity indices examined, including the CSI 300, S&P 500, EURO STOXX 50, and Nikkei 225, Japanese companies lead in terms of incidence of climate risk discussions. Fifty-two percent of companies in the Nikkei 225, which represents 68% of market capitalization, discuss climate risks in their company reports. Forty percent of EURO STOXX 50 companies, representing 44% of market capitalization, and 33% of S&P 500 companies, representing 53% of market capitalization, do so.

Chinese companies in the CSI 300 index trail significantly behind. Only 3% of companies, representing 13% of market capitalization, currently discuss climate risks in their sustainability reports.

Among companies that provide climate disclosures, more than 90% report on metrics related to carbon emissions and energy usage. The rates are similar across most sectors: within every sector, more than 90 percent disclose carbon emission and energy use. Transportation is an exception.

Disclosure of water usage is less common, with an average rate of 58% of companies in each sector including coverage.

Land use is underreported, with only 6% of companies disclosing it, possibly because it is only relevant for certain sectors, the report says.

Financial impact metrics are not well disclosed by companies. This is especially true for impact on capital and financing, with disclosure from only 16% of companies.

An analysis by sector found that insurance companies are “more articulate” in quantitative disclosures on “asset & liabilities” impacts, together with the Infrastructure and Transportation sectors. The latter are also better than other sectors in covering the “revenue and expenditures” dimension.

The report is titled, “Where we stand on climate disclosures and why we need them,” and is available on Ping An’s website.

Topics China Climate Change

Was this article valuable?

Here are more articles you may enjoy.

Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’