Westpac Banking Corp. has taken a A$1.2 billion ($871 million) charge against second-half earnings to cover a record money-laundering fine and the mounting cost of compensating customers for years of misconduct.

The charge is the latest blow to Australia’s oldest bank, which last month was hit with a A$1.3 billion penalty for the country’s biggest breach of anti-money laundering laws. Earlier this year it deferred paying a dividend as bad-debt charges swelled amid the coronavirus-induced recession.

Among the charges announced Monday were:

- A$415 million for the money-laundering fine, including legal costs. Westpac had previously provisioned A$900 million for a settlement, but the cost blew out after further breaches were uncovered.

- A$568 million to write down the value of its life insurance and auto-finance units, as well as software

- A$182 million to compensate customers, including business borrowers and wrongly charged insurance fees

- A$55 million from asset sales and revaluations.

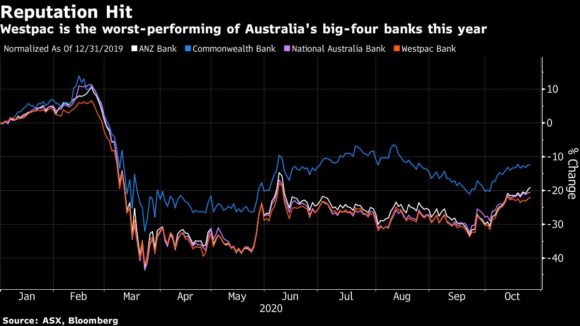

Chief Executive Officer Peter King is seeking to restore the bank’s battered reputation after the money-laundering scandal led to the departure of predecessor Brian Hartzer. Westpac shares rose 0.7% in early Sydney trading, paring this year’s decline to 22%.

Westpac releases full-year results Nov. 2.

Related:

- Australia’s Westpac Expects $578M Fine for Money Laundering Linked to Child Abuse

- Westpac’s Money Laundering Breaches Gave ‘Free Pass to Pedophiles:’ Australia Official

- Australia’s Westpac Bank Apologizes for Money Laundering, Links to Child Abuse Funds

Topics Profit Loss Australia

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan