China’s top financial regulators said on Wednesday that economic growth remains a priority and reforms and liberalization would continue, seeking to allay foreign investors’ fears that ideology could take precedence during President Xi Jinping’s third leadership term.

Speaking at the Global Financial Leaders’ Investment Summit in Hong Kong, officials made the first concerted effort to address the fallout from the Communist Party Congress last month, when Xi’s consolidation of his power led to concerns over policy direction and sparked panic selling of Chinese assets.

Senior officials from China’s central bank, securities and banking regulators assured their audience via video link that China would keep its currency and property markets stable, and remained committed to a pro-growth economic strategy.

“International investors should read more carefully about the work report that President Xi delivered” at the Congress, said Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC).

“There, he re-emphasized the centrality of economic growth in the entire work of the Party and the country, and that’s very significant,” showing China is “fully focused” on growth, he said.

Fang added China’s opening-up policy has a “firm foundation,” as it benefits both China and the rest of the world.

He also criticized international media coverage, saying that a lot of reports “really don’t understand China very well” and had a short-term focus.

Open-Door Policy

Yi Gang, governor of the People’s Bank of China (PBOC), said China will continue to deregulate its domestic market, improve the business environment, and protect intellectual property rights.

“Reform and open-door policy will continue,” Yi said.

Apparently seeking to ease worries over the impact of COVID lockdowns and a property market crisis, Yi said “the Chinese economy has remained broadly on track despite some challenges and downward pressure.”

“I expect China’s potential growth rate to remain in a reasonable range,” Yi said, citing the country’s “super large” market, a rising middle-class, technological innovation and a high-quality infrastructure network.

Xiao Yuanqi, vice chairman of the China Banking and Insurance Regulatory Commission (CBIRC), welcomed foreign participation, and noted that a large number of insurance and wealth management companies had been set up recently.

Regarding China’s property market, which has suffered from a prolonged debt crisis, Xiao described Chinese banks’ exposure to the sector as “reasonable,” and said the proportion of property-related bad loans, at about 1%, was still low.

“In general, the property sector, I think is stable,” Xiao said.

Noting the property sector’s links to other many other industries, PBOC’s Yi said “we hope the housing market can achieve a soft landing.”

Turning to the currency market, where the yuan has weakened roughly 13% against the dollar this year, Yi said the yuan has appreciated against other major currencies, and will remain relatively stable at a reasonable level, “maintaining its purchasing power, and keeping its value stable.”

(Reporting by Hong Kong and Shanghai newsrooms; writing by Samuel Shen; editing by Simon Cameron-Moore)

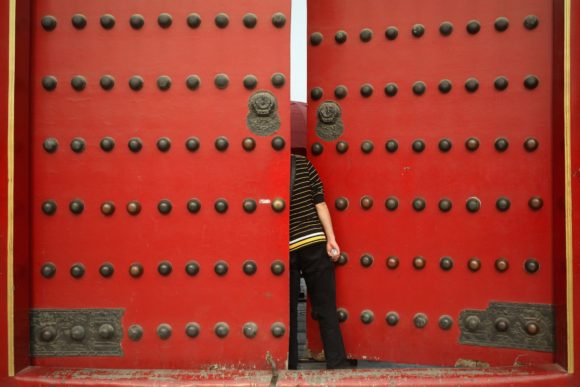

Photograph: A Chinese tourist peeks inside a red door of the Palace Museum inside the Forbidden City, which was the Chinese imperial palace from the mid-Ming Dynasty to the end of the Qing Dynasty, on May 18, 2011 in Beijing, China. Photo credit: Feng Li/Getty Images.

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears