Insured damages from Hurricane Fiona are now estimated at over C$800 million (US$591.2 million), according to the Insurance Bureau of Canada (IBC), quoting the Catastrophe Indices and Quantification Inc. (CatIQ).

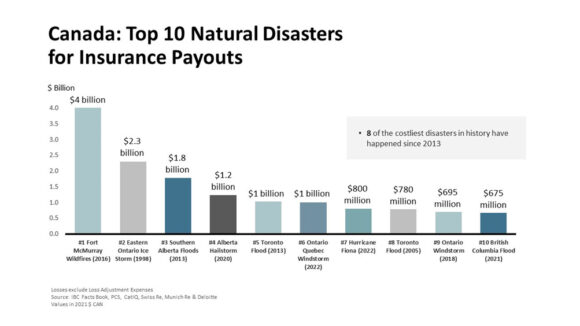

Hurricane Fiona remains the most costly extreme weather event ever recorded in Atlantic Canada and is now the seventh largest in Canada’s history in terms of insured damages – up from the 10th largest as previously reported.

This long-lived and powerful storm first made landfall in Atlantic Canada on Saturday Sept. 24, 2022. With maximum wind gusts exceeding 100 km/h in Atlantic Canada and Eastern Quebec, Hurricane Fiona resulted in tragic loss of life as well as torrential rainfall, large waves, storm surges, downed trees and widespread power outages.

The previous insured damage estimate, issued in October, was C$660 million (US$487.7 million).

The majority of the increase in insured damages is due to personal property claims, said IBC, noting that many affected residents were located in high-risk flood areas and flood plains where residential flood insurance coverage is generally not available. IBC explained, therefore, that damages occurring in these areas are not included in the insured-damage total.

As a result, it is expected that the cost to government from these events will total well into the billions of dollars once infrastructure and disaster financial assistance to uninsured residents are tallied, IBC noted.

“It is clear that a good deal of costs for this disaster will be borne by government,” said Amanda Dean, vice-president, Atlantic, Insurance Bureau of Canada (IBC).

“As we continue to see the increasing impacts of climate change, it’s clear much more must be done to enhance our resilience to these risks and build a culture of preparedness,” Dean added.

“This includes investments in new infrastructure to reduce the impact of floods and fires on communities, as well as retrofit programs that focus on resilience, improved building codes, better land-use planning and, increasingly, the creation of incentives to shift the development of homes and businesses away from areas of highest risk.”

Over the past 15 years, insurance claims resulting from severe weather have more than quadrupled, IBC continued. The new normal for yearly insured catastrophic losses in Canada is $2 billion – most of this due to water-related damage. In comparison, in the 15 years from 1983 and 2008, Canadian insurers paid out an average of about $422 million a year in losses related to severe weather.

The amount of insured damage is an estimate provided by CatIQ under license to IBC.

Source: Insurance Bureau of Canada (IBC)

Photograph: Destroyed houses perch on the edge of the rocks following Fiona in Burnt Island, Newfoundland and Labrador, on Tuesday, Sept. 27, 2022. After surging north from the Caribbean as a major hurricane, Fiona came ashore as a post-tropical cyclone, battering Nova Scotia, Prince Edward Island, Newfoundland and Quebec with hurricane-strength winds, rains and waves. (Frank Gunn/The Canadian Press via AP)

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer