Australia’s largest property and casualty (P/C) insurers should be well placed to manage claims stemming from tropical cyclone Alfred, which could top A$2billion (US$1.3 billion), according to a report published by S&P Global Ratings.

While the path and strength of the cyclone is uncertain, the storm is expected to hit the highly populated southern Queensland coast on March 7, 2025, which S&P explained is more southern than typical cyclone landfalls. The region includes the major city of Brisbane with a population of about 2.5 million.

The current parameters appear to match, or exceed, some of Australia’s largest natural catastrophes in the past 10 years, S&P said.

The Australian Cyclone Reinsurance Pool (ACRP) takes the first layer of insured losses after an initial deductible held by the insurer, while extreme losses can be covered by the pool’s A$10 billion ($6.2 billion) federal government guarantee.

“Australia’s three largest P/C insurers have strong credit quality and their maximum event retentions are well covered at the moment and represent about 20% of each entity’s natural perils allowance,” said S&P Global Ratings credit analyst Craig Bennett. “Capital adequacy is very strong, or better, by our assessments, based on our global insurance capital model.”

Credit fundamentals of the rated insurers are supplemented with participation in the ACRP. S&P expects the ACRP and government-guarantee, if required, to respond to eligible property claims incurred up to 48 hours after the event.

“Where claims fall outside the ACRP cover – like large commercial losses or ongoing rain and flood – primary insurers will have access to their own resources and then significant reinsurance covers,” the S&P report said.

“A cyclone hitting a major city like Brisbane can result in elevated property damage and insurance claims and may include significant business interruption,” Bennett added. “Most rated insurers have already enacted emergency disaster management plans.”

Brisbane council estimates about 20,000 homes are at risk of inundation in the Brisbane region alone. This compares with the 2022 floods where about 35,000 homes were materially damaged out of a total 245,000 claims, with incurred claims of about A$6.4 billion (US$4.0 billion).

The last major tropical cyclone, TC Debbie, occurred in 2017 and brought insured losses of about A$1.8 billion (US$1.1 billion) with approximately 77,000 claims filed.

Source: S&P Global Ratings

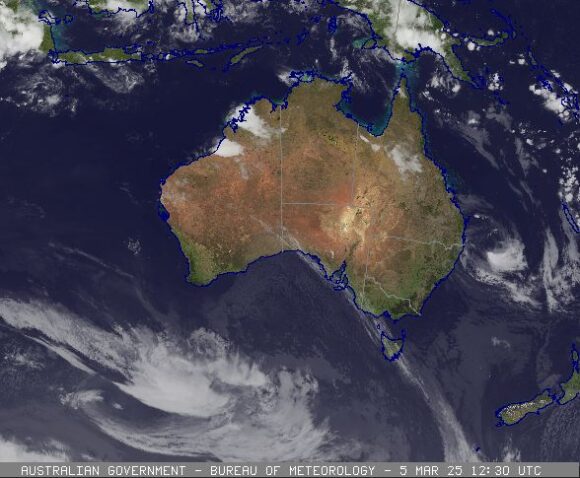

Photograph: Tropical Cyclone Alfred was estimated to be 365 kilometres east of Brisbane and 340 kilometres east northeast of the Gold Coast at 12:06 am EDT, on Thursday March 6, 2025. Source: Australia’s Bureau of Meterology.

Related:

Topics USA Profit Loss Australia

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan