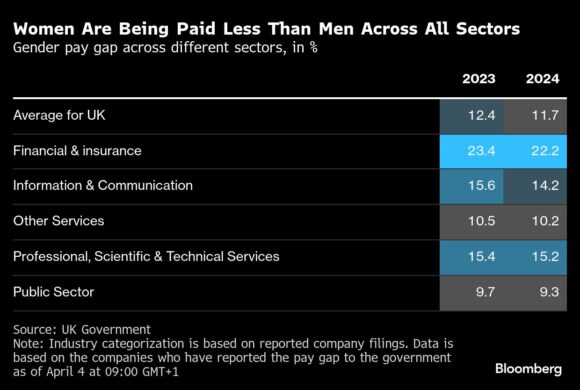

The average woman working in the UK financial sector earns about a fifth less than their male colleagues, a reflection of how the gender pay gap has stubbornly persisted even during a period when businesses pledged to address workplace inequity through diversity, equity and inclusion schemes.

Female employees in financial and insurance services earned around 78 pence for every pound that men do in 2024, according to a Bloomberg News analysis of government data. The pay gap shrunk shrunk by 1.2 percentage points since last year and is almost twice as high as the average across the whole UK workforce. The picture is particularly dire in investment banking, one of the top-paying corners of the industry.

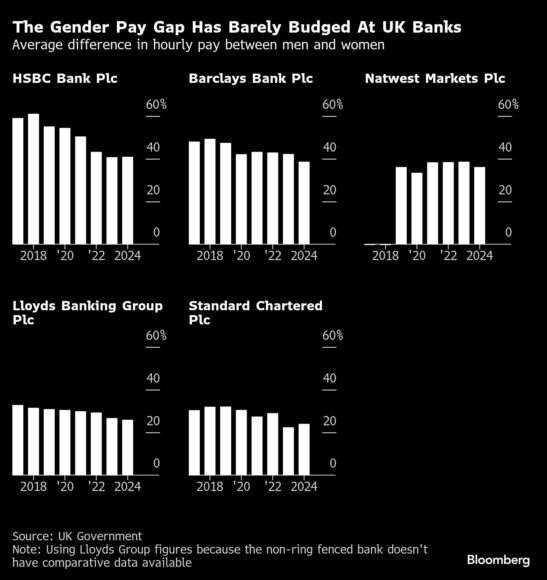

HSBC Bank Plc, which represents the lender’s UK investment banking operations, has the worst gender pay gap among the top five UK-listed banks at almost 41%. HSBC and Standard Chartered Plc are the only two companies on that list where earnings have become more unequal last year. Barclays Bank Plc made the most progress, with the gender pay gap falling by almost 4 points to 39%. The five banks also voluntarily publish their ethnicity pay gap data; the pay gap for Black workers increased at HSBC, Barclays and Standard Chartered in 2024 compared to the previous year’s reports.

On average, women working in the top five banks earned 67 pence for every pound earned by their male colleagues. Women working for the investing banking units at Wall Street banks in London have an even higher hurdle to tackle; the gender pay gap is 48% at J.P. Morgan Securities Plc and 46% at Morgan Stanley & Co. International Plc, according to the latest figures. Goldman Sachs International was again the investment bank with the highest gender pay gap at 50.4%.

“At Goldman Sachs, we pay men and women equal pay for equal work,” a spokesperson for the company said. “That’s something the UK gender pay report doesn’t measure, but it’s central to our pay-for-performance culture, allowing us to continue to attract and retain diverse, exceptional talent.” Morgan Stanley and JPMorgan declined to comment.

Despite a number of initiatives to recruit, retain and promote more women at all career stages, the pace of progress remains glacial since gender pay gap reporting was established in the UK in 2018. The bigger concern for equal pay advocates is that progress risks slipping in the other direction amid US President Donald Trump’s efforts to end what he calls “illegal DEI.” While some Wall Street banks have already scaled back programs, companies around the world are caught between making good on existing workplace targets and the risk of attracting unwanted attention from the US administration.

Several UK banks like HSBC and Barclays have publicly reaffirmed their DEI commitments and representation targets. Yet the language they use has subtly shifted in many cases, switching to words like “goals”, “ambitions” or “aspirations” instead of “targets”, according to Yasmine Chinwala , partner at the New Financial think tank.

“It may be that language changes again, and that strategy changes will influence how targets are being communicated or whether companies have targets at all,” Chinwala said.

The shift in narrative has already infiltrated the UK political discourse. Nigel Farage, leader of the insurgent Reform UK party — and aspiring prime minister amid a ratings boost, last week blamed the lack of women in senior positions on their being less willing to sacrifice their family lives then men. His comments echoed those made by Robby Starbuck, the Cuban-American activist who has pushed companies to ditch their DEI schemes, who said this year this women have to be “different career choices” to be paid more.

HSBC, Barclays, Natwest, and Standard Chartered did not respond to a request for comment. Lloyds confirmed the gender pay gap.

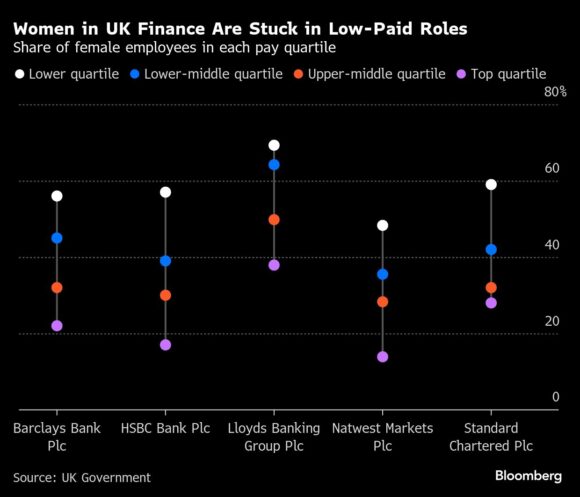

Progress to get more women in top finance jobs had slowed down in recent years even before activists in the US started targeting DEI schemes that some said discriminated against White men. The share of women in leadership roles in the financial services sector rose to 36%, up from just over a quarter a decade ago — but it’s only one point higher than the previous year, according to the latest UK government-backed Women in Finance charter review published on Thursday.

“For many years, the justification has been that we don’t have enough women at the top, but banks are doing a brilliant job of getting women in a graduate level and entry level, moving through into that middle rank,” said Pavita Cooper, UK chair of the 30% Club, which urges companies to ensure women take up almost a third of board seats. “Women are not progressing from there to C-suite and C-suite minus one.”

UK Financial Services Industry Slow to Hire Women to Top Roles, Report Finds

The UK government requires companies with over 250 employees to report their gender pay gap each year by April 4. The figures are a blunt snapshot of the difference in mean hourly pay between men and women on a specific date in between 5 April 2023 and 4 April 2024.

While the numbers don’t measure the pay of men and women doing the same job, or adjust for other factors like performance or location, they reveal who holds the top-earning roles.

At the current pace, women would achieve parity in senior finance jobs in 2038, according to New Financial.

“My key ambition for the Charter is to accelerate the average annual rate of progress beyond one percentage point per year by the end of this parliament,” said Chancellor Rachel Reeves, the first woman to hold the job in the UK, in a statement alongside the publication of the Women in Finance charter. “Our financial services sector is world class, but we can and must do better in female representation, particularly at senior levels.”

Around 20 financial services companies including names like Commerzbank AG, Rothschild & Co and Monzo Bank Ltd., missed their targets for female representation in leadership positions in 2024. Some firms put the blame on hiring freezes and restructuring amid a challenging economic backdrop.

Those macroeconomic troubles could intensify this year.

“We’ve got uncertainty from lots of different places, political, the volatility, the DEI backlash,” said Jenny Barrow, senior diversity and inclusion adviser at New Financial. “2025 is going to be a big year and it’s certainly going to be a tough one for many.”

Photograph: Commuters cross London Bridge in the City of London. Photo credit: Hollie Adams/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup