Aviva Plc faces a review by the UK’s merger watchdog into its plan to buy Direct Line Insurance Group Plc for roughly £3.7 billion ($4.9 billion) in a deal that would create the UK’s largest motor insurer.

The Competition and Markets Authority said Wednesday it’ll asses whether the deal could result in “substantial lessening of competition” in the relevant UK markets. The initial review of the deal is unlikely to result in a deeper antitrust probe, according to Bloomberg Intelligence analysts.

Aviva doesn’t disclose its auto profits but these aren’t large and the CMA is unlikely to find that the consumers face exploitation, according to Bloomberg Intelligence analysts Kevin Ryan and Charles Graham. “Aviva could clear antitrust scrutiny of Direct Line takeover as the target is barely profitable.”

Spokespeople for Aviva and Direct Line declined to comment following the announcement. Aviva and Direct Line shares were little changed in London trading.

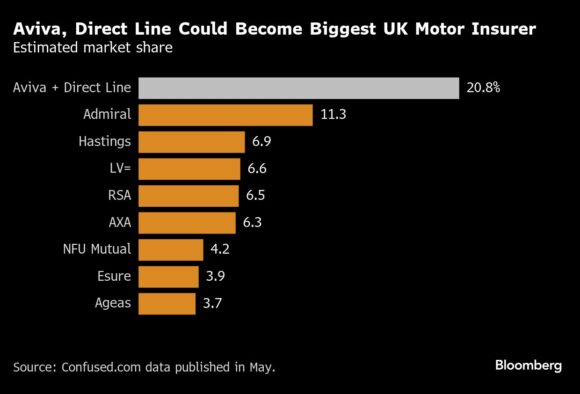

Direct Line and Aviva would surpass their biggest motor insurance competitor Admiral, according to some estimates. Bloomberg Intelligence has said previously that the deal could double Aviva’s share in that market.

Bromley, England-based Direct Line sells insurance under its eponymous brand as well as through units including Churchill, Green Flag, Privilege and Darwin Motor Insurance. In addition to car insurance, it also offers home, travel, pet and life insurance as well as offering cover for businesses.

The two firms expected the deal to be completed around mid 2025, much before the December 31, 2025 deadline, according to an exchange filing in February.

The CMA is seeking feedback from interested parties until May 29 on the tie up, which would combine the companies’ UK insurance operations — covering a wide range of products such as car and home insurance.

If the CMA finds concerns, the firms would have a chance to submit concessions to ward off the threat of a deeper probe. The CMA will give a decision on its initial review by July 10.

Photograph: The Direct Line website; photographer: Hollie Adams/Bloomberg

Related:

Topics Mergers & Acquisitions

Was this article valuable?

Here are more articles you may enjoy.

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer