Polish insurer PZU SA envisages playing a key role in attracting financing for the country’s big-ticket energy and infrastructure projects after it completes a merger with Bank Pekao SA.

Chief Executive Officer Andrzej Klesyk said he wants to channel some of the expected 20 billion zloty ($5.5 billion) of capital set to be released from the tie-up of the two state-controlled firms into a fund. This vehicle will invest in the flagship projects as well as lure foreign financing, including from sovereign wealth funds.

“We can’t finance all the major projects by ourselves, our financial sector simply doesn’t have enough resources,” Klesyk told Bloomberg News. “So creating a seed fund that would be an attractive partner for large infrastructure of sovereign wealth funds from abroad, including Asia and the Middle East, would be a positive side effect of our deal.”

Poland plans to spend $258 billion on renewable energy and power-grid upgrades to achieve the European Union’s climate goals. Furthermore, the government is pursuing its first nuclear power plant at a cost of around $31 billion as well as a $36 billion airport hub. The outlays come as the country’s budget is strained by record military spending due to war in neighboring Ukraine.

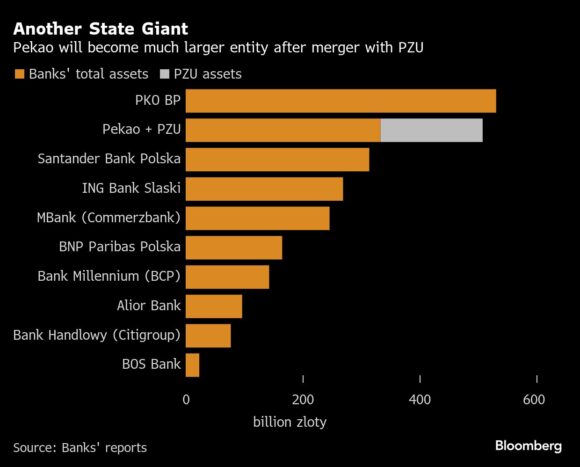

Klesyk said the all-share merger with Pekao, a bank in which PZU holds a 20% stake, should be completed by mid 2026. The planned bankassurance group will have assets rivaling those of Polish market leader, PKO Bank Polski SA.

The deal aims to streamline PZU under Pekao control and allow the group to benefit from favorable EU regulatory treatment for banks with stakes in insurers ahead of new capital requirements facing PZU in 2027.

In order to convince minority shareholders to back the deal, the CEO wants the merged entity to maintain a higher payout profile associated with both groups. Pekao has a dividend yield of 9.6% while PZU is at 7.5%, compared with around 7% for the WIG-Bank index and 4% for the benchmark WIG20 gauge.

Klesyk expects the details of transaction to be agreed in the last two months of 2025. Before that, PZU wants to pursue the first stage of the deal and reorganize itself into a holding.

Both of these steps require changes in Polish law. This could prove tricky as incoming President Karol Nawrocki, who has veto power over legislation, may not back a deal which would effectively dilute the government’s stake in the merged entity.

“It’s difficult for me to speculate what the new president will do,” Klesyk said. “We will present the economic rationale behind the deal and the benefits.”

Photograph: A PZU bank branch in Warsaw. Photo credit: Damian Lemański/Bloomberg

Topics Mergers & Acquisitions Carriers

Was this article valuable?

Here are more articles you may enjoy.

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance