Sound risk management, strategic use of technology and a maturing partnership with alternative capital have subdued the cyclical nature of the reinsurance market. To achieve or reach beyond the cost of capital, reinsurers must balance short-term opportunities with strategic long-term goals.

They need to be flexible—taking advantage of market conditions or retreating when pricing is not right—while also maintaining relationships and relevance over the long term.

High interest rates throughout 2024 kept the cost of debt high, but strong market performance drove down the cost of equity. The reinsurance industry’s weighted average cost of capital has been volatile over the past decade and dipped again to 7.66% in 2024 from 8.1% in 2023. It fell further in the first quarter of 2025, to 6.66%.

For the second consecutive year, reinsurers generated returns well above the cost of capital in 2024, due to positive underwriting results driven by repricing and de-risking of reinsurance portfolios. Returns were lower in the first half of 2025 because of natural catastrophe losses but stayed well above the cost of capital.

The current hardened market conditions in the reinsurance sector are being driven primarily by memories of prolonged historical underperformance, compounded by the abundant capital due to the extended low interest rate environment. A confluence of catastrophes, changes in interest rates and increases in social inflation caused rates to skyrocket, but increases are slowing.

Guy Carpenter calculated a 6.2% decrease in rate-on-line at Jan. 1, 2025, for both U.S. and European property-catastrophe reinsurers, after a moderate increase of 5.4% in 2024 compared with nearly 30% in 2023. However, there was some differentiation in 2025 renewals, as some loss-affected reinsurers saw steep price increases.

Even with the decrease in January, rates are up over 90% from 2017. Reinsurers have also implemented thorough de-risking measures, such as tighter terms and conditions and a sharp increase in attachment points, which are unlikely to be loosened. Market conditions indicate more sustainable pricing momentum, enhancing reinsurers’ ability to meet their cost of capital over the medium term.

Returns Remain High Despite Natural Disasters

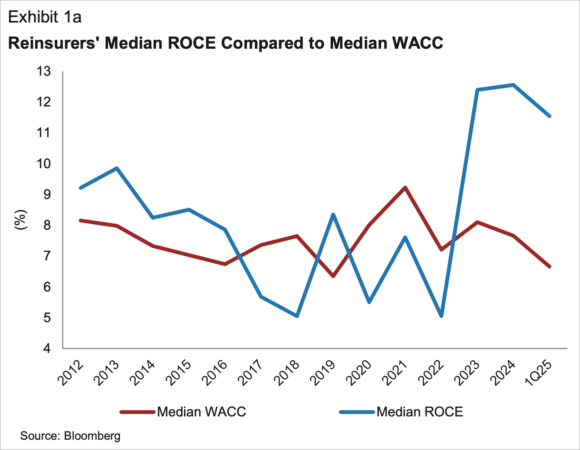

For reinsurers that take on high severity risks, meeting their cost of capital during years of severe catastrophe losses is a challenge (see Exhibit 1a). This is especially evident when comparing the median return on capital employed (ROCE) and the median weighted average cost of capital (WACC).

WACC measures a company’s cost of both debt and equity, whereby the weights are the relative proportion of financing based in each source. ROCE measures how well a company generates profits from its capital, including both debt and equity. ROCE is calculated by dividing earnings before interest and taxes (EBIT) by capital employed, with capital employed equal to total assets minus current liabilities.

The years when returns exceed the cost of capital are generally the ones with a lower frequency and severity of natural disasters. However, higher attachment points have allowed reinsurers to weather the increased frequency and severity of secondary perils.

According to Swiss Re, 2024 marked the fifth year in a row when global insured losses exceeded $100 billion. The majority of insured losses were due to numerous small- to medium-sized events and, owing to higher attachment points, most of the impact was retained by primary insurers.

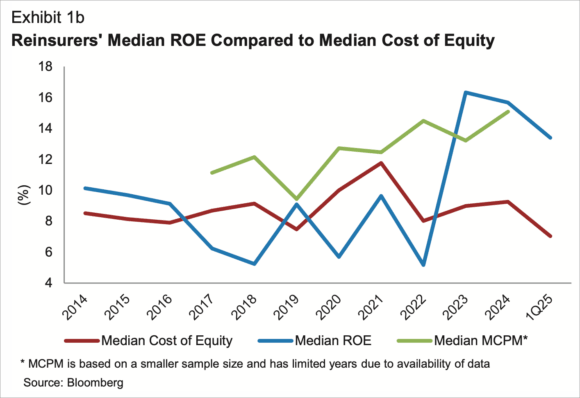

Reinsurers met the cost of capital again in 2024 after a four-year streak of failing to do so ended in 2023. The median return on equity (ROE) also exceeded the cost of equity (Exhibit 1b).

ROE is another measure of how efficiently a company generates profits. Unlike ROCE, ROE does not take debt into account. It is calculated by dividing net income by average shareholder equity.

The Market Derived Capital Pricing Model (MCPM) is a measure of the cost of capital that is often more conservative than the popular Capital Asset Pricing Model (CAPM). Reinsurers’ ROEs also exceeded the MCPM in 2024.

Most reinsurance players had very strong returns on equity in 2024. With a median of 15.7%, they were not as exceptional as the previous year but were still significantly higher than any year in the past decade.

These returns are due to ongoing positive underwriting results, as well as recoupment of unrealized investment losses from previous years thanks to higher reinvestment rates. The exceptional ROE in 2023 is unlikely to be repeated, although reinsurers are expected to maintain underwriting discipline over the near term.

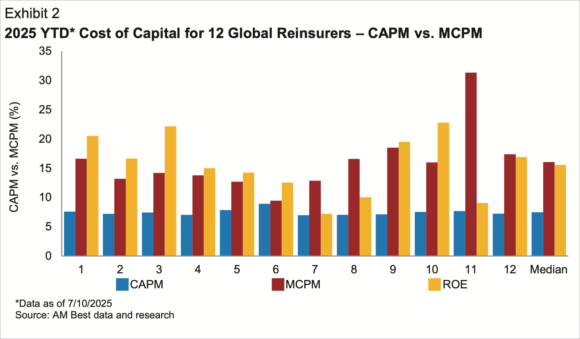

MCPM Suggests Higher Cost of Capital

There are multiple methods used to estimate the cost of equity, the most popular being CAPM, which divides risk into systematic risk (the risk of being in the market) and idiosyncratic risk. Systematic risk is measured by beta, a portfolio’s relationship to the overall market, and cannot be diversified. Idiosyncratic risk is specific to a company and can be mitigated through appropriate diversification, making beta the more important factor in the CAPM.

The cost of debt is simpler to calculate: averaging the yield to maturity for a company’s outstanding debt.

By contrast, the MCPM uses the price of options rather than historical data to estimate future volatility. MCPM relies on the same forward-looking market expectations that are built into a company’s stock price and may provide a more accurate figure for firms to use when making decisions about capital allocations.

For global reinsurers for which options data was available, the MCPM cost of capital differed markedly from the CAPM cost of capital (See Exhibit 2). The median CAPM cost of capital for these reinsurers was 7.5%, versus the MCPM’s 16.0%. The majority of these reinsurers were still able to meet their cost of capital due to high ROEs but with a much narrower margin.

A Rising Tide Lifts All Boats

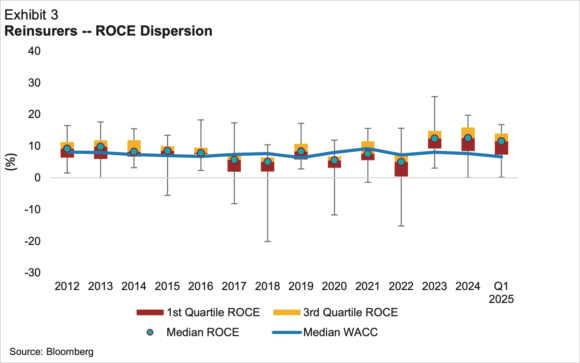

Between 2012 and 2016, the reinsurance industry’s ROCE was steady, despite Superstorm Sandy in 2012. Generally, in years when losses were more severe, the variance in the spread of returns was wider (See Exhibit 3).

For example, in 2019, reinsurers’ returns ranged from 2% to 21%. In 2022, a year with high catastrophe losses, returns ranged from -25% to 20%. In years such as 2014, when global insured catastrophe losses were below average (less than $35 billion according to various estimates), the range of returns was between 3% and 17%, while in a year like 2017 (industry losses estimated at more than $150 billion), the variance was significantly wider, between -13% and 21%.

The year 2023 was an exception, when the wider spread was due not to higher losses but to a few exceptional returns, with the minimum being 5% and the maximum being 37%. Despite high catastrophe losses in recent years, de-risking measures and pricing increases have mitigated this dispersion and maintained a higher floor for returns.

Managing Risk/Return Trade-Off

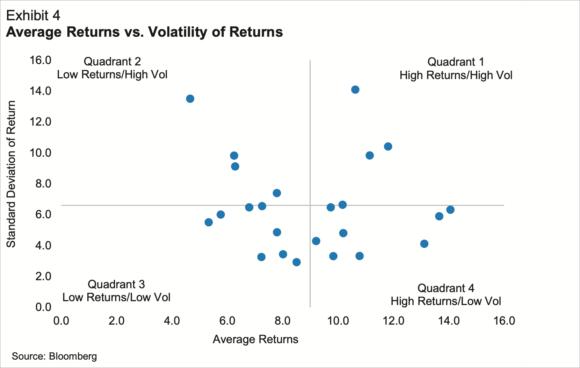

Reinsurers look to optimize their cost of capital and maximize their returns while taking risks commensurate with their risk appetites. Significant volatility in returns can indicate inefficiencies with regard to managing risk, resulting in a higher cost of capital.

In 2022, a year with high cat losses, about a third of reinsurers experienced low returns and high volatility. However, since rates have increased and thorough de-risking measures have been implemented, there has been a general decrease in the volatility of earnings.

An insurer’s ability to raise capital (especially in times of stress) and the potential cost of capital are important considerations in the ratings process. When assessing operating performance, AM Best looks at an insurer’s returns on equity in comparison with its peers and vis-à-vis cost of capital, as well as return on revenue, combined ratio, return on assets and underwriting expenses. AM Best also examines the absolute level of these metrics and their historic volatility.

This article is an abridged version of an AM Best report published on Aug. 27, 2025 under the title, “Reinsurers Meet Cost of Capital for Second Consecutive Year.” The article first was published in Insurance Journal’s sister publication, Carrier Management.

Topics Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows