Zurich Insurance does not expect any material financial losses from claims related to Hurricane Melissa, the insurer’s finance chief Claudia Cordioli said on Thursday.

“A large number of members of those communities and businesses were uninsured. So you should expect the loss for the industry to be relatively contained,” Cordioli said during a media call.

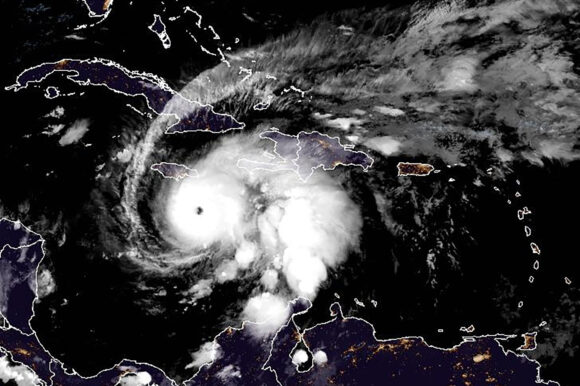

The category 5 hurricane made landfall in southwestern Jamaica last week, the strongest-ever storm to directly hit the Caribbean nation’s shores, and the first major hurricane since 1988.

Cordioli’s comments came after Europe’s second-largest listed insurer by market capitalisation reported higher nine-month gross written premiums at its core property and casualty business.

Gross written premiums in the P&C business rose to $38.9 billion in the January-September period, from $36 billion a year earlier, with growth driven by its retail and commercial insurance offerings.

Catastrophe losses remained below last year’s level due to fewer events this year and a more “sophisticated risk selection,” Zurich Insurance said without providing a specific number.

This time last year, it had flagged a $360 million exposure to hurricanes Helene and Milton.

RISKS FROM US GOVERNMENT SHUTDOWN

Analysts from Vontobel said the results were good, but warned the insurer’s high exposure to the United States might lead to a slowdown in business activities due to the ongoing U.S. government shutdown, the longest in the country’s history.

North America is Zurich Insurance’s single largest market, accounting for more than half of operating earnings in the crucial P&C segment.

“We are in business as usual mode,” Cordioli said when asked how the shutdown was affecting the company’s business. “Hopefully we’ll have clarity as soon as possible and business can resume its normal course.”

Shares of Zurich Insurance fell nearly 2% by 0936 GMT.

Photo: Hurricane Melissa spins in the Caribbean on Oct. 26, 2025. Photo credit: NOAA

Was this article valuable?

Here are more articles you may enjoy.

Why Power Outages Do More Economic Damage Than We Think

Why Power Outages Do More Economic Damage Than We Think  Berkely Says It’s No Longer Pressured to Push for Rate ‘Across the Board’

Berkely Says It’s No Longer Pressured to Push for Rate ‘Across the Board’  Bumble, Panera Bread, CrunchBase, Match Hit by Cyberattacks

Bumble, Panera Bread, CrunchBase, Match Hit by Cyberattacks  Opportunity for Private Flood Insurers With Threat of Another NFIP Lapse

Opportunity for Private Flood Insurers With Threat of Another NFIP Lapse