Aviva Plc has kicked off the search for a partner to help fund a planned new skyscraper in the heart of the City of London’s insurance district, as it aims to tempt investors willing to make a bold bet that office rents are set to soar.

The insurer’s investment management arm has appointed broker Knight Frank to sell a stake in the 130 Fenchurch Street project, people with knowledge of the process said. A deal could pave the way for a start on the development, which secured planning planning approval in September, or a new partner could wait to secure a tenant for some or all of the 31 story building before commencing construction, the people said, asking not to be identified as the process is private.

A representative for Aviva Investors did not respond to requests for comment.

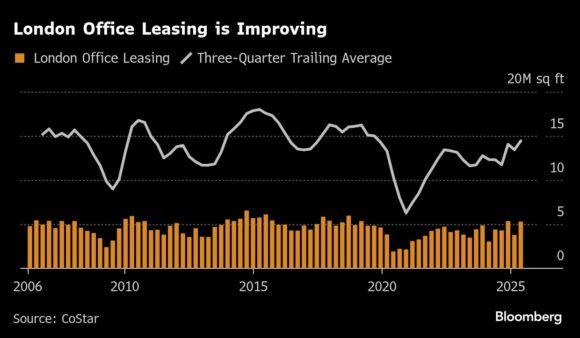

The chance to buy a stake in one of the largest planned office developments in central London comes as the city’s biggest tenants, developers and investors face a high stakes stand off. Higher construction costs threaten to make many projects unprofitable unless they achieve much higher rents than are currently being paid, prompting developers to hold off on new starts.

The combination of higher asking rents and far higher costs for fitting out new offices are in turn giving large companies pause before committing to long term deals. While higher costs can be spread over time by signing longer term leases, companies are also grappling with significant uncertainties about how much space they need.

That’s because some staff are still working flexibly while the rise of artificial intelligence has further complicated the process of forecasting future headcount. The upshot is a severe shortage of new office development, a factor Aviva is counting on to lure investors willing to make a bold bet on higher rents, the people added.

There are already signs that rental inflation is starting to accelerate. Law firm Proskauer Rose LLP set a record rent for City of London office space at 8 Bishopsgate in the third quarter, agreeing to pay £140 ($186.82) a square foot for additional space on th 46th floor, according to a report published by broker Savills Plc.

BlackRock Inc. has already begun scouting options for a new London headquarters despite having about 10-years left on its lease because of the dearth of available options, two other people said. Chief Executive Officer Larry Fink complained in an interview with the Times newspaper in London earlier this year that he was unable to find space to accommodate recent acquisitions.

A spokesperson for BlackRock declined to comment.

Aviva’s planned 130 Fenchurch Street development, a block south of the key Lloyd’s of London insurance market, will include over 600,000 square feet (57,500 square meters) of office space, a public garden terrace on floor 20. The project, which is set to be overseen by developer Co-re, will also include ground floor stores, bars and restaurants.

Demolition of the existing building, known as Fountain House, is set to complete next year and work on the new tower could be concluded as early as 2030, according to a City of London press release.

Photograph: Skyscrapers and commercial buildings in the skyline of the City of London, UK, on Monday, Sept. 29, 2025. Photo credit: Jason Alden/Bloomberg

Topics London

Was this article valuable?

Here are more articles you may enjoy.

World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Preparing for an AI Native Future

Preparing for an AI Native Future  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley