Sompo Holdings Inc. is aiming to increase investments in higher-yielding overseas credit to boost profits as traditional business flounders at Japan’s third-biggest property and casualty insurer.

The Tokyo-based company moved several investment managers from its Japan insurance subsidiary to work in the US from this month, according to Toshinobu Kondo, general manager of Sompo’s investment management department. The Japan and US units may try to lower costs by picking the same asset managers for deals including those with private credit and junk bonds, he said.

Sompo intends to “invest broadly in credit assets that offer high profitability and different risk-return characteristics,” Kondo said in an interview. Asset management is becoming even more key as a source of profits for the insurer, he said. Kondo declined to say by how much the firm plans to push up investments.

Property and casualty insurers in Japan like Sompo are struggling to post strong growth in the mature home market, as a rapidly aging population weighs on demand for their mainstay auto and home insurance products. That’s prompted companies to target expansion in overseas markets, with some early signs of success.

For instance, Sompo’s total operating revenue rose 4.7% in the fiscal year ended March 2025, but that was bolstered by a 8.6% increase in overseas revenue while the gain in Japan was limited to 1.9%, Bloomberg-compiled data show. The domestic figure had been nearly flat for half a decade.

A push from policymakers to get companies to unwind cross shareholdings, which have been cited as one cause of overly cosy ties between firms that have reduced competition, may also give the insurers a temporary boost. Selling off those shares has been providing one-off trading profits, though it will take away income from dividends.

“Further sales of strategic stock holdings and robust underwriting results are the main profit engines,” wrote Steven Lam, a Bloomberg Intelligence senior industry analyst covering insurers, in a report.

Natural Disasters

Still, risks face insurers chasing profits from underwriting: the rising number of natural disasters is one, while the increasing cost of repairs threatens the sector’s auto insurance business, as the most severe inflation in decades hits Japan’s economy.

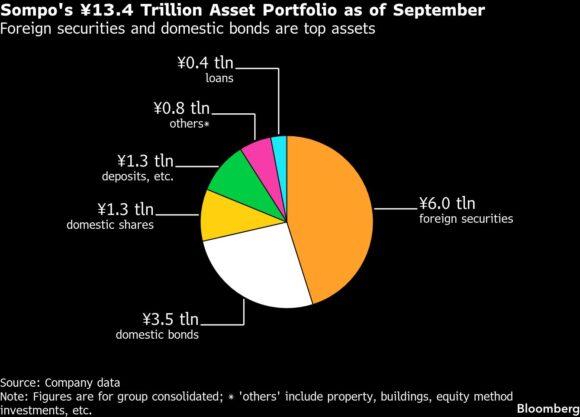

The sheer size of Japan’s non-life insurance sector suggests that signs of shift into riskier but high yielding overseas credit will be closely watched by investors. Sompo managed ¥13.4 trillion ($85 billion) in assets at the end of September last year, the least among the top three P&C insurers. Tokio Marine Holdings Inc. led with about ¥31 trillion in assets, while runner-up MS&AD Insurance Group Holdings Inc. held about ¥20 trillion, according to the insurers’ data.

Globally, private credit has grown into a $1.7 trillion market. Lending spreads have narrowed compared with 2023 due to intensifying competition, but for Sompo the debt remains attractive because spreads are still wider than other credit products. And their floating-rate structure lets investors resist damage from rising interest rates, according to Sompo.

Photograph: Sompo Group in Tokyo. Photo credit: Kiyoshi Ota/Bloomberg

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Preparing for an AI Native Future

Preparing for an AI Native Future